Sports Business Looks at Slow Rebuild

Fans are beginning to trickle back to live sports, and there’s a glimmer of hope that music events will start to appear on calendars in the late summer or fall. Both of those are good signs for merchandise sales – whether at the venues, at retail or online. But it’s uncertain how long it will take to rebuild the business to pre-pandemic levels.

The Major League Baseball season opens this week in the U.S. with the Texas Rangers aiming for a filled stadium (with some allowance for social distancing) but most other teams selling tickets for about a quarter of capacity. Teams in the NBA and NHL have been playing in front of sharply reduced “crowds” – often 10%-20% of capacity, governed by local health regulations.

Next Year, or Later

Overall, the majority of 800 sports industry executives surveyed by PricewaterhouseCoopers (PwC) for its 2021 Sports Outlook expected the overall business – media rights, gate revenue, sponsorships and licensing revenue – to return to pre-COVID-19 revenue levels in 2022 (43.7%) and 2023 (27.1%).

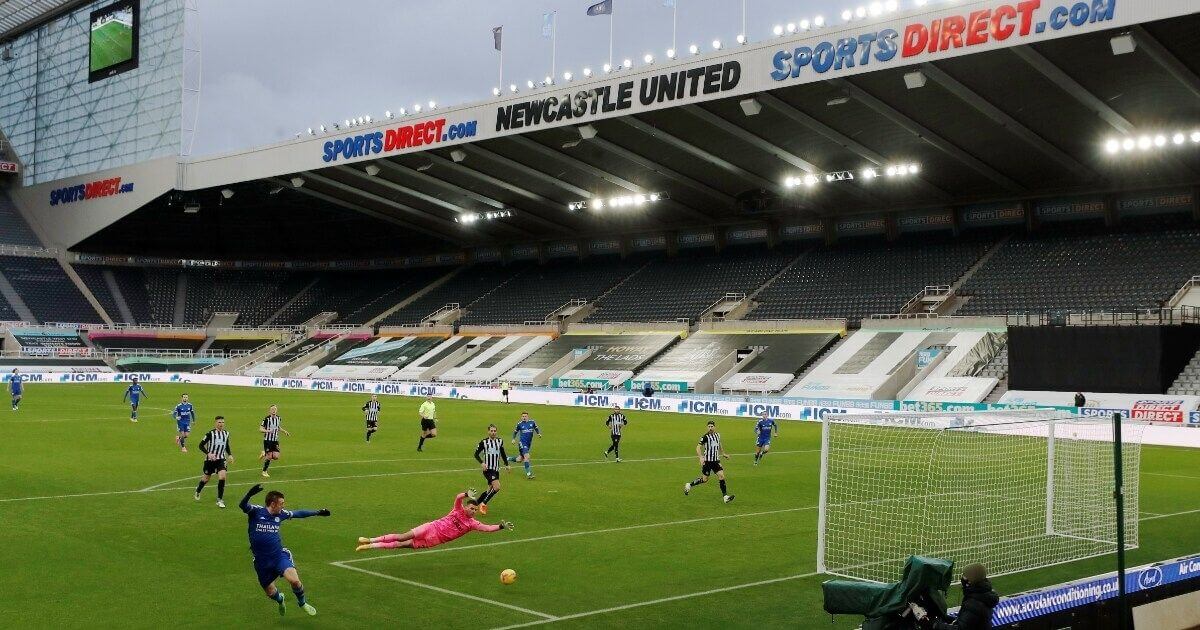

Many of the top European soccer leagues are barring spectators until the 2021-22 season. But British Prime Minister Boris Johnson announced last month a plan to let 10,000 into large UK soccer venues beginning in mid-May, with the potential for all restrictions being lifted by the following month. Germany’s Bundesliga, which was among the first European leagues to resume play last May, ran a six-week test in September-October allowing fans to return at 20% of stadium capacity.

In South America, the 10-team Copa America (June 13-July 10) remains on schedule. But whether spectators will be permitted hasn’t been decided due in part to the spike of coronavirus cases in Brazil.

A “Local” Olympics

The Tokyo Olympics (July 23-Aug. 8) remains scheduled for July 23-August 8, but with no fans from outside Japan allowed to attend. A recent survey within Japan found 61% favored cancelling or postponing the Games, while 36% supported moving forward with them – not exactly a welcoming sign for local sales of licensed goods.

Collegiate licensing agent CLC doesn’t expect a full recovery to pre-COVID sales levels at the schools it represents before 2023, says CLC CEO Cory Moss. He expects those revenues to reach 70-80% of 2019 sales in the fiscal year ending June 30, 2022.

For the live music business, it’s a matter of when venues are allowed to host enough fans to make business sense. Live Nation Entertainment CEO Michael Rapino told analysts earlier this year that “given the limited touring activity in 2020 and ’21, the pipeline for 2022 is much stronger than usual with almost twice as many major touring artists on cycle in 2022 in a typical year, about 45 artists versus the usual 25, and there remains plenty of scheduling availability at arenas, amphitheaters, and stadiums to accommodate these additional tours.”

“As long as the states open up to the right capacities, we can start mid-summer into Southern U.S. and could go all the way to November” with outdoor concerts, he said. To supplement the on-site business, Live Nation is selling VIP packages and merchandise combined with live stream concerts. A t-shirt and merchandise in a VIP platform is “another incremental revenue stream to the current physical show.”

The company sold out its electronic music festival Creamfields (Aug. 26-29) in the UK within 24 hours of announcing the event –after the UK government announced that live events could operate at 100% capacity starting June 21. Music festivals in Leeds and Reading (Aug. 27-29) remain scheduled.

Amid the pandemic, one company that continued to chug along was sports-licensed merchandise behemoth Fanatics, whose market value doubled between funding rounds last August and earlier this month, and is forecasting sales of more than $3 billion this year.

But for most in the sports merchandising business, it will be a season (or seasons) of recovery amid a changed consumer landscape. “There are going to be retailers and licensees that continue to struggle this year,” says CLC’s Moss. “They have been able to patch things together during the pandemic.

“But as things start to progress and you get somewhere close to normal, the same number of retailers aren’t there; what have consumers done and how have they changed their buying habits? Do the same number of fans attend (games) or are they doing things that they might not have been doing two years ago? There haven’t been the same number of sporting and other events that drive [potential customer] traffic across campuses. That’s a lot of ground to cover” in making up for lost sales.

“There are still waves of [previously purchased] inventory [retailers] have to get through,” says Moss. “There are new products for the fall and holiday, but the numbers are going to be conservative, as far as how much retailers order and put out” in stores. “That’s where we have to get through for them to have confidence in getting back close to the numbers we used we see.”