Celebrities Put the Spotlight on Joint Ventures

By Mark Seavy

Celebrities and influencers are increasingly focused on forming joint ventures (JV) rather than inking traditional licensing agreements.

These A-listers turned entrepreneurs are, in many cases, putting their financial and social media muscle behind the business as a whole rather than just lending their name, image, and likeness to a specific product or range.

Licensing remains an important component of the JV but it is not the sole source of income—something that is also derived from a share of the annual profits, minimum guarantee, or potential sale of the business. In many cases, these JVs are managed by talent agencies.

Rapper Curtis “50 Cent” Jackson was an early example when his inclusion of Vitamin Water in a 2004 commercial he did with Reebok resulted in him taking a 10% stake in Vitamin Water’s Formula 50 brand. Brand owner Glaceau’s sales then grew from $100 million to $700 million over three years and Jackson ultimately invested in Vitamin Water as a whole. Jackson further cashed in when Coca-Cola bought Vitamin Water for $4.1 billion in 2007.

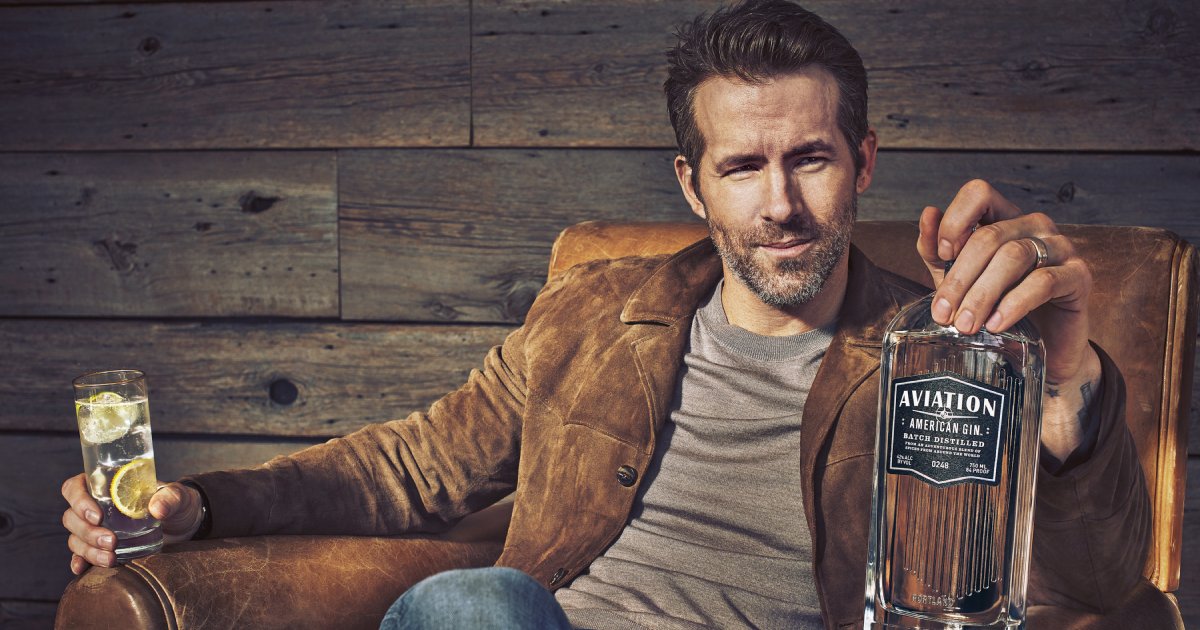

The number of celebrity-centric JVs has grown steadily in recent years. For example, serial entrepreneur and actor Ryan Reynolds sold his Aviator gin business to drink maker Diageo in 2020 for $610 million and sold the mobile phone service Mint Mobile to wireless carrier T-Mobile for $1.35 billion in 2023. Both businesses benefitted from Reynold’s financial backing as well as his social media presence, which includes 54 million followers on Instagram.

Actor George Clooney founded Casamigos tequila in 2013 and sold it four years later to Diageo for $1 billion. And actress/singer Selena Gomez’s Rare Beauty cosmetics brand was valued at $2 billion when she hired bankers to explore a potential sale of the business.

Alcohol, Beauty, and Health & Wellness are key categories for celebrity JVs, though Food & Beverage and Pet Products are growing, said Anna Ho Sandig, VP in United Talent Agency’s Venture Studio Department. “This is largely due to the personal connection that can be involved, and it isn’t a huge leap to see that talent can get behind a product in these spaces. It also goes back to industry structure. In both alcohol and beauty, you have large manufacturing companies with capabilities and distribution in place. Those deals are easier to get done because of that.”

Celebrities and influencers typically take a 20-40% equity stake in a JV.

“Licensing is almost a formality now because it is part of the deal and the package of legal documents that is the formation of the company and how the equity is going to be split, what are the rules that list a celebrity’s or influencer’s responsibilities in terms of in-person appearances, social media posts, and position within the JV,” said Jed Ferdinand, a partner at Meister, Seelig & Fein. “It [licensing] is more like a legal checkbox and no longer is the primary negotiated document [for celebrity and influencer JVs].”

While licensing may not be the sole focus for these JV agreements, it still carries weight. Master licensees can sometimes act as sub-agents and royalties are typically lower because they dilute profit, Ferdinand said. In addition to a share of the profits, celebrities and influencers also typically receive a minimum guarantee, although it is spread over a period of time and not paid up front.

These JVs are designed to reinforce a celebrity or influencer’s commitment to a brand by having them take a financial position in the business, potentially reducing the risk that they will do something to damage the brand.

Despite that increased investment in the brand, there are joint ventures that don’t work out. Rihanna launched plans for a Fenty fashion line with LVMH in 2019, but the project was put on hold two years later amid the pandemic. However, the singer has since launched Fenty Beauty, Fenty Skin, and Savage X Fenty lingerie. And actors Arnold Schwarzenegger, Bruce Willis, and Sylvester Stallone’s Planet Hollywood filed for bankruptcy twice (three restaurants and four hotels remain open, down from a peak of 32 U.S. facilities). Its location in the Forum Shops at Caesar’s in Las Vegas ended a 29-year run in 2023.

“Sometimes there just isn’t a match with how a consumer perceives the brand and whether it fits into a category,” a licensing executive said. “But then those are the risks you take.”

Taking those risks into consideration, however, many celebrities and influencers see the financial benefits of JVs as far outweighing any potential obstacles.

“Celebrities have appreciated that they are not getting as much money from these [straight licensing] deals as they could and that is why an equity stake in addition to negotiating other financial provisions like compensating them for marketing and other work gives them more of a financial upside,” Ferdinand said. “The license is still part of that because the celebrity has to license their name, image, and likeness or trademark but, all of a sudden, they are an owner and are vested in the company’s success.”