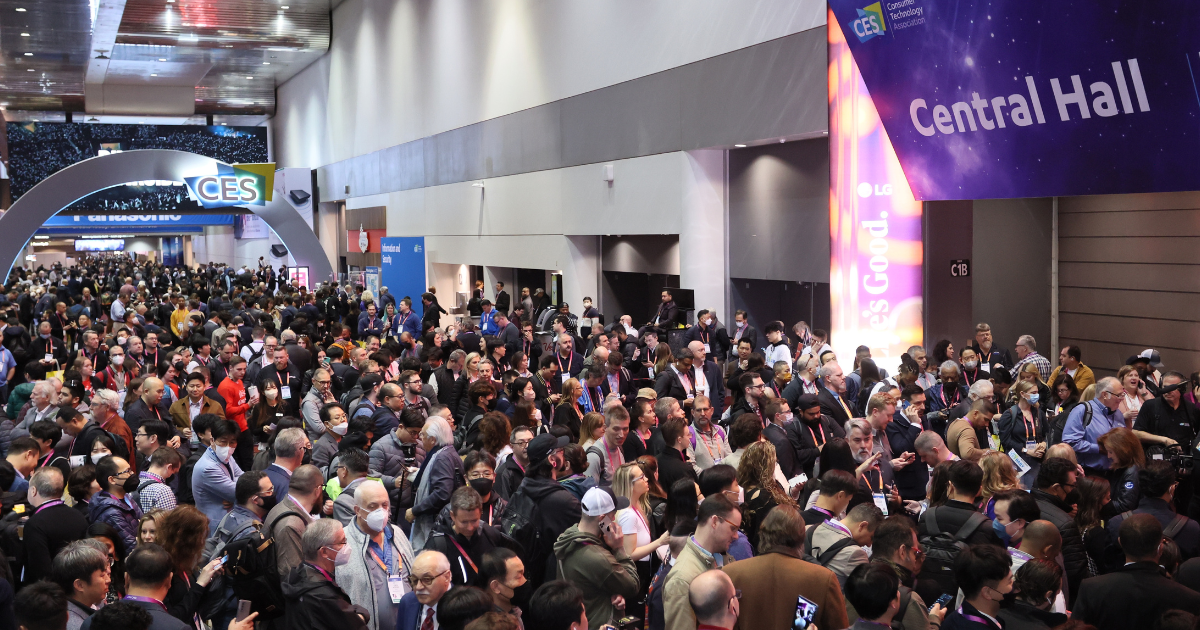

Licensed Brands Gain Traction at CES

By Mark Seavy

Artificial intelligence (AI), healthcare, and mobility will be center stage at CES in Las Vegas this week, according to industry experts. This shifting spotlight means consumer electronics brands that were once showstoppers at the tech event will take on a supporting role.

The changes come as CES has expanded from a hardware-focused show to one that also highlights software, automobile connectivity, interactivity, and even cosmetics. For example, L’Oréal CEO Nicolas Hieronimus was announced as a keynote this year.

To reflect this expanded focus, the name of the annual event—once the Consumer Electronics Show—was shortened to CES. And the trade association that runs the event rebranded to the Consumer Technology Association (CTA) from the Consumer Electronics Association.

AI, in particular, is expected to be a major focus at the event due to several launches. Software company Cerence, which develops AI-powered virtual assistants, is set to announce a partnership with Volkswagen, while Amazon will unveil a generative AI effort with BMW. Intel will demonstrate AI-equipped PCs with Dell, Lenovo, Hewlett-Packard, and Microsoft. Samsung will launch AI-driven 8K LCD TVs in 65- to 85-inch sizes featuring upscaling technology that boosts 4K resolution to 8K.

“The week-long event will be filled with major advancements across the entire AI ecosystem, ranging from software to hardware, branching into the automotive space in an AI Arms Race kicking off for 2024,” Wedbush Securities analyst Daniel Ives said in a research note. “This mainstream technology wave is unlike anything we have seen since the Internet in 1995.”

In fact, due to AI increasingly gaining traction, CTA is forecasting that U.S. consumer technology sales will increase 2.8% to $512 billion this year. That follows 2023 when sales hit $498 billion, surpassing an earlier CTA forecast for $485 billion.

Despite this shift in focus, major consumer electronics (CE) brands like LG Electronics, Samsung, Sony, and Panasonic will still have a significant presence on the CES show floor. There will also be a number of lesser-known, multi-brand licensees present, with many of them fielding nostalgic CE brands.

In many cases this return to the likes of RCA, Kodak, Blaupunkt, Magnavox, and others is being spurred by companies seeking to compete with one-time contract Chinese manufacturers turned brands unto themselves, including Hisense and TCL.

“I see the licensing of CE brands growing because the companies that were sourcing products before really need some extra leverage to compete with the Chinese brands,” said Jason Sutton, Senior Business Development Director for Telefunken at Gordon Brothers. Gordon Brothers acquired the brand and 30 licensees last year, the largest of which is Turkish manufacturer Vestel (TVs).

Among this cast of licensees is Star Glory Limited, which is fielding licensed Kodak (TVs, Bluetooth speakers, headphones), Blaupunkt (LED lighting), and Daewoo (mobile, audio electronics) products. Southern Telecom has Packard Bell (notebook PCs) and Brookstone (wireless headphones) offerings, while Maxtalent Technology will have items from Kodak (digital photo frames) and Thomson (audio).

Talisman Brands-owned RCA, which was among the top CE brands in the U.S. when it was owned by Thomson, will return to the show floor with licensees Treasure Creek (TVs) and Top Tech (Bluetooth audio). It also will have a pet feeder, perhaps an homage to RCA’s former dalmatian mascot, Nipper. Talisman, which operates under Established Inc., acquired the RCA brand in buying Technicolor’s licensing business, which also included the Thomson, Ferguson, and Victor labels. Additionally, Funai (Philips and Magnavox TVs) and CE supplier Vizio will both be exhibiting at off-site hotel suites.

Other formerly stalwart standalone CE brands will be at the show with their new owners, including Toshiba (Hisense), Sharp (34%-owned by Foxconn), and Westinghouse Digital (Tsinghua Tongfang).

“It’s now a small handful of companies that are taking the licenses, but they are taking them to address different markets, regions, and retailers. For them, it means being able to have multiple offerings so if they a have a retailer that doesn’t like one brand, they have another they can go with,” Sutton said.