How Much Of The Ecommerce Gain Will Last?

How quickly will consumers return to stores, and what will they find when they get there?

That’s the lingering question as global economies slowly re-open while still also navigating social distancing and other health guidelines as the pandemic continues to linger.

As the stores fling open their doors, it’s an open question whether consumers will flock to them after weeks of shopping online, save for occasional trips to grocery stores and pharmacies. Sixteen U.S. states and multiple countries around the globe are in the process of lifting stay-at-home restrictions and defining – in stages – the terms of “a new normal.”

A permanent trend?

“It will remain to be seen if the increase in online buying becomes a permanent trend, or just a moment in time” over the next 12-18 months, says Silver Buffalo VP Greg Alprin. “I think eventually people will gravitate back to traditional retailers for things like apparel, accessories and trend items that are harder to shop for online. I’m convinced that people still like the in-store shopping experience.”

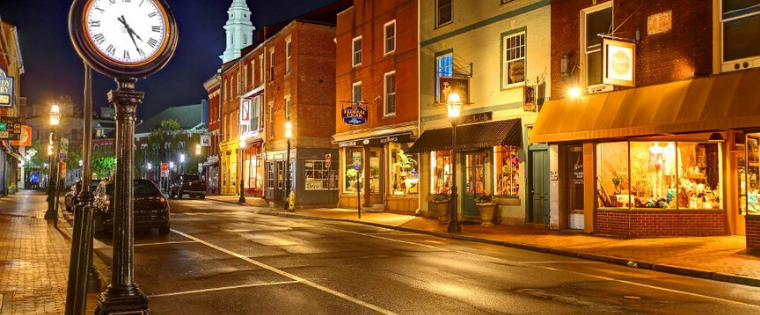

But there’s little doubt there will be a changed brick-and mortar landscape. Some retailers are expected to close under-performing locations that were further weakened by corona closures. Others will convert more of their physical space to servicing online orders. And everyone will facing the conundrum of how to sell tactile goods such as apparel, accessories and bedding to customers who may be leery about touching products that others have handled. Retailers will have to make sure that consumers feel safe in their aisles.

Testing new concepts

“We may also see more testing of concepts that draw customers into stores, whether its experiential elements like VR or designing entirely new concepts such as pickup only locations,” says Greg Zakowicz of Omnisend, an email marketing automation platform built for ecommerce brands.

But there’s definite momentum toward at least a modest reordering of the shopping landscape. Coresight Research said its consumer survey conducted April 22 found “a significant increase in the proportion of respondents expecting to switch retail purchases from stores to e-commerce once the crisis ends—this rose to 27.8% of all respondents, from 22.7% last week.”

Online grocery big winner

Online grocery – for the moment at least — seems to be a big winner in the U.S., with a shopping cartful of consumers submitting orders for the first time. Hershey CEO Michele Buck cited recent research findings that 45% of consumers said they’d used one or more online grocery services since mid-March, 23% of them for the first time. And 31% of U.S. shoppers – including 50% of millennials –said they likely or very likely would continue to use online grocery pick-up or delivery in a post-pandemic world, according to March/April survey by research firm Acosta. (Last summer, Gallup reported that only 11% of Americans ordered groceries online at least once a month.)

Target said its ecommerce sales in Q1 ended March 30 doubled from a year earlier. Another indicator: downloads of Walmart’s and Instacart’s grocery delivery apps rose 160% and 218% percent, respectively, from February through March 15. Hershey’s ecommerce business jumped 120% in March, doubling the increase registered in January and February.

And retailers aren’t the only ones weighing new strategies for a post-pandemic world. One major apparel licensee plans to more than triple its direct-to-consumer business during the next two years. It’s a strategy that was well underway prior to the COVID-19 outbreak, and while the revenue it produces is small compared to the share of its business that goes through brick-and-mortar, it protects against business disruptions, an executive at the licensee said.

“We are looking at scaling this across all territories so that we are less reliant on retail” going forward,” he said.