Private Label Proves It Has Staying Power

By Mark Seavy

Private label retail brands have gained serious staying power.

In the past, retailers’ focus on private label goods grew or declined depending on ever-changing strategies. Recently, however, the sizeable investments made in private label by Walmart, Target, Tesco, Asda, and others have signaled there is little chance of turning back.

Target’s private label brands, for example, have generated $30 billion in annual revenue since Cat & Jack was introduced in 2016. That decision triggered Target’s shift away from Direct-to-Retail (DTR) efforts, a move that has since produced 10 private labels with sales of $1 billion or more in annual revenue, including Cat & Jack, All in Motion (activewear), Gigglescape (Toys), and Good & Gather (food)—the latter being the top seller at $4 billion.

Walmart has 315 private brands spread across 30,000 products, including George (apparel), Mainstays, and Great Value. Walmart also has a long-running DTR for Dotdash Meredith Corp.’s Better Homes & Gardens magazine brand, which it first deployed in 1998 and has been used across 3,000 products. Kroger’s Psst (saltines and other food items) and Heritage Farm (meat) also have been deployed by the grocery chain for 10 years.

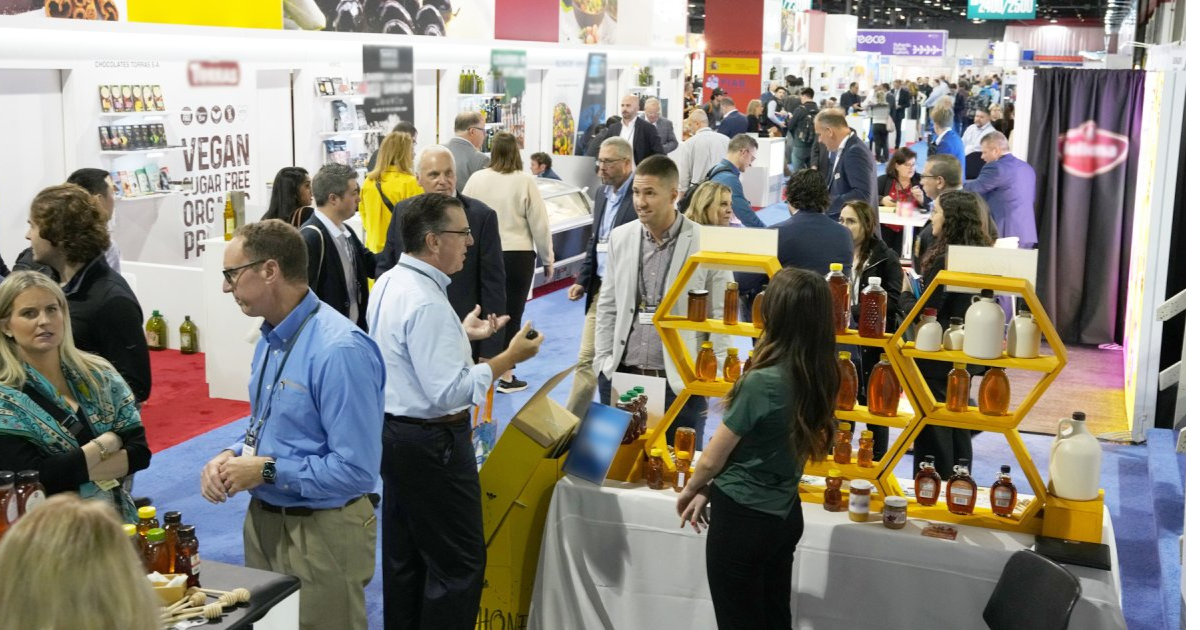

The depth of retailers’ reliance on private labels was on full display at the recent Private Label Manufacturers Association (PLMA) show in Rosemont, IL where exhibitors offered production, packaging, and everything else needed to enter the business.

And while there has been little evidence of these products cutting into sales of licensed or national brands—the latter is sometimes also the supplier of private labels—their impact is measured by their expansion from opening price point (OPP) goods to premium positioning.

“Private label is always going to be there, and I don’t feel like it is having any impact on the licensing of brands in many categories,” said Janna Markle, SVP of Licensing and Strategic Partnerships at the agency Brand Central. “We had considered having conversations with private label buyers about combining a licensed brand with a private label. That hasn’t always been well-received by buyers since private label is all about saving money and they question having the added cost of a royalty.”

In the past, many brands might have also balked at the idea of partnering with private label. But whatever stigma was once attached to private label in terms of product quality and innovation has eroded with consumers. About 60% of consumers surveyed by the research firm Circana believe private labels were on par with national brands in terms of innovation, quality, and trust. And 25% of those surveyed thought private labels were better than national brands, according to Circana.

“Many store brands are positioning private brands as premium, and moving away from value, which increases the margins and generates profits,” said James Slifer, Managing Director of Business Development at Joester Loria Group. “And retailers are pushing manufacturers for cleaner labels, origin of production, sustainability, and better-for-you options.”

In grocery, private label accounted for 19% of total U.S. spending in 2023, up from 17% in 2013 and forecasted to increase to 25-30% by 2034. In Europe, private label accounted for 38% of fast-moving consumer goods (FCMG) value sales, or about $244 billion, with Spain (47%) Germany (41%), and the Netherlands (40%) leading the way, according to Circana.

“While private label growth has historically lagged behind expectations, the tide may be finally turning,” Tom Bailey, a Senior Consumer Foods analyst at RaboResearch told FoodNavigator. “Several factors are driving this growth, [including] the rise of hard discounters like Aldi and consumer demand fueled by improved perceptions of private labels and quality.”

At grocery chain Aldi, which operates more than 2,500 U.S. stores, private label represents 80% of annual revenue across Sunday Shoppe (ice cream), L’Oven Fresh bakery goods, and Baker’s Corner All-Purpose flour that are supplied by House of Flavors, Bimbo Bakeries, and ADM Milling Co., respectively.

In addition to retailers, there were also a number of licensees at the PLMA show that doubled as private label suppliers. Among them were White Coffee Co. (Mars and Entenmann’s licenses), SunTree Snack Foods (almonds, sunflower kernels, walnuts, and Tapatio license), and frozen pouch supplier Big Easy Blends (Welch’s smoothies, Airheads snow cones).

“The cyclical nature of the private label business is changing as retailers invest more in it,” a licensing executive said. “That said, licensees also now have two ways—licensing and private label manufacturing—to approach retailers, which gives the business more staying power.”