Mattel Reports Third Quarter 2023 Financial Results

Third Quarter 2023 Highlights Versus Prior Year

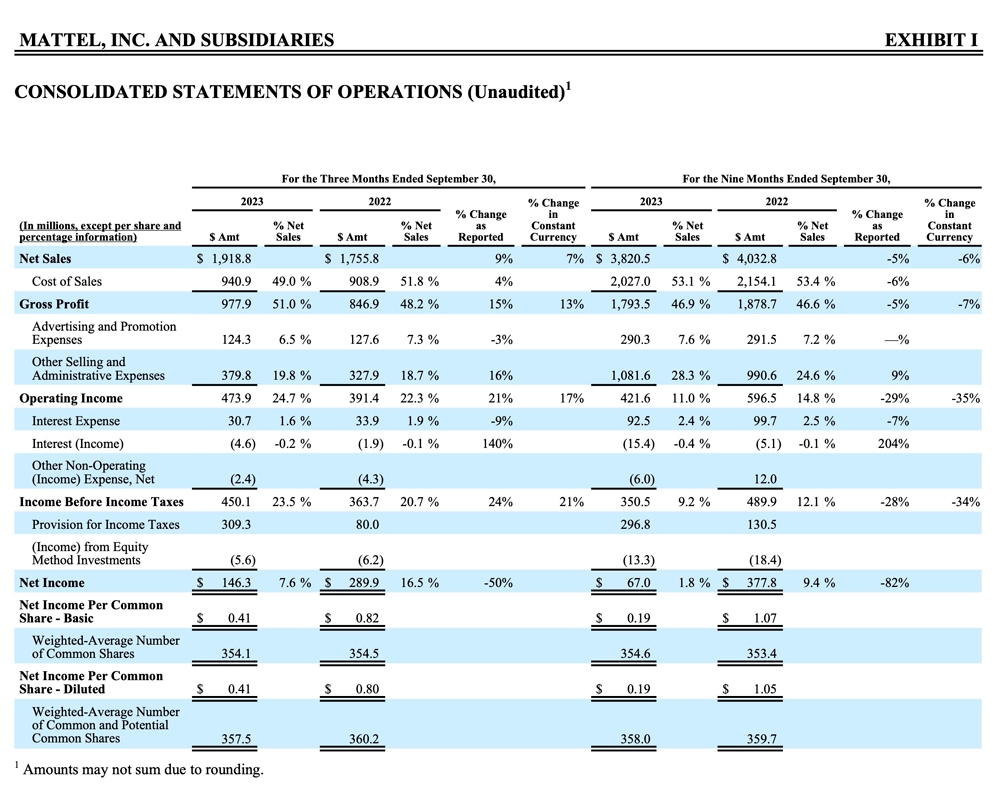

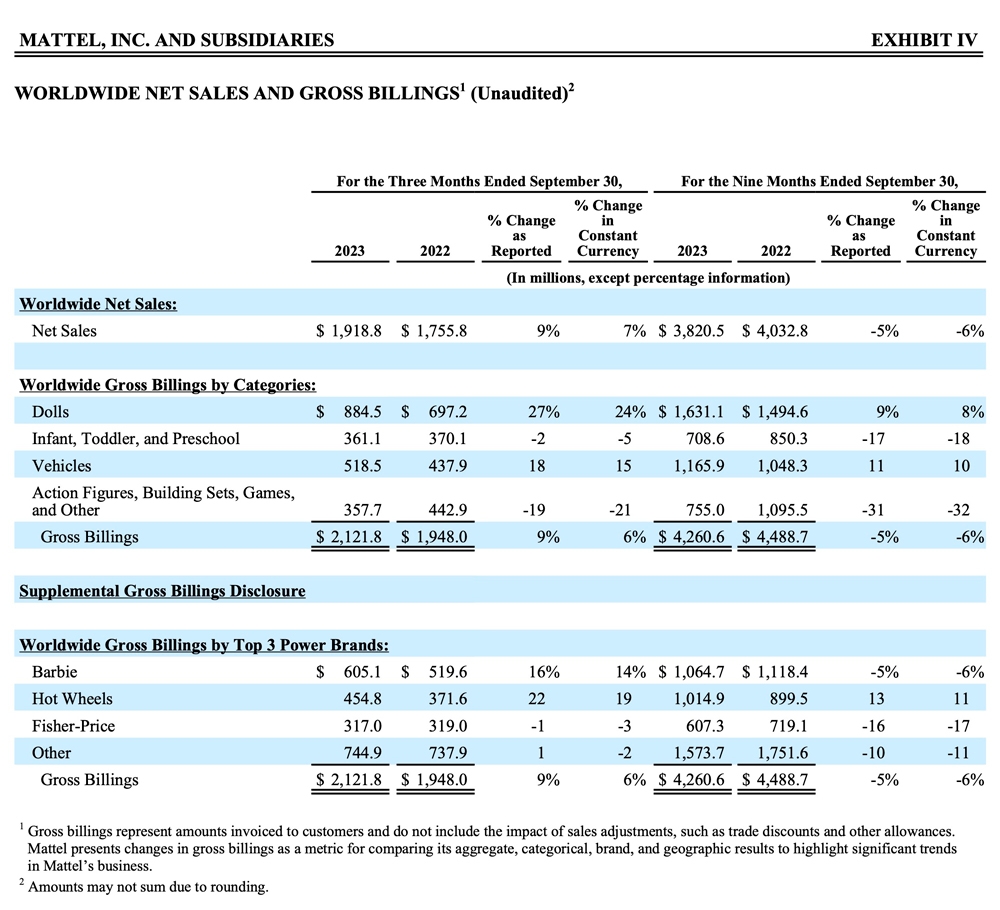

- Net Sales of $1,919 million, up 9% as reported, or 7% in constant currency

