US Toy Industry Sales Decline 8% in 2023, While Remaining $5.7 Billion Above 2019 Sales, Circana Reports

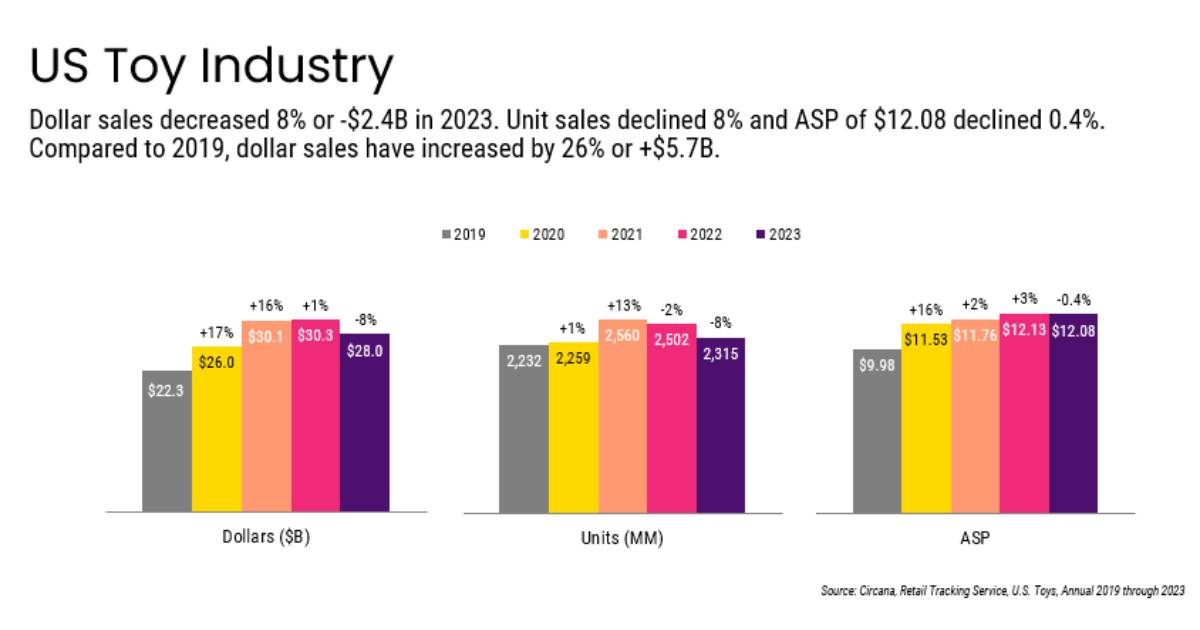

CHICAGO – Circana, a leading advisor on the complexity of consumer behavior, today announced the U.S. toy retail sales performance results for 2023. Despite a year-over-year 8% decline in dollar sales in 2023, the industry has experienced an overall $5.7 billion increase in sales since 2019, driven by average selling price (ASP) growth. Dollar sales grew, on average, by 6%, year-over-year, during the past four years.

Several headwinds emerged in 2023, including continued inflation, depleted consumer savings, and rising consumer credit card debt. These factors contributed to declines in consumer spending, as shoppers focused more on the “must-haves” and cut discretionary spending. In the fourth quarter, specifically, dollar sales decreased by 8% compared to last year, according to Circana’s Retail Tracking Service, while unit sales declined at a slightly slower rate of 6% and ASP dropped by 2%.

“While 2023 was a challenging year for the U.S. toy industry, the four-year compound annual growth rate remains positive,” said Juli Lennett, vice president and toy industry advisor at Circana. “Economic challenges have impacted overall consumer behavior, but let’s not overlook the fact that we have seen an influx of new consumers over the past few years. Keeping these consumers interested with new and exciting products is important for driving future growth.”

2023 Highlights

Within supercategories, three of the 11 supercategories tracked by Circana experienced growth in 2023. Building Sets had the most significant dollar gain of $220 million and the fastest growth, with LEGO Icons, LEGO Disney Classic, and LEGO Speed Champions dominating the growth in the category. Plush had the second-largest dollar gain, up $31 million, with Pokémon, Furby, Harry Potter, Snackles, Sesame Street, and Cookeez Makery as the main drivers of growth. Within Vehicles, which grew $6 million, the largest increases came from Hot Wheels, The Fast and The Furious, and Ninja Turtles. Outdoor and Sports Toys was the largest supercategory with a 16% share of all toy dollars; however, it faced the largest dollar decline. The top toy properties of 2023 included Pokémon, Barbie, Squishmallows, Star Wars, Marvel, Hot Wheels, Fisher-Price, LEGO Star Wars, Disney Princess, and Melissa & Doug.

“Consumers will continue to face financial pressures in 2024, but they will not forgo the important toy buying occasions throughout the year,” said Lennett. “To succeed in 2024, a focus on marketing, seasonality, innovation, and value is critical.”

About CircanaCircana is the leading advisor on the complexity of consumer behavior. Through unparalleled technology, advanced analytics, cross-industry data, and deep expertise, we provide clarity that helps almost 7,000 of the world’s leading brands and retailers take action and unlock business growth. We understand more about the complete consumer, the complete store, and the complete wallet so our clients can go beyond the data to apply insights, ignite innovation, meet consumer demand, and outpace the competition. Learn more at circana.com.