U.S. Retailers Plan Big Private Label Growth

U.S. retailers are continuing to expand their private label offerings, creating a growing challenge for brand owners and suppliers in search of shelf space to showcase and sell their goods. Several are charting a course for big jumps in the next few years.

U.S. private-label sales rose 11.8% to a record $158.8 billion in 2020, due to broader product availability and homebound consumers seeking good quality at lower prices, according to a report by NielsenIQ and the Private Label Manufacturers Association (whose research skews heavily toward grocery and HBA in the supermarket, warehouse club, drug and mass channels).

Among recent developments:

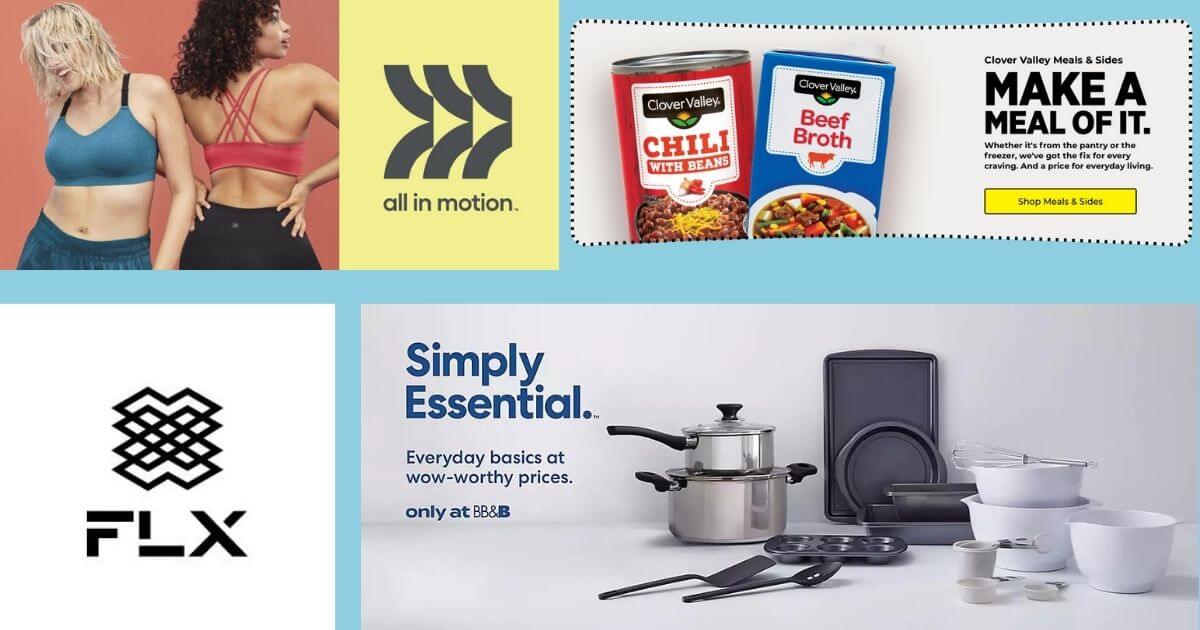

- Kohl’s launched its FLX athleisure line in March as part of an effort to expand the category to 30% of annual revenue by 2023, up from the current 23%.

- Bed Bath & Beyond recently launched the launched Simply Essential label, which has 1,200 SKUs across bedding, home décor, storage and other products – one of eight new brands on tap for this year. Earlier, it rolled out Nestwell (mattress toppers, pillows, blankets) and Haven (bath rugs and furniture, shower curtains). The company wants to have private label account for 30% of annual revenue by 2023.

- As dollar stores revamp their stores, they’re also expanding their assortment of private labels. Dollar General has about 15 owned brands including its Clover Valley food label that has $1 billion in annual revenue. “We believe there is significant opportunity with other [private] brands as well,” Chief Operating Officer Jeff Owen “In fact, our plans this year include the rebranding of several additional product lines, including stationery, laundry, hardware, automotive, pet food and party.”

- Target introduced its All In Motion activewear brand earlier this year after deciding not to renew an agreement with Hanesbrands’ for an exclusive C9 By Champion collection . The company now has more than 40 private label brands, four of which – Good & Gather (food), Cat & Jack, Up & Up (personal care) and Threshold (homegoods) – register more than $2 billion in annual sales. Good & Gather expanded recently into plant-based products with 30 SKUs including dips and spreads and oak milk. Target’s owned brands sales rose 36% in the first quarter ended May 1.

- Private label sales are surging in grocery. For example, Kroger’s Our Brands Division had its “best year ever” in 2020, posting $26.2 billion in sales, about 25% of the company’s total revenue, CEO Rodney McMullen Own Brands was led by the Simple Truth cross-category label, which produced $3 billion in revenue.

At Albertson’s, private label accounted for 25% ($3.9 billion) of sales in the first quarter ended Feb. 27. And ShopRite replaced its nameplate private labels with “Bowl & Basket” (crackers and snacks) and “Paperbird” (napkins, paper plates, sponges) brands as part of an effort to appeal to a younger shopper. And even smaller grocery chains are investing heavily in private label. Tops Markets, which has 169 stores, introduced 200 new store brand items last year. - J.C. Penney, which recently emerged from bankruptcy protection with a new owner, recently unveiled a Ryegrass women’s apparel line including skirts, dresses and denim. The line joins the Loom + Forge bedding and Stylus apparel brands that were launched recently. The renewed focus on private label comes at a chain that, at its peak, generated 50% of its revenue from owned brands.

- Macy’s has made private label central to its “Polaris” turnaround strategy. That includes driving its Charter Club, Concepts, Style & Co. and Alfani labels to $1 billion in annual sales by 2025, when private label is planned to account for 25% of annual revenue, company executives have said.