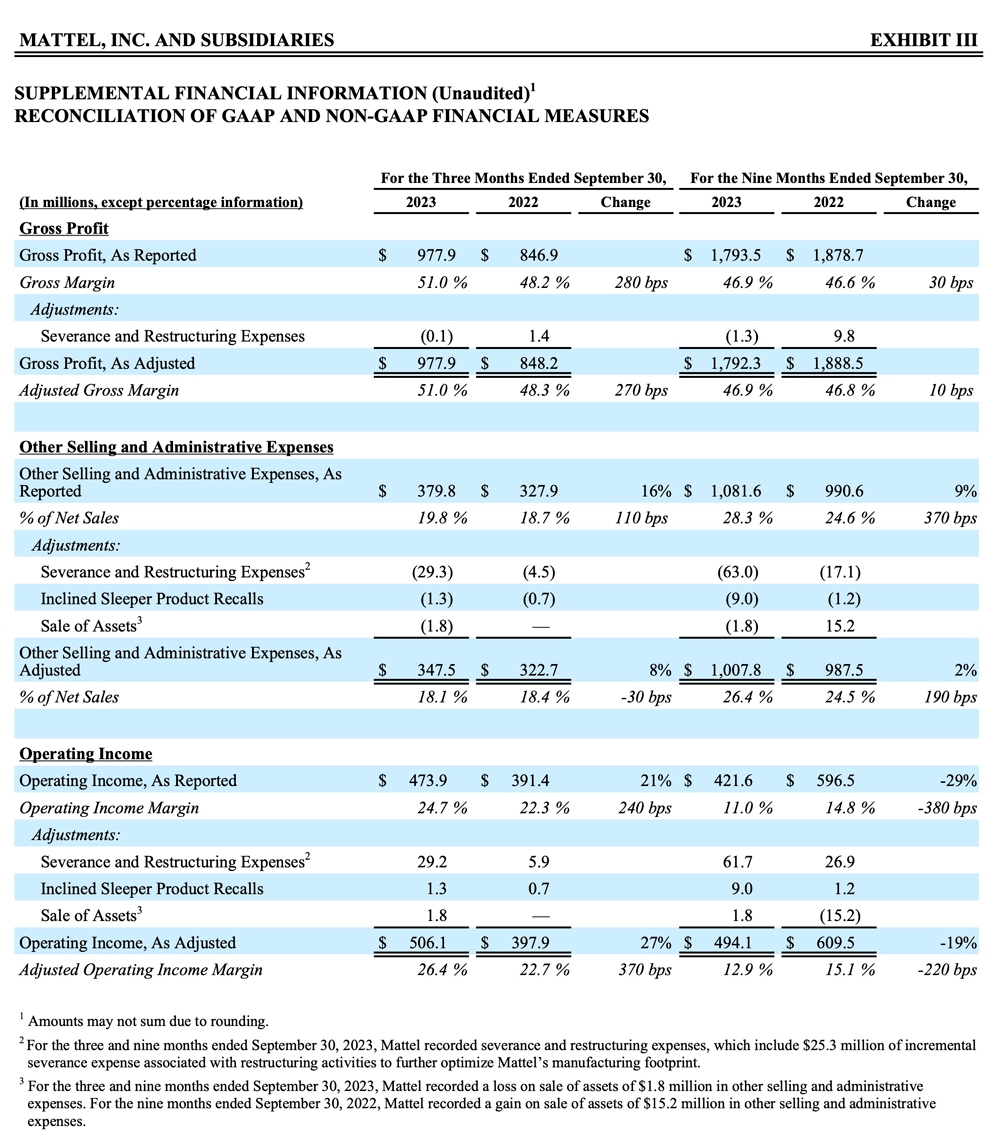

- Gross Margin of 51.0%, an increase of 280 basis points; Adjusted Gross Margin of 51.0%, an increase of 270 basis points

- Operating Income of $474 million, an increase of $82 million; Adjusted Operating Income of $506 million, an increase of $108 million

