For a Lucky Few, 2020 Was Just What They Needed

There’s no doubt it’s been a rough year – there’s a reason one of the most popular ornaments this holiday season is a dumpster on fire. But for a lucky few, the flames of 2020 actually helped forge their revival. These are the 2020 Comeback Kids

Barbie and Other Classic Toy Brands

Barbie’s back, baby, and so are other nostalgic toy brands like Tonka, Hot Wheels and Play-Doh as panicked parents turned to their own youth for inspiration while searching for ways to occupy their kids and minimize screen time during the long hours of lockdown.

In the case of Barbie, a yearning for simpler, screen-free times wasn’t the only factor in play. After years of declining sales and a growing sentiment that the brand was losing cultural relevance, Mattel set out to reinvent its flagship doll brand in 2014 with more diverse, outspoken and on-trend persona and products.

In the case of Barbie, a yearning for simpler, screen-free times wasn’t the only factor in play. After years of declining sales and a growing sentiment that the brand was losing cultural relevance, Mattel set out to reinvent its flagship doll brand in 2014 with more diverse, outspoken and on-trend persona and products.

That groundwork meant that Barbie was perfectly poised (isn’t she always though?) to reign as a potent combination of nostalgia, social awareness and boredom struck homebound consumers this year. New original content on Netflix was the icing on the cake.

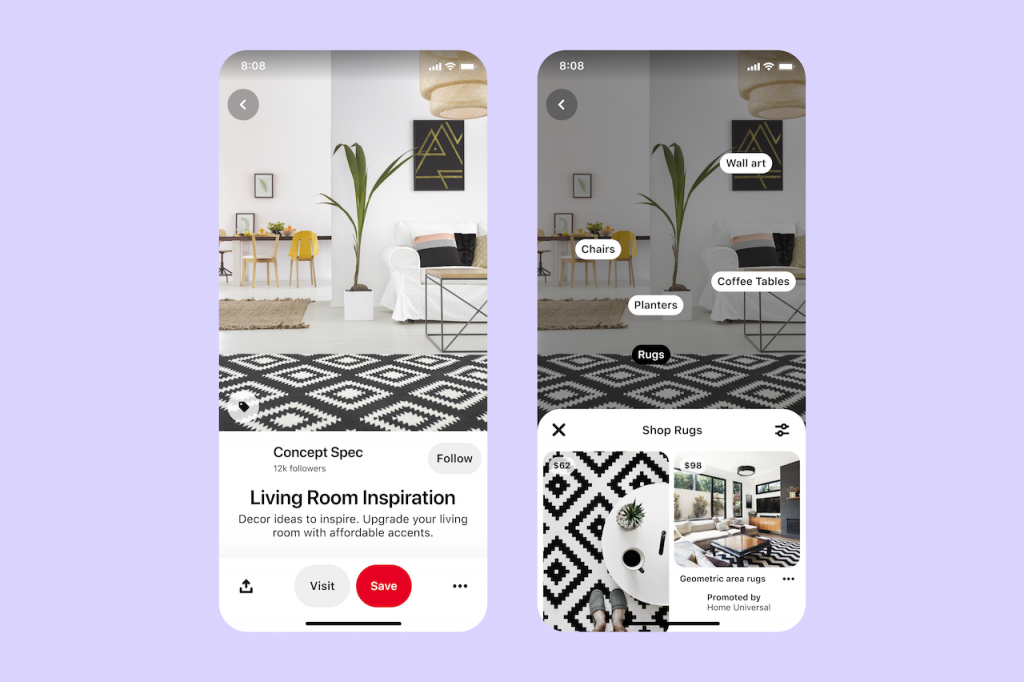

Pinterest

Turns out, in between all the tik-ing and tok-ing this year, people were also pinning. Don’t feel bad if you forgot Pinterest existed. But after several years of being overshadowed by its flashier counterparts, Pinterest stepped back into the spotlight in a big way.

In Q3, the platform saw a 58% jump in year-over-year revenue and a 37% YOY increase in monthly active users (that’s stronger growth than Facebook, Snapchat and Twitter).

In Q3, the platform saw a 58% jump in year-over-year revenue and a 37% YOY increase in monthly active users (that’s stronger growth than Facebook, Snapchat and Twitter).

Turns out the homebound Doers of 2020 were using Pinterest for inspiration, and perhaps more importantly, purchasing. The number of users shopping on the platform was already up 50% in the first half of the year and that was before Pinterest updated its shopping features in September.

Further bolstering the platform was Pinterest’s longstanding reputation as a “brand safe” environment, which became even more appealing as other social sites battled issues with misinformation, hate speech and national security concerns.

Now, as it continues to work toward its goal of “making every Pin shoppable,” Pinterest is in a prime position to rule the ranks of mobile commerce well beyond the pandemic.

Junk Comfort Food

Pandemic snacking (and the resulting Pandemic 15) was a thing this year as homebound consumers turned to familiar packaged favorites, bucking a years-long trend toward healthier food choices.

Almost across the board CPG companies like Campbell Soup Company, Mondelez, J.M. Smucker and Kraft Heinz reported banner sales this year.

It’s no secret that relationships formed in the face of adversity can be uniquely strong. What remains to be seen is whether the new relationship consumers have developed with Big Food during the pandemic is an enduring one, or whether the chips will get chucked in favor of kale crisps as soon as the crisis is past.

