Gen Z is Redefining Entertainment—Are Brands Listening?

Dubai – Backed by global data and trend analysis from BrandTrends Group, this article explores the evolving expectations of Gen Z—highlighting the major shifts entertainment brands must make to thrive in today’s rapidly changing licensing landscape.

Gen Z (ages 12–26) aren’t just the future. They’re the now. And as they continue to mature into a dominant economic and cultural force, entertainment and licensing stakeholders face a critical question: what truly grabs their attention?

Backed by global consumer tracking across 40+ countries, BrandTrends Group has identified a profound generational shift in how youth audiences engage with entertainment brands. This shift brings both risks and opportunities for licensors, licensees, retailers, and agents. To thrive, industry stakeholders must not only understand each generation but respond with strategies that reflect their unique expectations.

MARVEL LEADS, BUT GENDER GAPS TELL A BIGGER STORY

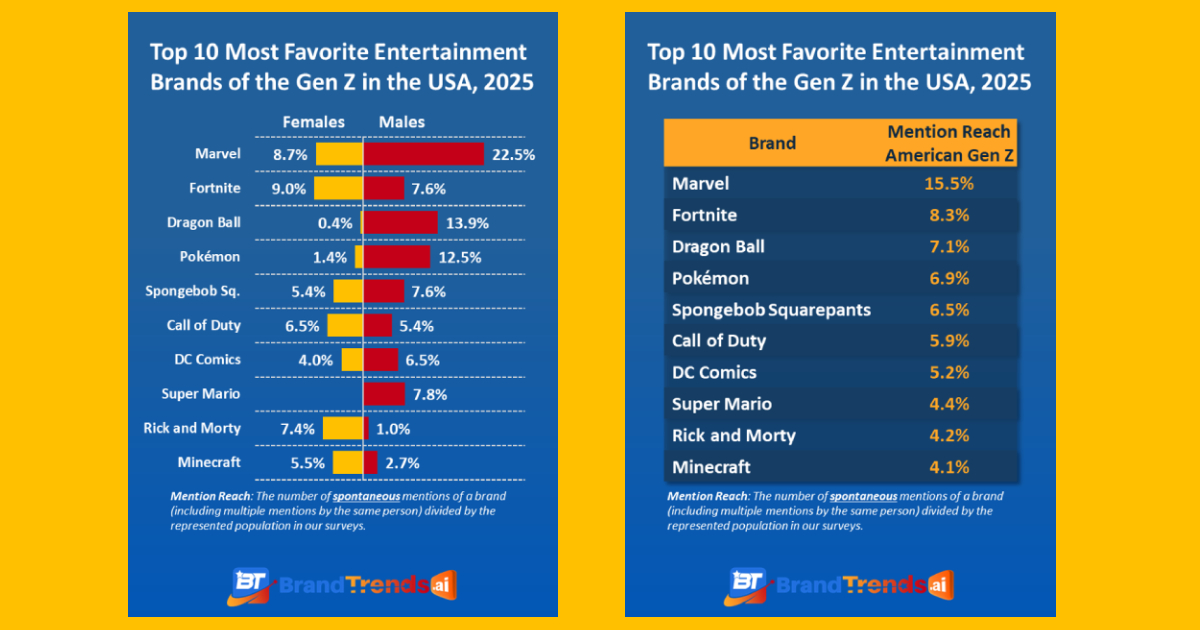

Our most recent dataset—collected via open-ended (unaided) responses from Gen Z respondents in the United States among 6,080 respondents—shows that Marvel ranks as the most favored brand overall, mentioned spontaneously by 15.5% of respondents. Notably, its appeal is strongest among males (22.5%) but remains significant among females (8.7%), making Marvel one of the few brands demonstrating cross-gender resonance.

However, beyond Marvel, the data paints a sharply segmented picture. Balance is rare and most brands see a clear divide:

- Dragon Ball and Pokémon are cited by 9% and 12.5% of males, respectively, but just 0.4% and 1.4% of females.

- Rick and Morty presents the opposite pattern, with 4% of female mentions compared to 1.0% male.

These figures indicate a significant gender imbalance in brand affinity—a pattern that recurs across several entertainment domains, particularly in gaming.

GENDER DISPARITIES IN ENTERTAINMENT PREFERENCES

The analysis of spontaneous mentions of brands reveals persistent structural divides:

Gaming-related IPs like Counter Strike, Valorant, and Asphalt show no female engagement, effectively excluding half of the Gen Z demographic. This exclusion suggests a deep-seated misalignment between content format and audience inclusion, warranting strategic reevaluation.

BALANCED BRANDS ARE THE EXCEPTION, NOT THE RULE

Despite widespread segmentation, a few brands achieve gender parity. Fortnite, for example, is mentioned by 7.6% of males and 9.0% of females, positioning it as a rare gaming IP that resonates across the spectrum. Similarly, Call of Duty garners near-equal interest (5.4% males vs. 6.5% females), a surprising finding for a franchise rooted in first-person shooter mechanics.