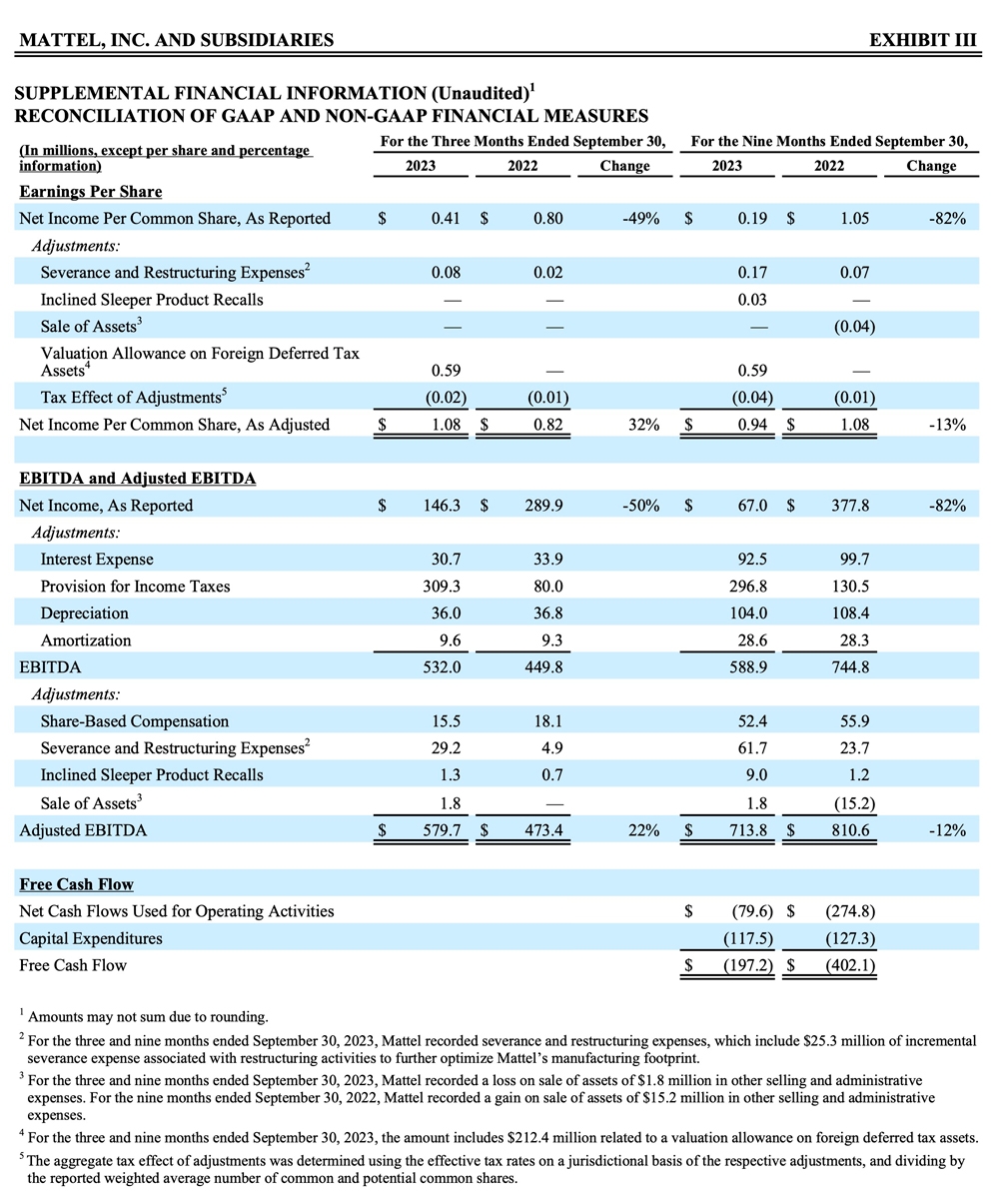

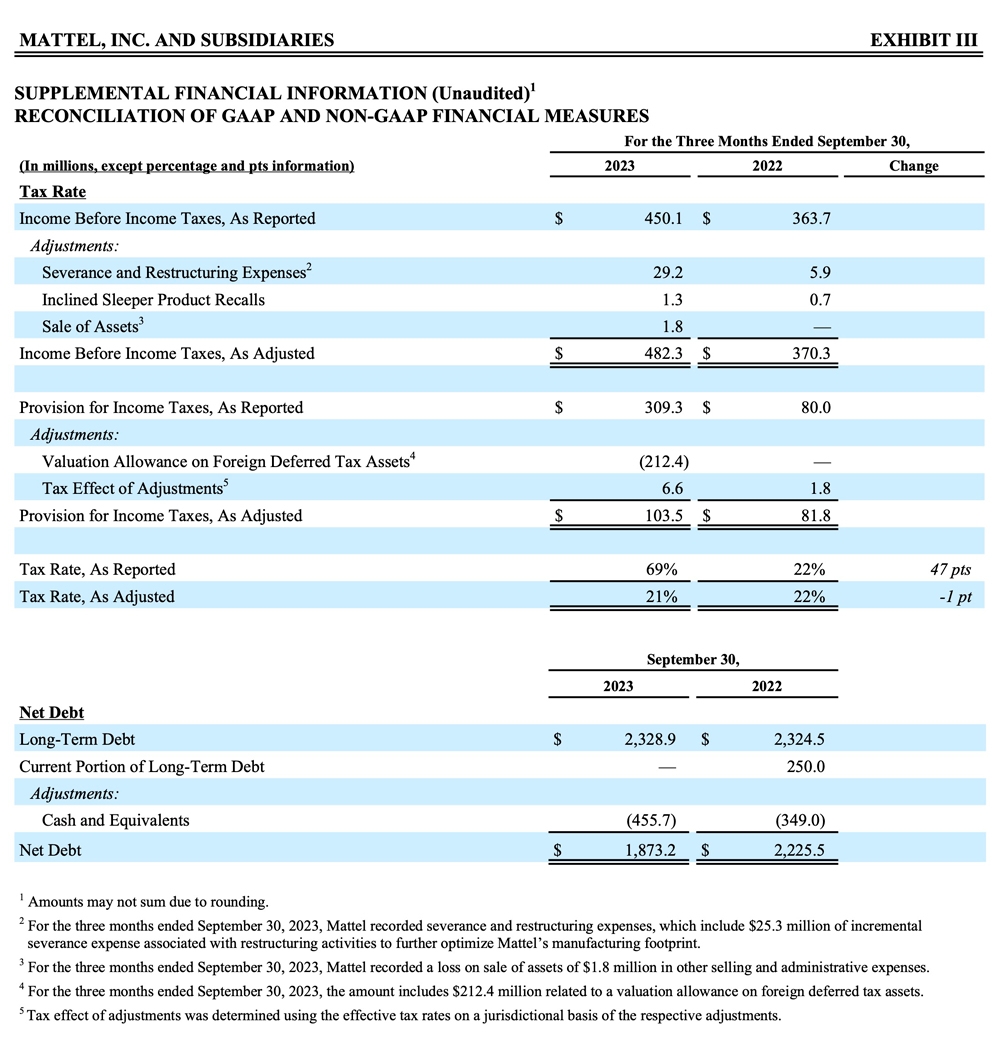

- Net Income of $146 million, which includes a non-cash charge of $212 million relating to the establishment of a valuation allowance on foreign deferred tax assets, compared to prior year Net Income of $290 million