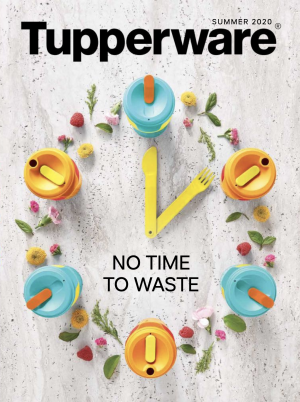

Tupperware

Consumers were eating more than just Oreos and Mac ‘N Cheese this year though, they were also cooking in record numbers. And amid the surge in homecooked meals, one storied kitchenware brand gained fresh relevance.

Tupperware posted its first double-digit quarterly sales increase (14.1%) in nine years in the third quarter, with gains in nearly all of its core markets globally. That’s a sharp turn from a pre-pandemic outlook for sales and profits so poor that the company’s continued existence was in question.

Tupperware’s recipe for success involved more than an unplanned worldwide pandemic. A revamped direct sales force, armed with digital tools and analytics for the e-commerce era has been key. Zoom Tupperware party anyone?

Now the company is looking to, you guessed it, licensing, to keep the growth going even after restaurants reopen.

“We are exploring alternative revenue streams such as licensing to expand brand awareness, create leads for our sales force and increase revenue from channels and consumers we don’t reach today” including “partnerships” outside its traditional direct selling, said CEO Miguel Fernandez in releasing Q3 results.

Best Buy

The work from home boom has been a boon for Best Buy, which posted its best quarterly same-store sales growth in a quarter century in Q3.

To be fair, this ship was already turning well before the pandemic, but it wasn’t so long ago that Best Buy looked like it was going to be just another “showrooming” casualty of Amazon. Smart improvements in tech and e-commerce allowed the retailer to emerge as one of the winners in this loser of a year for retail.

Of course, it didn’t hurt that Best Buy’s core product – electronics – turned out to be essential to working (and playing) from home.

Nintendo

Xbox and PlayStation may have stolen the spotlight for a bit in recent weeks, but Nintendo still won the year.

Xbox and PlayStation may have stolen the spotlight for a bit in recent weeks, but Nintendo still won the year.

Long before the Xbox Series X/S and PlayStation 5 entered the scene, the Switch was burning holes in wallets. Even in November, when the two much lauded competitive consoles debuted, the Switch still sold more units than either and marked a record-breaking 24 months as the best-selling console in the U.S.

Lest we forget, before the Switch entered the scene in 2017 things were looking dire for Nintendo. The company hadn’t had a hit since the Wii in 2006, which proved to be relatively short-lived as far as consoles go.

The Switch changed all that, and while it was already a champion well before COVID, the console’s flexible format and family-friendly games proved to be just the ticket for multi-generational players confined to their homes.

The timely release of “Animal Crossing: New Horizons” on March 20, just as the world found itself unexpectedly locked down, gave gamers a comforting dose of unreality and the ability to move around freely at exactly the moment when neither was available in the real world.

All of that has led to a 200% increase in profits for Nintendo and a comfortable position in players’ homes likely for years to come.

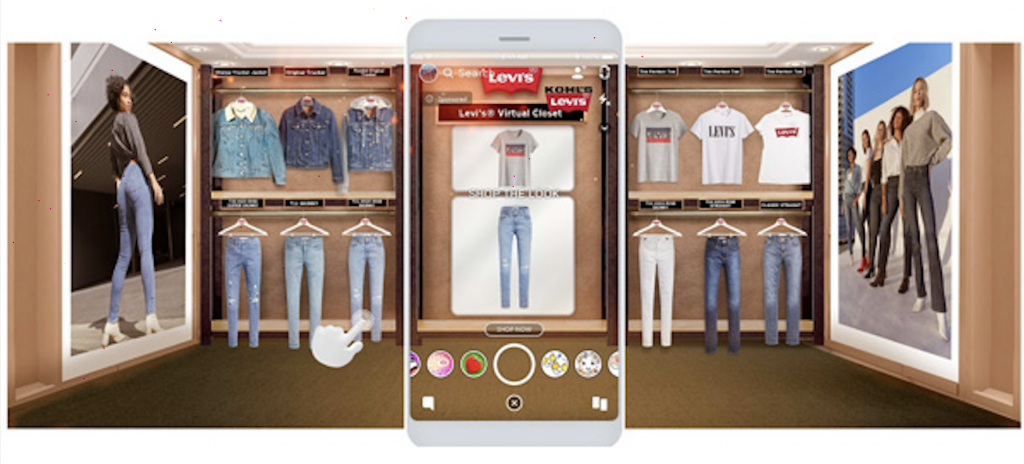

Augmented Reality

One too many gimmicky Augmented Reality marketing ploys had soured the appetite for AR somewhat… until the pandemic.

Advanced tech and a sudden, substantial need to replace physical experiences with virtual ones have brought Augmented Reality back to the forefront.

Take for example, Kohl’s collaboration with Snapchat in May. The retailer teamed up with the social platform to create Kohl’s AR Virtual Closet, which let users shop and purchase a curated assortment of Kohl’s products without ever leaving the app.

Earlier this year Apple’s Tim Cook predicted that AR will eventually “pervade our entire lives,” and indeed, with use cases popping up across retail, gaming and social media, he looks to be right, especially as 5G begins to roll out around the world.

The Drive-In

Pre-pandemic estimates had put the number of remaining drive-ins across the whole of the US at just a little over 300. Enter COVID. As movie theaters struggled to keep their doors open, the drive-in becomes the distribution platform of choice for everything from film festivals to tentpole releases.

At the traditional kickoff to summer blockbuster season in May, just 320 theaters were open across the U.S., and half of those were drive-ins.

Now that colder months have arrived, enthusiasm has chilled, but it is possible (albeit unlikely) that this brief interlude reminded consumers of the charm of the format, ushering in a more permanent return for the drive-in. Guess we’ll find out next summer.