Advent Calendars Open New Doors with Licensing

By Mark Seavy

Advent calendars have shifted from a traditional holiday treat in the month leading up to Christmas to become a marketing bonanza ripe for licensing.

Once home to small trinkets—chocolates were added to the mix in the 1950s and Cadbury kicked off the widespread sale of chocolate-filled calendars in 1971—the calendars have become gifts unto themselves for everything from jams and cookies to whiskies and wines to pricey beauty products.

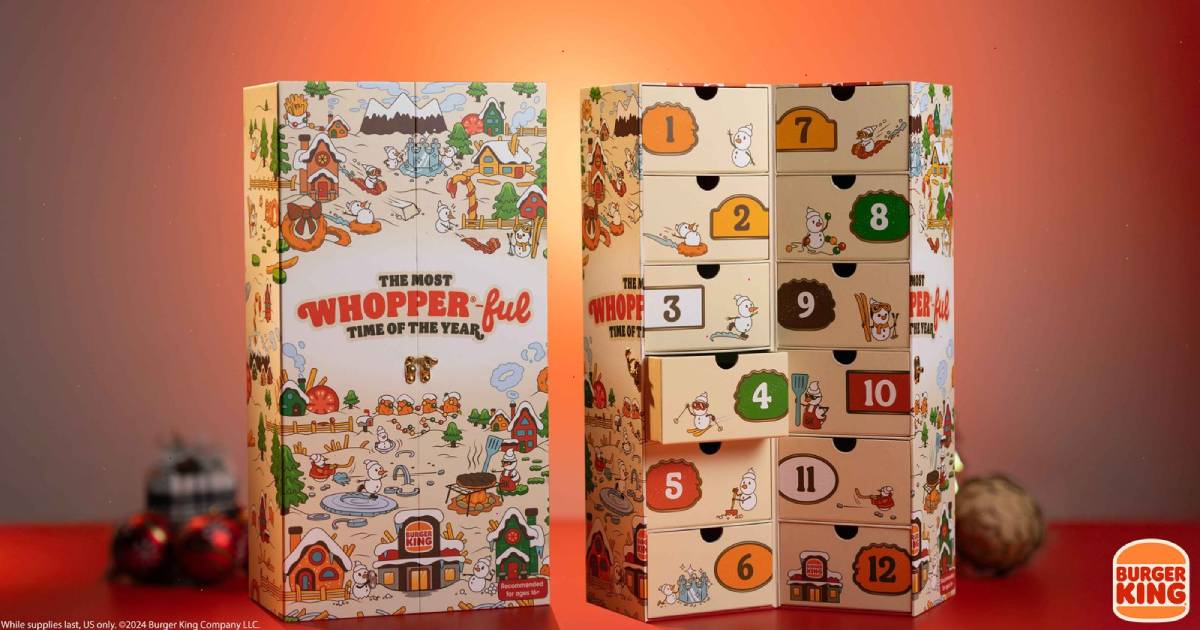

For example, Tiffany’s fielded a $112,000 calendar with each of the 24 compartments containing a gift in the company’s trademark blue box, including an 18-karat yellow gold bracelet. And for consumers with an appetite for fast food, Burger King entered the market for the first time this year with a calendar filled with 12 curated collectibles, including a snow globe, a hat emblazoned with the chain’s logo on the front, and Kids Club-themed sunglasses.

“What you have seen start to emerge the past few years is that brands are tapping into this kind of traditional moment to have a brand moment,” said Camille Moore, Co-Founder of the research firm Thought Leader Labs. “Brands will construct basically 24 or 25 days of gifting, where the brand can have a different moment every day up until Christmas.”

Those moments have taken hold with consumers. In the U.K., 33% of consumers buy advent calendars annually with 47% using them as a daily activity and 44% using them as a means for marking the holiday season, according to market research firm YouGov.

Despite the influx of branding and gifts, YouGov reports that chocolate-filled calendars still account for 75% of sales overall. Among 18- to 24-year-olds, the majority reported they usually buy chocolate calendars (59%), followed by jewelry (21%), candles (19%), beauty products (19%), and alcohol (13%). And chocolate continues to be the top choice by far for older demographics, including 45- to 54-year-olds (80%) and those 55 and older (79%).

The purchase of this new generation of advent calendars, however, come at a higher price given the influx of brands. Advent calendars—which were first reported in 1851 when they appeared in religious devotional books in Germany—have become, much like the holiday season itself, as much about commercial business as religion.

U.K. department store Selfridges & Co. offered 18 advent calendars this year, including licensed Polly Pocket and Pokémon versions ($47) alongside one stocked with Astrid & Miyu jewelry ($731). And Saks Fifth Avenue sold eight types of calendars (down from 18 in 2022) at prices ranging from $105 to $825. The 25 Days of Beauty advent calendar features the department store chain’s logo and sells for $225 with cosmetics like Sisley Paris hair care oil and Dr. Lara Devgan extreme lengthening mascara.

For its part, retailer Williams-Sonoma is fielding several “exclusive” advent calendars, including traditional Elf, Grinch, Peanuts, and Harry Potter offerings as well as bourbon distiller Woodford Reserve’s eight-day cocktail calendar ($149), which contains mixers and bitters. Food & Wine Magazine, meanwhile, detailed what it deemed the “13 Best Whiskey Advent Calendars” as well as wine versions.

“There is little chance of this turning back [to more traditional calendars] because brands have invested too much time and effort in this. And while the revenue may not be huge, the recognition is,” a licensing executive said.