- Earnings per Share of $0.41 compared to prior year Earnings per Share of $0.80; Adjusted Earnings per Share of $1.08 compared to prior year Adjusted Earnings per Share of $0.82

- Adjusted EBITDA of $580 million, an increase of $106 million

- Repurchased $60 million of shares, bringing year-to-date total to $110 million

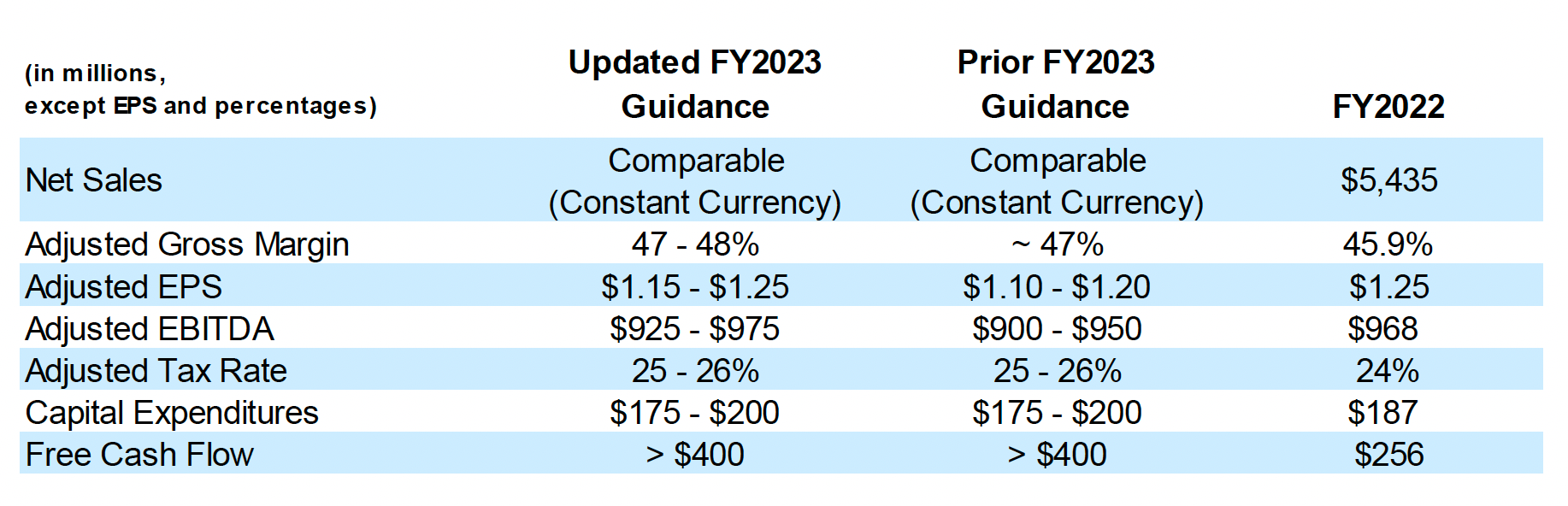

- Company raises 2023 guidance for Adjusted Gross Margin, Adjusted EBITDA, and Adjusted EPS

EL SEGUNDO, Calif., Oct. 25, 2023 – Mattel, Inc. (NASDAQ: MAT) today reported third quarter 2023 financial results.

Ynon Kreiz, Chairman and CEO of Mattel, said: “Mattel’s strong third quarter performance reflects the successful execution of our strategy to grow Mattel’s IP-driven toy business and expand our entertainment offering. Consumer demand for our product increased in the quarter, and we continued to outpace the industry. Our results benefited from the success of the Barbie movie, which became a global cultural phenomenon, and marked a key milestone for Mattel.”

Mr. Kreiz continued: “We are very well positioned competitively and expect to gain market share in the fourth quarter and full year. I would like to thank the entire Mattel organization for their achievements, hard work, and commitment to create shareholder value.”

