Fanatics’ Trading Card Shocker Continues Consolidation

Fanatics’ recent stunning disclosure of licensing agreements for trading cards with three of the major sports leagues and their unions is just the most recent – albeit a high profile one – in a series of deals bent on consolidating the sports licensing business.

Buying new real estate

Unlike its earlier acquisitions of Top of the World (collegiate headwear and apparel), Majestic (on-field uniforms) and Wincraft (sports collectibles and fashion accessories), in this case Fanatics didn’t buy a company. But the licensing deals bought it massive real estate in a booming business.

They came on the heels of a $325 million funding round that valued it at $18 billion (up from $6.2 billion a year earlier) and by all accounts Fanatics is positioning itself for an IPO. (And, speaking of the financial markets, the news of Topps’ loss of the MLB business in particular was quickly followed by the withdrawal of Topps’ merger with Mudrick Capital via a SPAC.)

“Fanatics’ getting those agreements was certainly a shock, but we live in a digital world with huge valuations for trading cards” especially during the past year when sales have soared, says a sports licensing executive. “And Fanatics now appears to be first in line.”

Three leagues, three unions

According to news reports, Fanatics’ deals with Major League Baseball, the National Basketball Association and National Football League and the players associations for those leagues are exclusive deals that begin after existing agreements with Topps and Panini run out (between 2023 and 2026, depending on the league and union).

MLBPA Executive Director Tony Clark said in a memo that the deal was more than 10 times larger than any of the union’s previous agreements.

According to one study, global sports card revenue is expected to increase 23% annually to reach $98 billion by 2027, with the Asia Pacific and Middle East expected to be fast growing regions, driven by a sharp rise in sales of autographed cards.

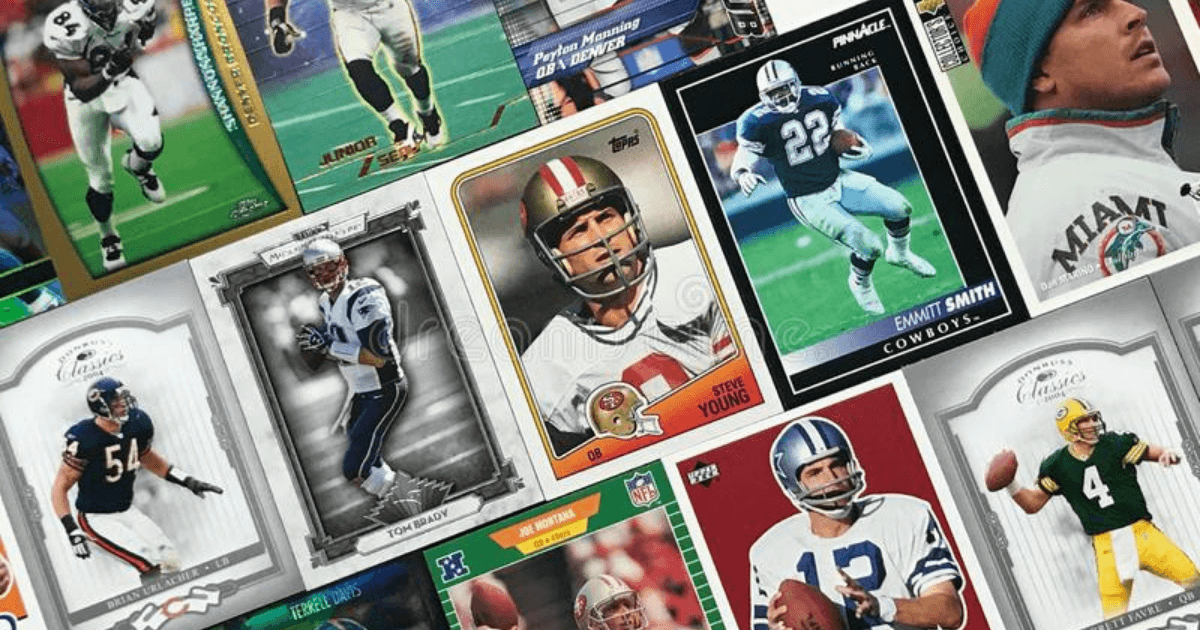

The market for physical trading cards has boomed recently, driven in part by casual collectors spending more time at home due to the pandemic, rekindling a hobby that perhaps had waned. The sports collectibles business, like many others, is also caught in the midst of a digital revolution, whether via digital “cards” that mirror their cardboard equivalents, or more recently, through NFTs.

A big share of the business remains in the traditional cardboard versions – 55% of Topps’ $567 million in revenue in 2020 came from physical cards, sales of which were forecast to rise another 23% this year to $692 million – but everyone in the trading card business is well down a digital path.

A potential signal of Fanatics’ aggressive intentions came earlier this year when MLB signed an agreement with Fanatics’ new venture Candy Digital to develop NFTs, starting in June with a token of Lou Gehrig delivering his iconic “Luckiest Man” speech at Yankee Stadium in 1939.

Not that the trading card companies hadn’t been making their own forays. Earlier in the spring, Topps released MLB NFT trading cards on the Wax blockchain network and Panini, which developed its own private network, introduced its first MLB set this week under its premium Prizm brand. Panini also has NFTs for the NFL and NBA. Both companies also have on-demand capability for print and digital cards (Panini Instant, Topps Now ) for “in the moment” production of commemoratives marking key plays and events. As a major player in sports licensing, Fanatics already is a big player in such “hot market” opportunities.