These instances show that gender-neutral content is achievable, particularly when franchises evolve beyond core gameplay to incorporate socialization, collaboration, and user-generated content.

THE CULTURAL FRAMEWORK OF GEN Z: A DATA-INFORMED PROFILE

To contextualize these patterns, it’s necessary to understand the cultural operating system of Gen Z. Based on recurring themes across BrandTrends’ global datasets, Gen Z’s media behavior and brand interactions are shaped by the following dynamics:

1. Digital fluency and instant visualism

Raised on smartphones and social platforms, Gen Z prefers brands that communicate visually and concisely. Brands that fail to adapt to TikTok-like formats or meme-literate discourse risk irrelevance.

2. Identity-first consumption

This cohort values personal expression, fluid identity, and inclusivity. The absence of dominant female-centric entertainment IPs in unaided responses suggests that many brands have yet to authentically serve these values.

3. Authenticity and trust

Our data, on all our trackers, consistently shows that Gen Z rewards brands that are transparent, value-driven, and socially aware. This aligns with broader cultural movements where performative marketing is scrutinized, and emotional resonance drives loyalty more than aesthetics or status.

4. Community-driven engagement

Gen Z engages through micro-communities—cosplay, fandoms, streamers, and niche platforms—more than mainstream media. Brands that support co-creation, roleplay, and shared storytelling see higher engagement.

IMPLICATIONS FOR LICENSING AND BRAND STRATEGY

Gen Z is setting the bar higher—and faster—for brand relevance. Here’s what stakeholders must embrace to stay competitive:

1. Address the female engagement gap

With most top-ranking brands skewing male, the licensing industry is overlooking significant opportunities. Developing entertainment IPs tailored to female Gen Z tastes—without relying on outdated stereotypes—could unlock new consumer bases.

2. Expand transmedia integration

Brands with presence across multiple media (e.g., Marvel, Pokémon, Minecraft) consistently outperform others. These IPs benefit from ecosystem thinking, where content is not only consumed but experienced—through gaming, streaming, merchandise, and fan events.

3. Leverage cross-gender IPs for broader reach

Brands like Fortnite and Call of Duty prove that even traditionally male-leaning genres can evolve into inclusive franchises. Storytelling choices, character diversity, and collaborative gameplay are key levers.

4. Localize global appeal

Japanese anime continues to thrive among U.S. males, illustrating Gen Z’s openness to global content ecosystems. Building franchises with international resonance will become increasingly essential.

RELEVANCE ISN’T A GIVEN—IT MUST BE EARNED.

Gen Z is a complex audience: digitally native, socially conscious, and emotionally driven. Marvel’s continued success proves legacy franchises still resonate—but the data exposes deep market imbalances, and with them, untapped potential.

“Gen Z is shaping culture through brand alignment. Gen Alpha takes it further—fully digital, visually expressive, and demanding instant engagement,” says Philippe Guinaudeau, CEO of BrandTrends Group. “If you’re planning to license for tomorrow, start designing with both generations in mind today.”

The future belongs to brands that commit to authentic storytelling, inclusive design, and multiformat scalability. Entertainment companies, licensees, and marketers must adapt now or risk falling behind a generation that refuses to be boxed in. The brands that win will be those that see licensing not as an endpoint, but as a gateway to immersive, personal, and value-driven consumer journeys.

At BrandTrends Group, we continue to monitor these shifts globally, offering our partners the insights necessary to future-proof their brand strategies in an ever-evolving entertainment landscape.

ABOUT THE REPORT

This report provides a detailed analysis of brand awareness, popularity, and purchase intent for the most prominent entertainment brands in the U.S. What sets it apart is that all insights are drawn from spontaneous, open-ended responses—not influenced by any pre-defined brand list—offering a true reflection of top-of-mind consumer sentiment. Based on a nationally representative sample of 6,080 American respondents, the findings also identify product category purchase intentions. Part of a global tracking service covering 42 countries and over 200,000 respondents annually, the study monitors more than 11,500 entertainment, fashion, and sports brands across all age groups, from infants to seniors.

ABOUT BRANDTRENDS GROUP

BrandTrends Group is the global benchmark in brand and licensing intelligence, recognized as the gold standard in the industry. Specializing in brand equity, consumer behavior, and lifestyle trends—particularly among children, youth, and families—BrandTrends operates in up to 53 markets annually, providing consistent, indepth insights into brand performance and consumer sentiment worldwide. What sets BrandTrends apart is its ability to turn complexity into clarity. Its team of expert analysts and data scientists uses proprietary tools like the Brand Popularity Index and Consumer Demand Gap to deliver actionable, strategic foresight. These insights help clients optimize retail activations, brand positioning, and product development. At the core of its methodology is the seamless integration of advanced technology and AI— enhancing every stage of the research process, from data collection to analysis and delivery, with speed, scale, and precision. Trusted by global corporations and smaller organizations alike, BrandTrends is committed to democratizing market intelligence and elevating the licensing ecosystem. To learn more, visit www.brandtrends.ai.