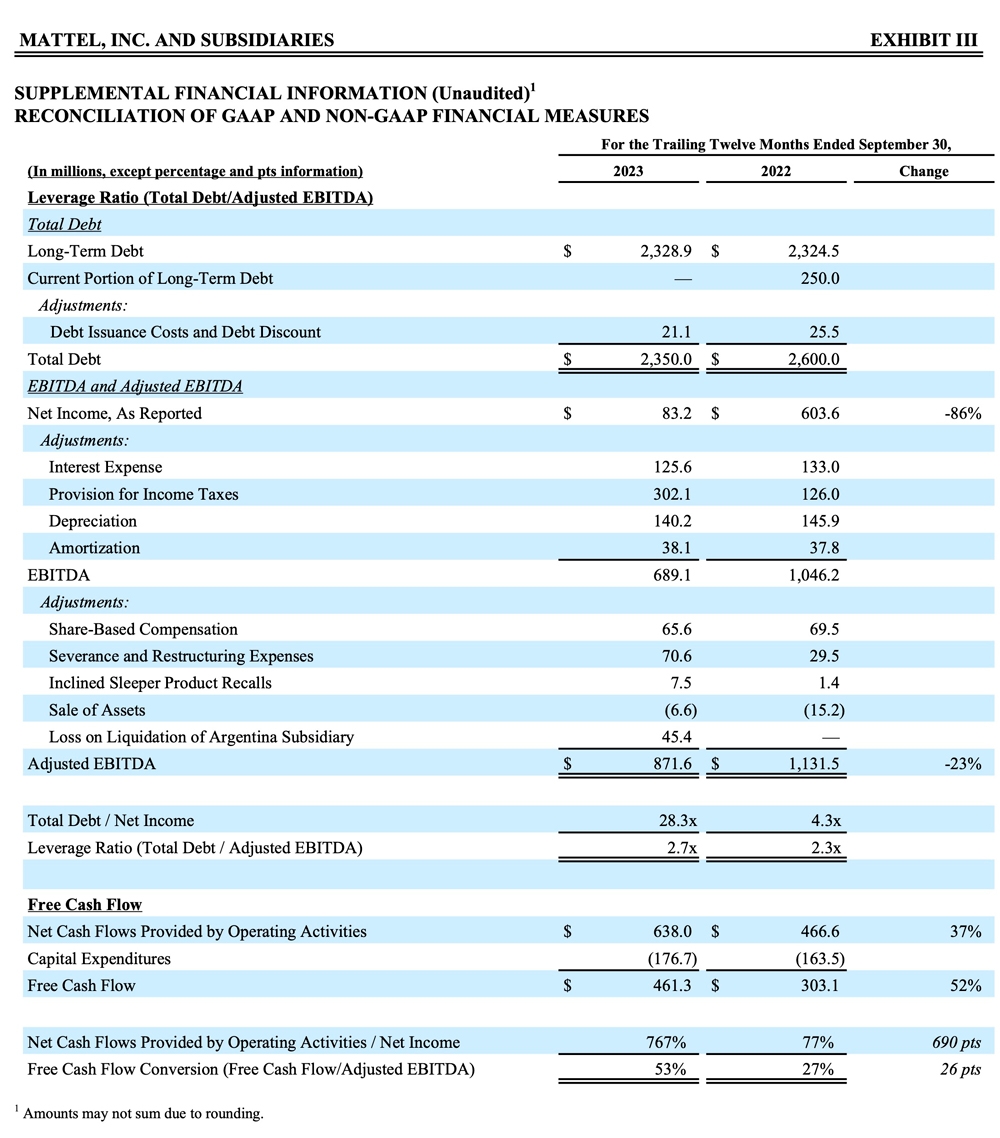

Anthony DiSilvestro, CFO of Mattel, added: “Our performance in the third quarter was comprehensive with topline growth, market share gains, adjusted gross margin expansion, and significant free cash flow improvement. Given our year-to-date performance and expectations for a strong holiday season, we are updating our guidance for 2023 to reflect anticipated upside to our margin and bottom-line results.”

Financial Overview

For the third quarter, Net Sales were up 9% as reported, or 7% in constant currency, versus the prior year’s third quarter. Reported Operating Income was $474 million, an increase of $82 million, and Adjusted Operating Income was $506 million, an increase of $108 million. Reported Earnings Per Share were $0.41, which includes a non-cash charge of $0.59 relating to the establishment of a valuation allowance on foreign deferred tax assets, compared to prior year Reported Earnings Per Share of $0.80, and Adjusted Earnings Per Share were $1.08, compared to prior year Adjusted Earnings Per Share of $0.82.

For the first nine months of the year, Net Sales declined 5% as reported, and 6% in constant currency, versus the prior year’s first nine months. Reported Operating Income was $422 million, a decline of $175 million, and Adjusted Operating Income was $494 million, a decrease of $115 million. Reported Earnings Per Share was $0.19, which includes a non-cash charge of $0.59 relating to the establishment of a valuation allowance on foreign deferred tax assets, a decline of $0.86, and Adjusted Earnings Per Share was $0.94, a decline of $0.14.

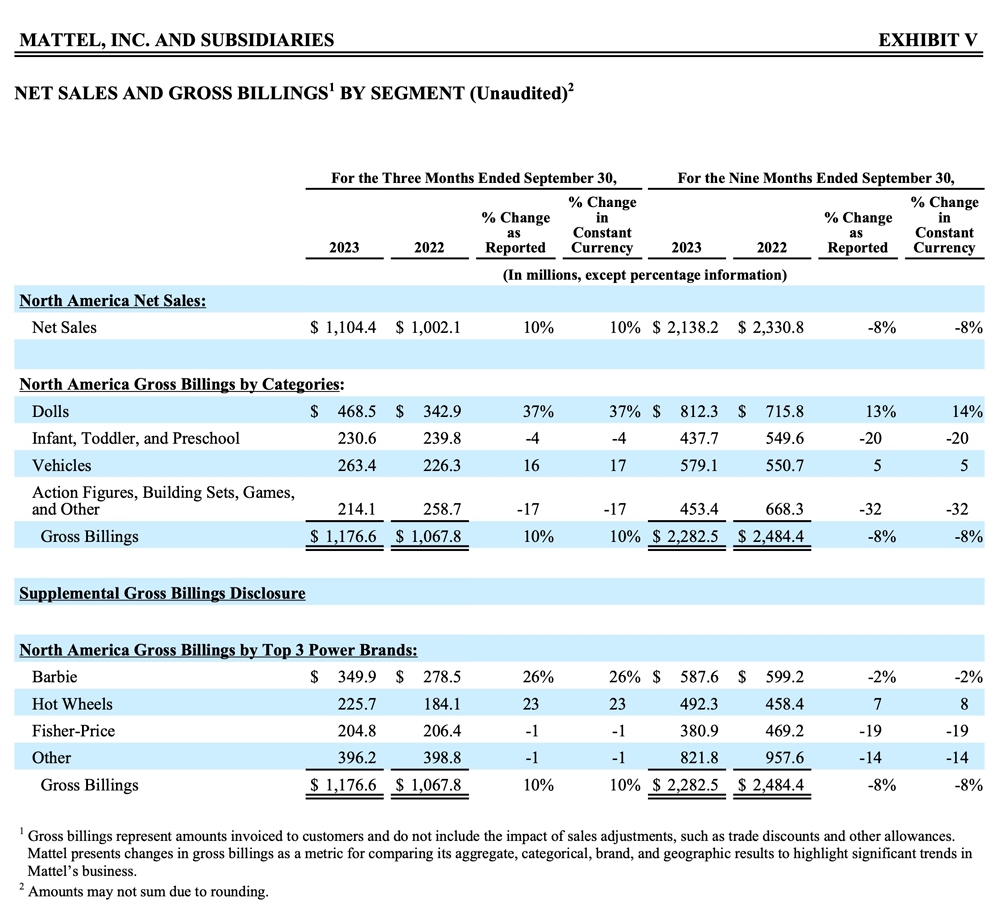

Net Sales in the North America segment increased 10% as reported and in constant currency, versus the prior year’s third quarter.

