Brand Partnerships Satisfy Appetite for Value

An Executive Voices Blog by Carl Quash III, Snacks & Nutrition Industry Manager for Euromonitor International

Popcorn and cereal may not seem like a natural pairing, and you may never have thought to infuse crackers with wine, but unique partnerships are becoming more common in the food and beverage landscape as snack manufacturers look for new ways to promote their brands. This is especially important because, in a time where consumers are more concerned than ever about the value they are receiving from products, brand power is a crucial part of closing the gap in value expectations.

Today, consumers say low-priced groceries are their top priority when shopping. At the same time, Euromonitor International’s Lifestyle Survey reveals that one in four consumers are still seeking out strong or well-known brands. As inflation continues to wear down consumers, purchasing branded foods brings a sense of comfort in not having to trade off to cheaper, potentially lower quality, and less well-known options. And branded snacks, in particular, are seen as affordable luxuries for consumers who have had to sacrifice larger purchases like new electronics or travel.

Iconic snack brands like Lay’s, M&M’s, Reese’s, and Oreo symbolize value for consumers and can even justify additional spend in some cases. For many consumers, a brand can trigger positive nostalgia and emotional comfort. For others, the value can be found in a culturally relevant flavor that connects to a sense of community. Brands can also be seen as delivering value through superior taste, high-quality manufacturing, environmental friendliness, novel experience, enhanced nutrition, and more.

Given that consumers still see the value in strong branding, there is an opportunity for food manufacturers to grow awareness and market share through licensing deals. Looking at snacks, branded products make up 80% or more of sales across each global region. Asia Pacific has the most fragmented snack market, followed by the Middle East and Africa. Consumers in the latter region also tend to be more likely to purchase branded products compared to all other regions. As both regions contain numerous snack brands vying for purchase, the need for strategies that allow them to stand out is key. In regions where the top one to five snack manufacturers control a larger share of the market, licensing snack brands into new categories for faster growth or new usage occasions can help to maintain and even grow future share.

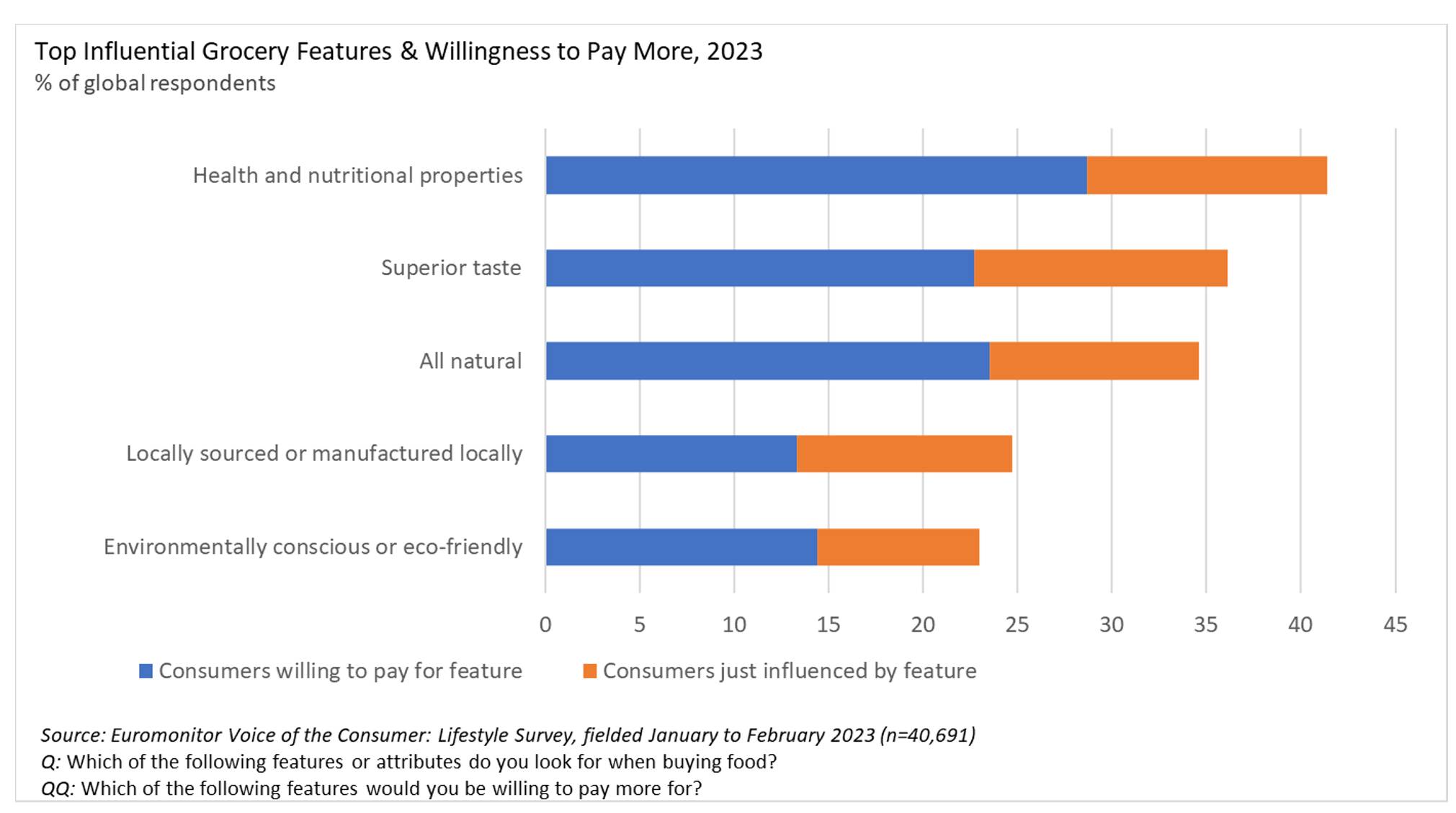

Licensing allows brands to either expand on their current value propositions or expose new ones. For example, brands can leverage the fact that consumers value taste and health when it comes to their grocery purchases. In fact, more than one in three shoppers are influenced by superior tasting product features (e.g. bold flavors, unique textures, freshness) and one in five say they are willing to pay more when they come across these features in the grocery aisle.

Kellanova’s (formerly Kellogg’s) savoury biscuit brand, Club, has recently expanded into its superior taste value proposition via a deal with JaM Cellar’s. The partnership saw JaM Cellar’s buttery chardonnay infused into Kellanova’s mini Club savoury biscuits. Similarly, the company SNAX-sational continually seeks to expand its portfolio’s taste value proposition and offers new product experiences through licensed partnerships. A recent deal with Post Cereal’s Fruity Pebbles breakfast cereal brand resulted in increased awareness for SNAX-sational products and allowed Fruity Pebbles to enter the faster growth popcorn category.

Global snack sales are expected to grow by over 20% in dollar value across the next five years, but that growth is expected to come with challenges from consumers who are more concerned with costs and value due to inflation. Leveraging brand power to grow in or outside of the category, expanding upon value propositions with deals that position brands in a new light, and strengthening broader awareness will continue to be priorities for the industry.

More information about this topic is available in the “Affordability, Value, and the Cost of Living: Where Do Opportunities Lie?” report published in November 2023, and the Inflation Surge: Packaged and Fresh Food report, published in November 2022.

Euromonitor International helps organizations understand where and how consumers shop through both traditional and emerging retail channels. Comprehensive international coverage and insights as part of syndicated offerings that provide retailers, brands, and others in the industry with data and analysis to help guide decisions on investment, expansion, and product positioning by category, channel, or country. Bridging methodologies based on data science and on-the-ground research, Euromonitor International provides context to strategic and tactical data, helping you answer your biggest challenges and identify opportunities.