Gross Billings in the North America segment increased 10% as reported and in constant currency, driven by growth in Dolls (including Barbie and Disney Princess and Disney Frozen) and Vehicles (Hot Wheels®), partly offset by declines in Action Figures, Building Sets, Games, and Other (primarily Action Figures), and Infant, Toddler, and Preschool (primarily Thomas & Friends).

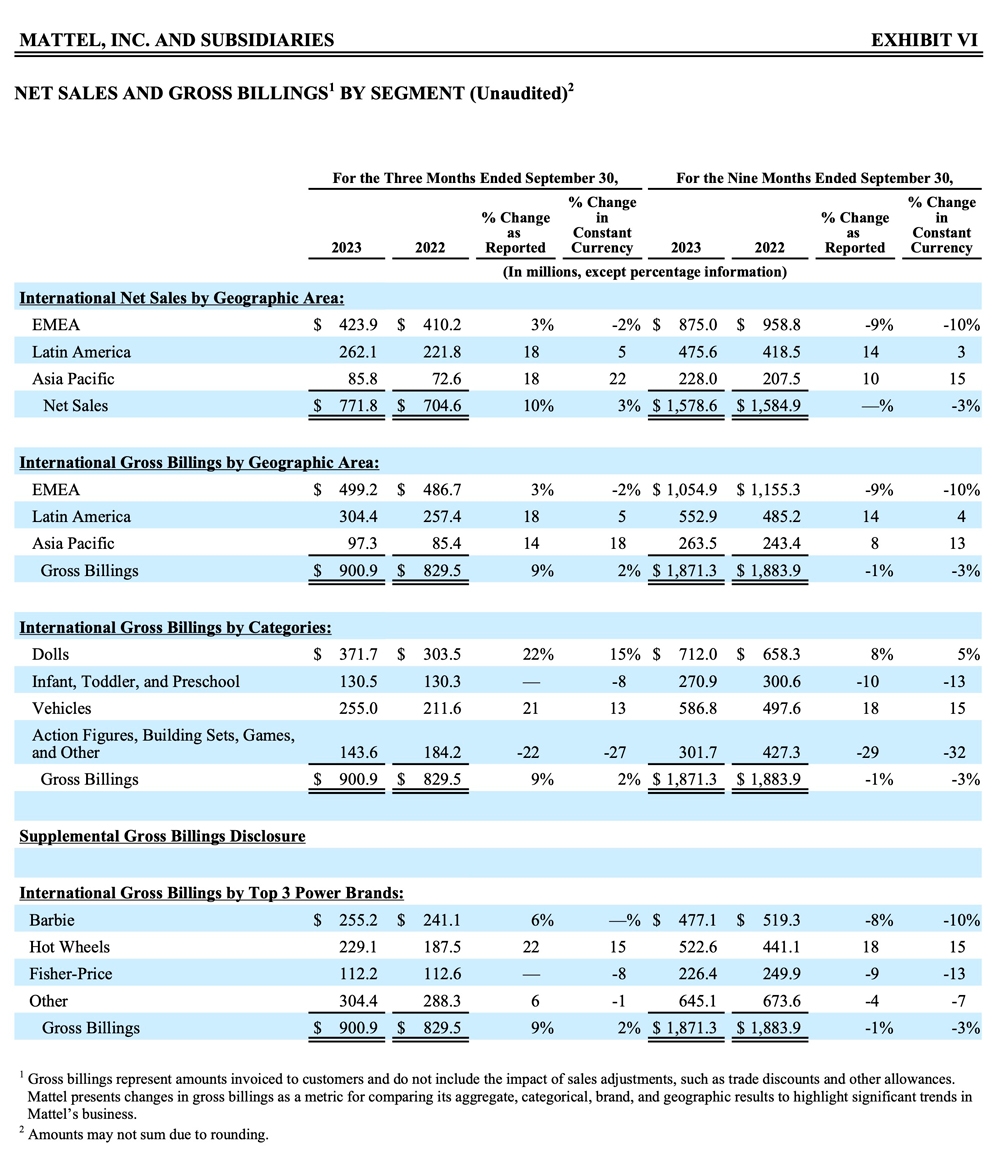

Net Sales in the International segment increased 10% as reported, 3% in constant currency.

Gross Billings in the International segment increased 9% as reported, or 2% in constant currency. The increase in Gross Billings as reported was driven by growth in Dolls (including Disney Princess and Disney Frozen, Monster High, and Barbie) and Vehicles (primarily Hot Wheels), partly offset by declines in Action Figures, Building Sets, Games, and Other (primarily Action Figures).

The increase in Gross Billings in constant currency was driven by growth in Dolls (including Disney Princess and Disney Frozen, and Monster High) and Vehicles (primarily Hot Wheels), partly offset by declines in Action Figures, Building Sets, Games, and Other (primarily Action Figures) and Infant, Toddler, and Preschool (including Fisher-Price).

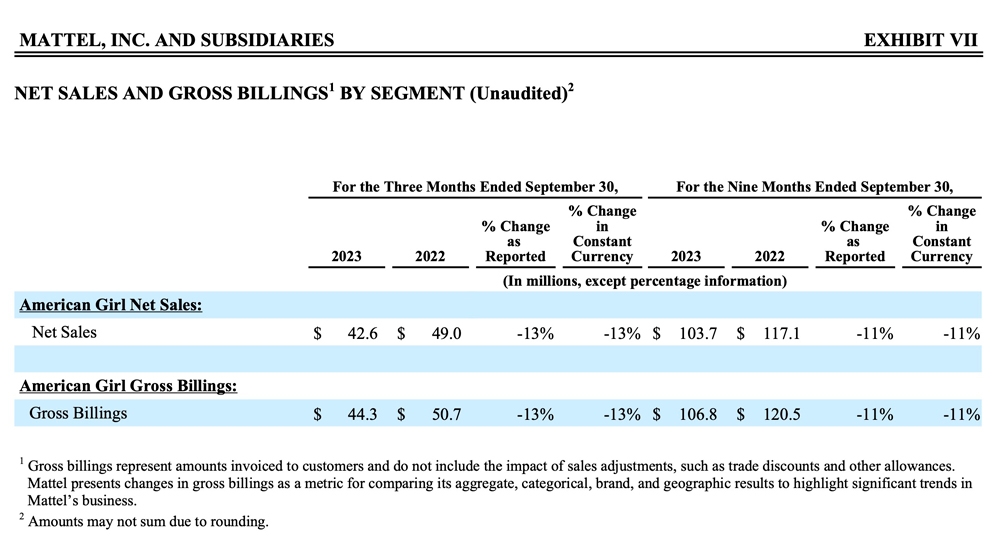

Net Sales in the American Girl® segment decreased 13% as reported and in constant currency. Gross Billings in the American Girl segment decreased 13% as reported and in constant currency.

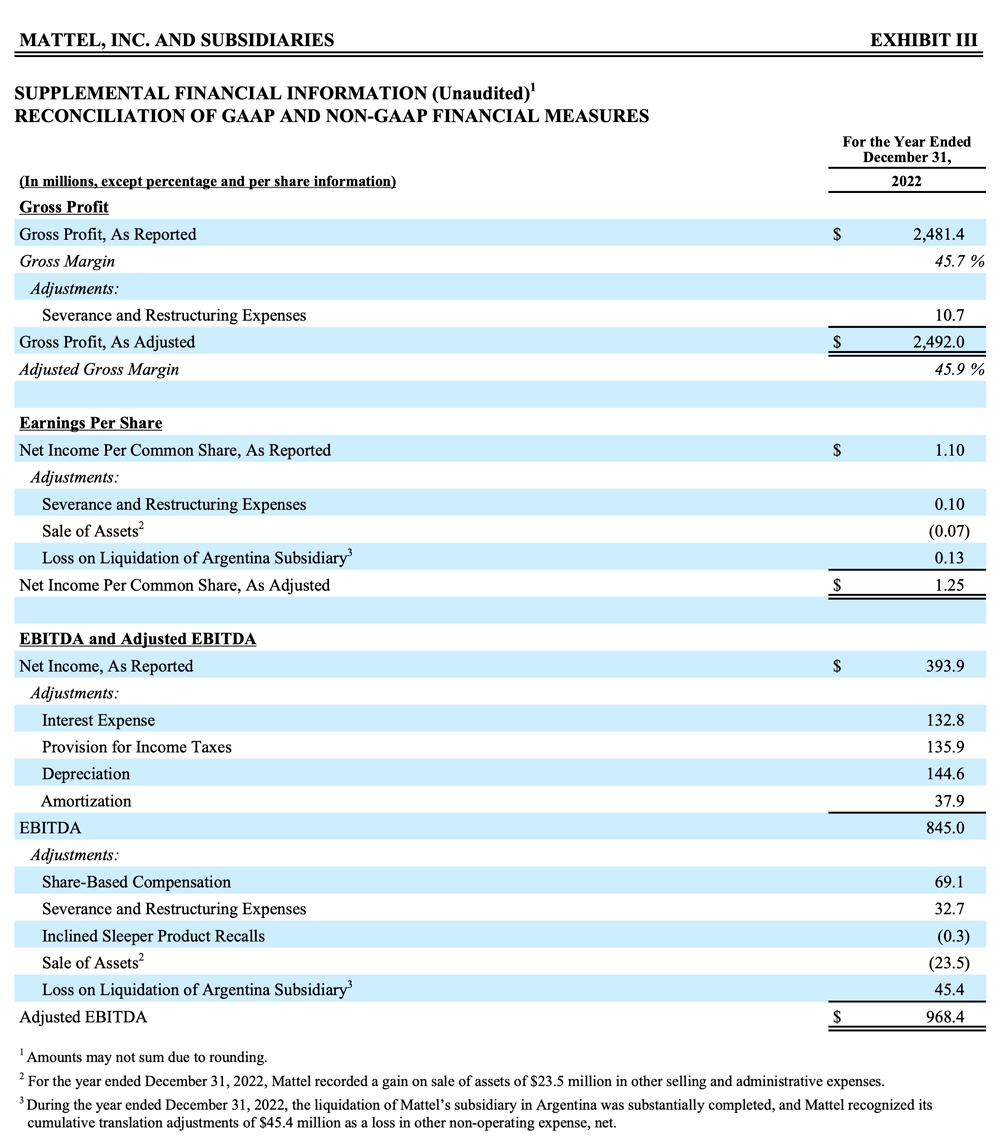

Reported Gross Margin increased to 51.0%, versus 48.2% in the prior year’s third quarter, and Adjusted Gross Margin increased to 51.0%, versus 48.3% in the prior year. The increase in Reported Gross Margin was primarily driven by favorable mix, primarily benefits related to the Barbie movie, pricing, savings from the Optimizing for Growth program, and cost deflation, partially offset by unfavorable fixed cost absorption and other supply chain costs.

Reported Other Selling and Administrative Expenses increased $52 million, to $380 million, primarily due to higher severance and restructuring expenses, incentive compensation, and pay increases, partially offset by savings from the Optimizing for Growth program. Adjusted Other Selling and Administrative Expenses increased $25 million, to $347 million, primarily due to higher incentive compensation and salary and market-related pay increases, partially offset by savings from the Optimizing for Growth program.

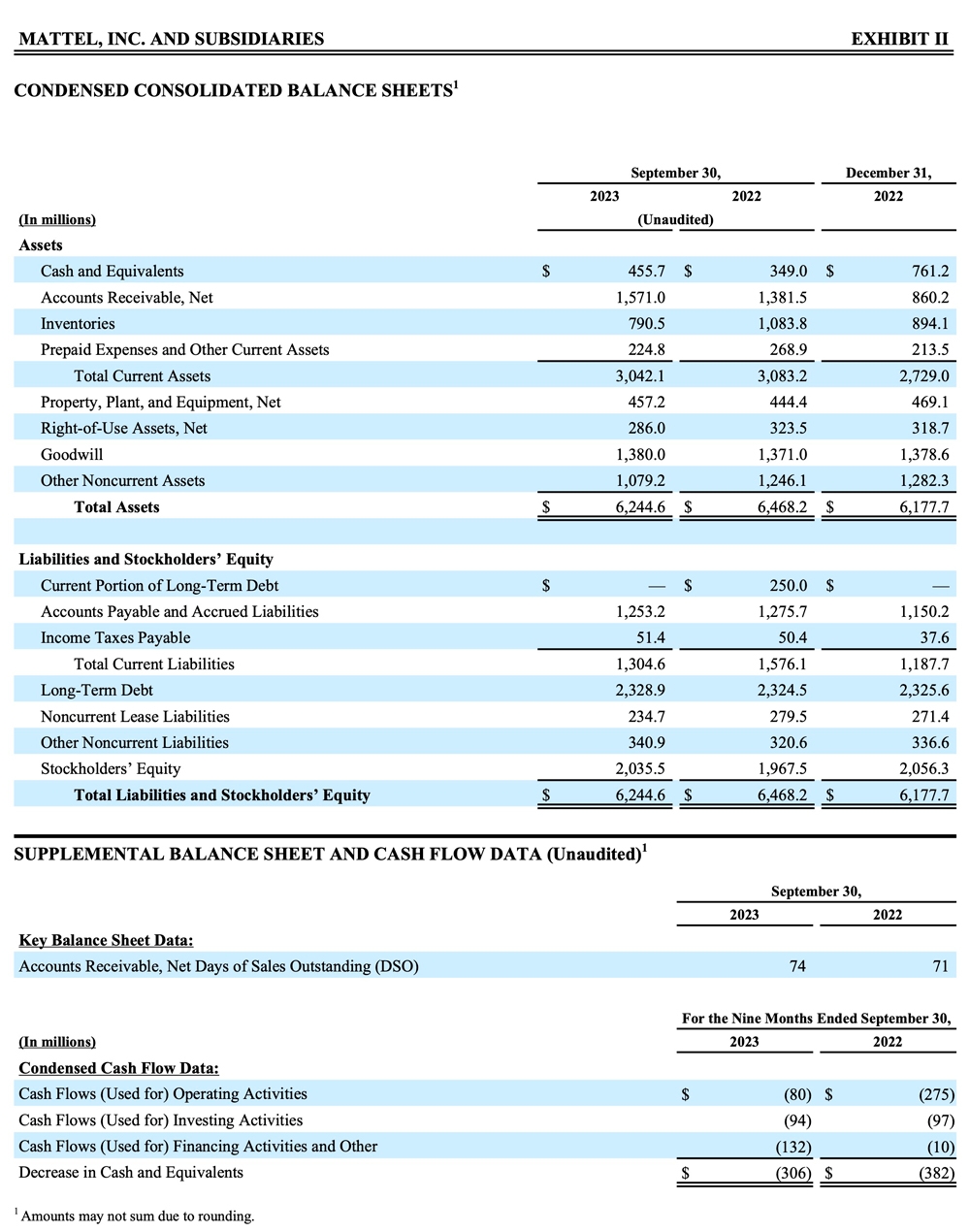

For the nine months ended September 30, 2023, Cash Flows Used for Operating Activities were $80 million, an improvement of $195 million, versus the prior year’s first nine months, primarily due to lower working capital usage, partially offset by changes in net earnings, excluding the impact of non-cash items. Cash Flows Used for Investing Activities were $94 million, a decrease of $4 million, primarily due to higher net proceeds from foreign currency forward contracts in the first nine months of 2023, partially offset by lower proceeds from the sale of assets. Cash Flows Used for Financing Activities and Other were $132 million, as compared to $10 million in the prior year, with the increase primarily due to share repurchases during the first nine months of 2023.

Gross Billings by Categories

For the third quarter, worldwide Gross Billings for Dolls were $884 million, up 27% as reported, or 24% in constant currency, versus the prior year. The increase in Gross Billings was driven by growth in Barbie, Disney Princess and Disney Frozen, and Monster High.

Worldwide Gross Billings for Infant, Toddler, and Preschool were $361 million, down 2% as reported, or 5% in constant currency. The decrease in Gross Billings as reported was due to declines in Thomas & Friends.

Worldwide Gross Billings for Vehicles were $518 million, up 18% as reported, or 15% in constant currency, primarily driven by growth in Hot Wheels.

Worldwide Gross Billings for Action Figures, Building Sets, Games, and Other were $358 million, down 19% as reported, or 21% in constant currency, primarily due to declines in Action Figures (related to 2022 theatrical releases).

2023 Guidance

Mattel’s updated full year 2023 guidance is: