Mattel Reports First Quarter 2025 Financial Results

- Net Sales of $827 million, up 2% as reported, and 4% in constant currency

- Gross Margin of 49.4%, an increase of 140 basis points; Adjusted Gross Margin of 49.6%, an increase of 130 basis points

- Operating Loss of $53 million, an increase of $17 million; Adjusted Operating Loss of $16 million, an improvement of $7 million

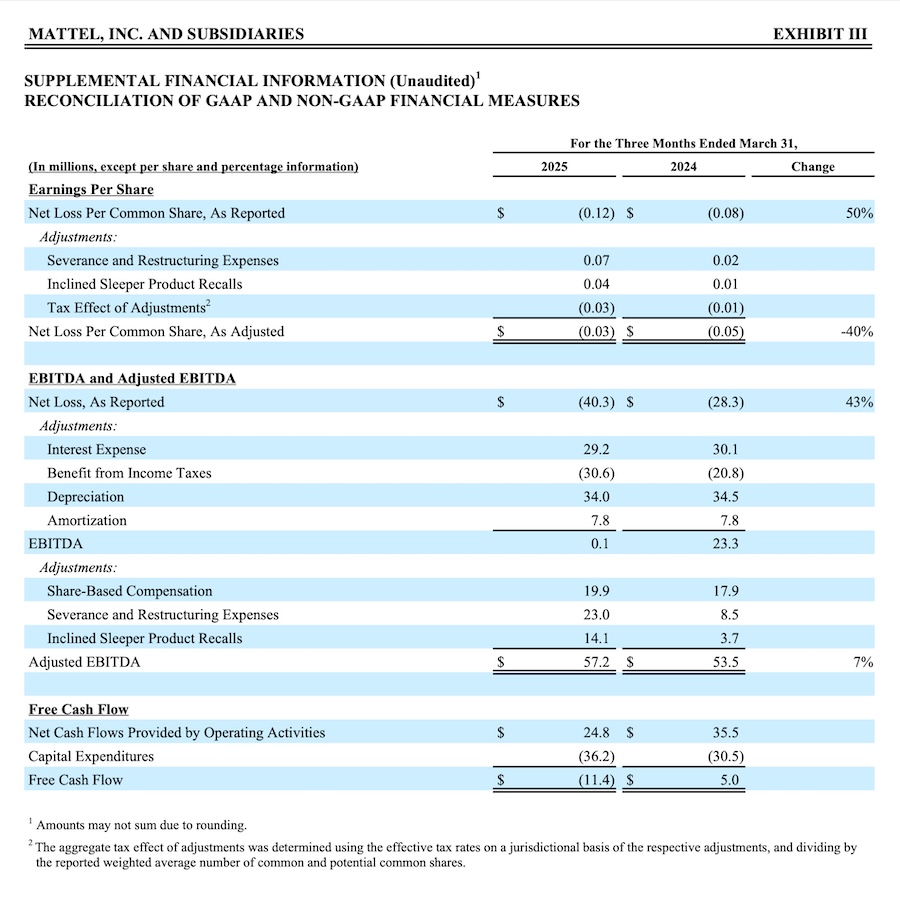

- Net Loss of $40 million, an increase of $12 million

- Loss per Share of $0.12 compared to a Loss of $0.08 per share; Adjusted Loss per Share of $0.03 compared to an Adjusted Loss of $0.05 per share

- Adjusted EBITDA of $57 million, an improvement of $4 million

- Repurchased $160 million of shares

- Pausing full-year 2025 guidance until company has sufficient visibility, given the volatile macro-economic environment and evolving U.S. tariff situation

- Maintaining $600 million share repurchase target for 2025

El Segundo, CA – Mattel reported first quarter 2025 financial results.

Ynon Kreiz, Chairman and CEO of Mattel, said: “This was a strong quarter for Mattel, with positive performance and continued operational excellence. Our brands are thriving, our products and experiences stand out in the marketplace, and our balance sheet gives us resilience and flexibility to execute our strategy. As we navigate the current period of macro-economic volatility, we are adapting with speed, agility, and discipline. We expect not only to manage through this period but strengthen our competitive position.”

Anthony DiSilvestro, CFO of Mattel, added: “Mattel achieved top line growth in the quarter, with broad-based category strength and expanded gross margins. Given the evolving tariff situation, we are taking mitigating actions designed to fully offset the potential incremental cost impact. We are well positioned financially with ample cash and will continue to manage our balance sheet in line with our capital allocation priorities.”

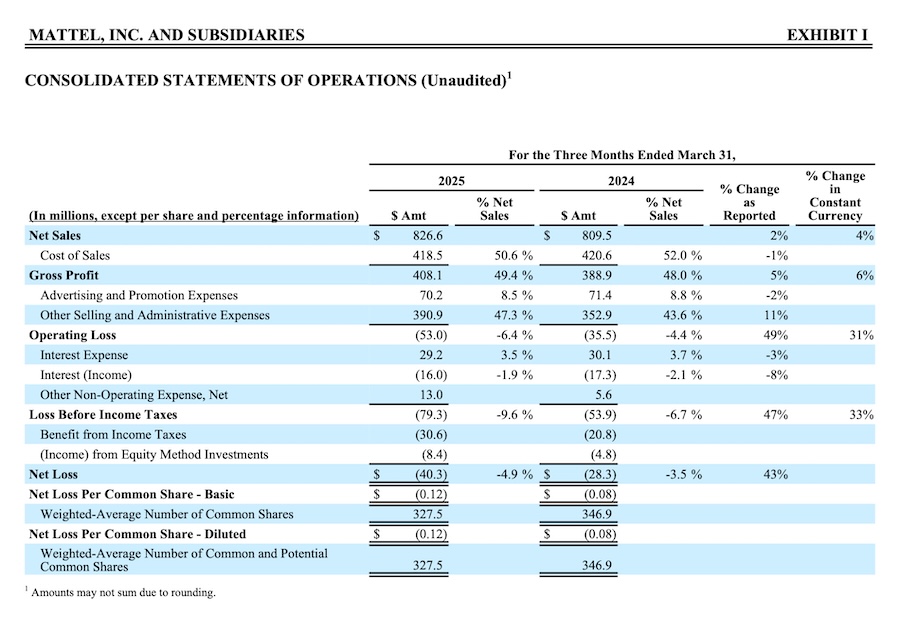

First Quarter Financial Overview

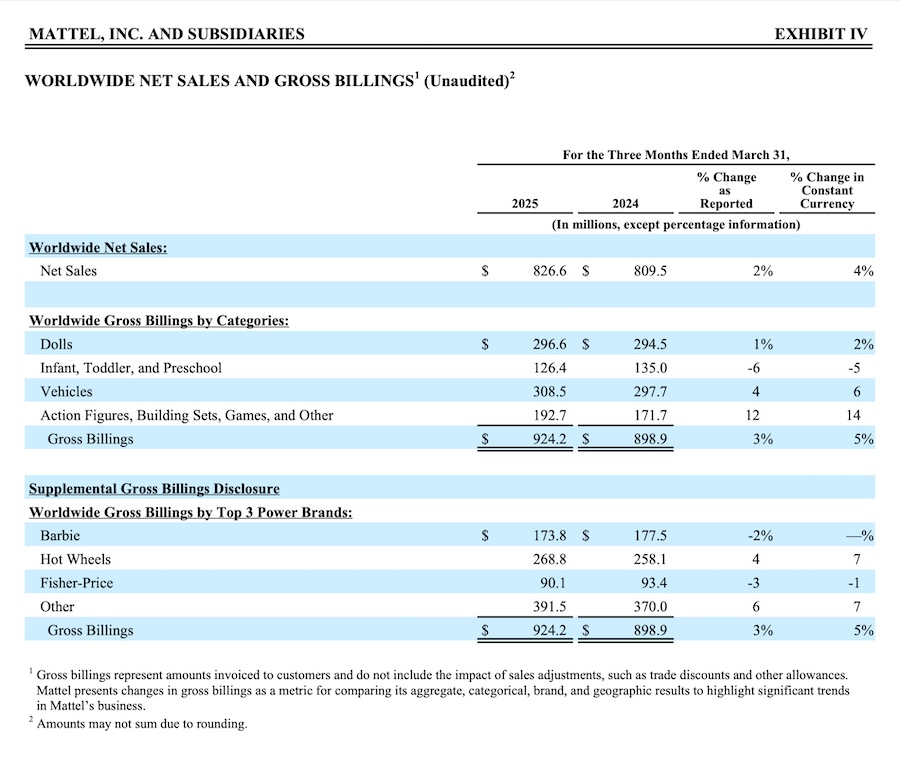

Net Sales

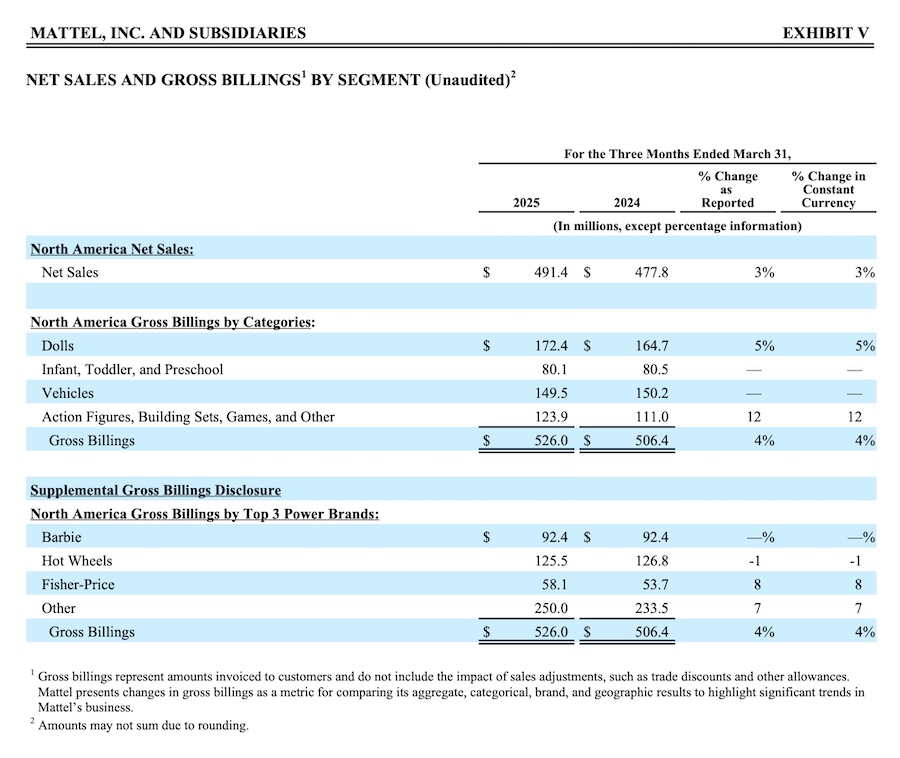

Net Sales were $827 million, up 2% as reported, or 4% in constant currency, versus the prior year’s first quarter. The increase in Net Sales as reported was driven by a 3% increase in North America, and a 1% increase in International. The increase in Net Sales in constant currency was driven by a 3% increase in North America, and a 5% increase in International.

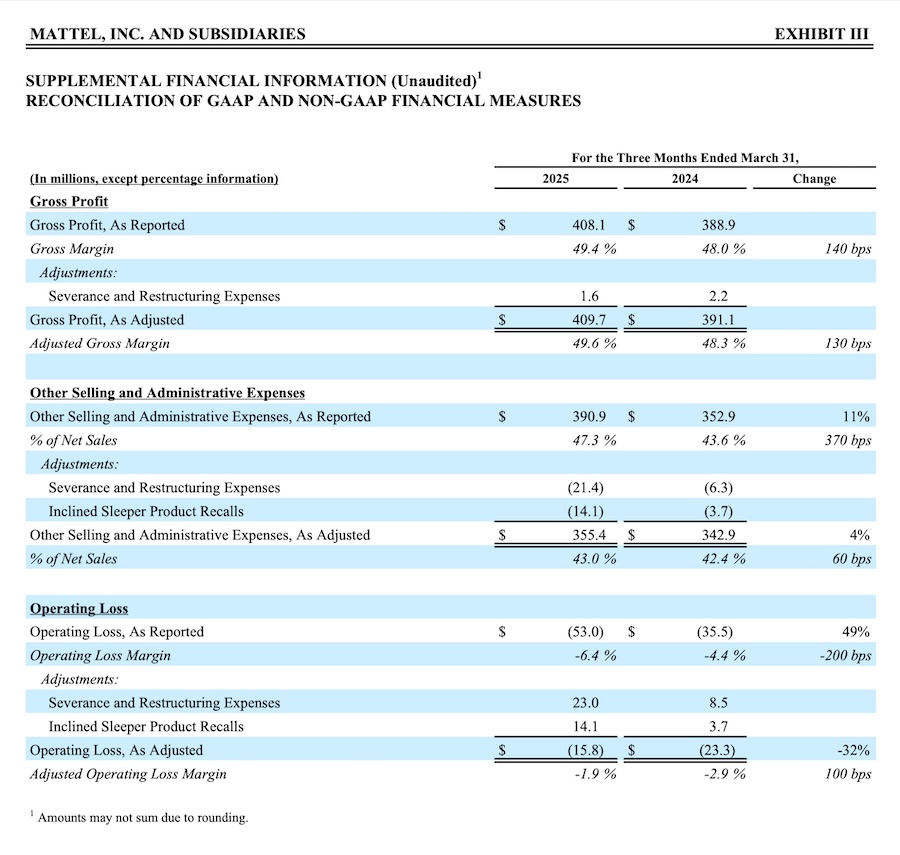

Gross Margin

Reported Gross Margin increased to 49.4%, versus 48.0% in the prior year’s first quarter, and Adjusted Gross Margin increased to 49.6%, versus 48.3%. The increase in Gross Margin was primarily driven by lower inventory management costs, principally obsolescence and closeouts, and savings from the Optimizing for Profitable Growth program, partly offset by cost inflation.

Operating Loss

Reported Operating Loss was $53 million, an increase of $17 million, and Adjusted Operating Loss was $16 million, an improvement of $7 million. The increase in Reported Operating Loss was primarily due to an increase in Other Selling and Administrative Expenses, partially offset by higher Net Sales and Gross Margin. The improvement in Adjusted Operating Loss was primarily driven by higher Net Sales and Adjusted Gross Margin.

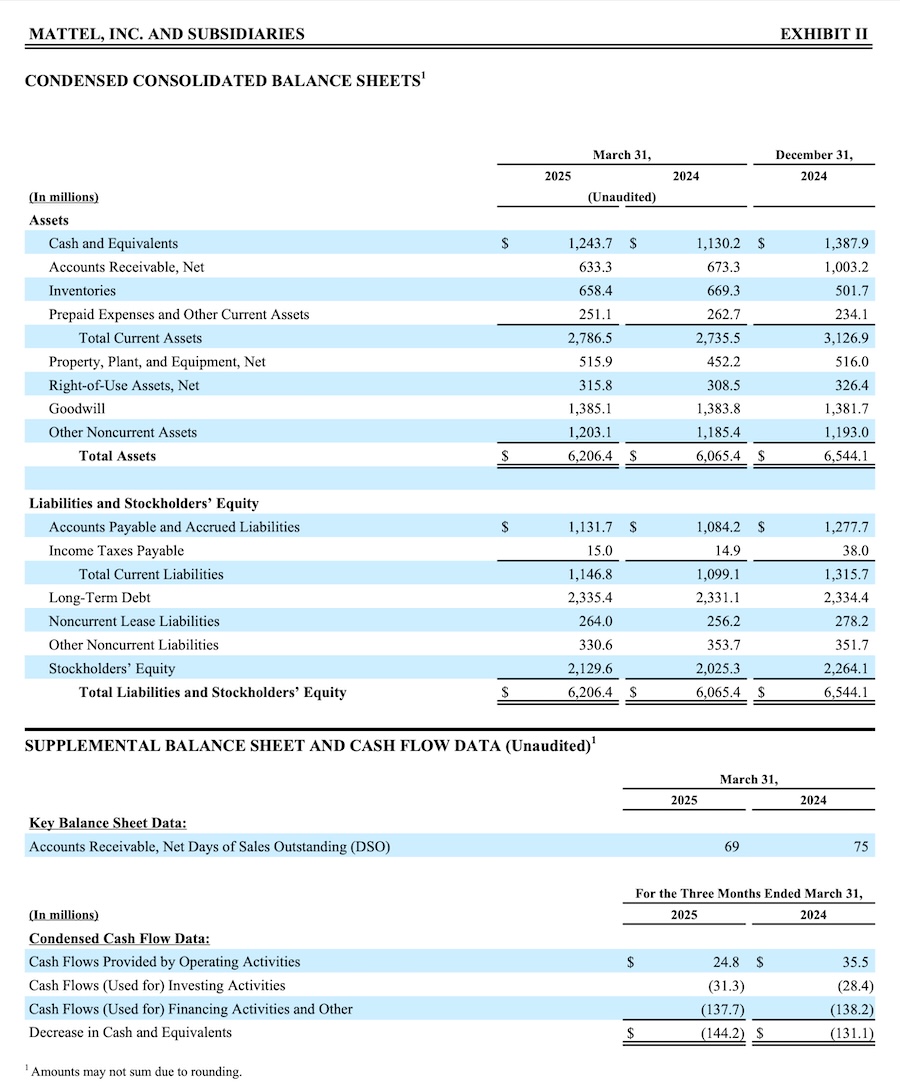

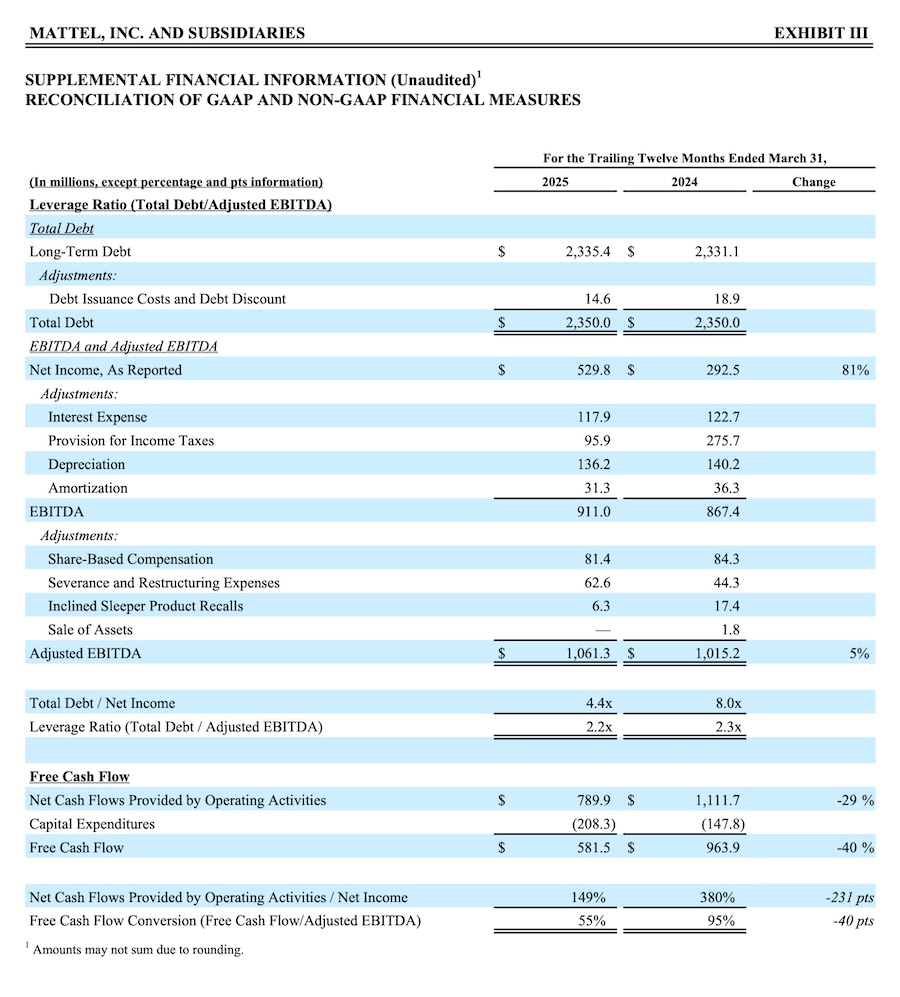

Cash Flow

For the first three months ended March 31, 2025, Cash Flows Provided by Operating Activities were $25 million, a decline of $11 million, primarily driven by unfavorable changes in net earnings, excluding the impact of non-cash items, partially offset by lower working capital requirements.

Cash Flows Used for Investing Activities were $31 million, an increase of $3 million, primarily due to higher capital expenditures.

Cash Flows Used for Financing Activities and Other were $138 million, comparable to the prior year period.

First Quarter Gross Billings by Category

Worldwide Gross Billings for Dolls were $297 million, up 1% as reported, or 2% in constant currency, versus the prior year’s first quarter, primarily driven by growth in Disney Princess and Wicked.

Worldwide Gross Billings for Infant, Toddler, and Preschool were $126 million, down 6% as reported, or 5% in constant currency, primarily due to declines in Baby Gear & Power Wheels.

Worldwide Gross Billings for Vehicles were $308 million, up 4% as reported, or 6% in constant currency, primarily driven by growth in Hot Wheels.

Worldwide Gross Billings for Action Figures, Building Sets, Games, and Other were $193 million, up 12% as reported, or 14% in constant currency, primarily driven by growth in Action Figures, partly offset by a decline in Building Sets.

Business Update

The company is operating in an uncertain macro-economic environment with significant volatility, including changes in global trade policy and U.S. tariffs. Although tariffs did not affect Mattel’s first quarter financial results, the company is taking mitigating actions designed to fully offset the potential incremental cost impact of tariffs on future performance. These include:

- Accelerating diversification of its supply chain and further reducing reliance on China-sourced product,

- Optimizing product sourcing and product mix, and

- Where necessary, taking pricing action in its U.S. business.

The company also intends to rebalance promotional activity to drive cost efficiencies while maintaining sufficient support and is accelerating cost savings actions and increasing the 2025 savings target under the Optimizing for Profitable Growth program from $60 million to $80 million.

Given the volatile macro-economic environment and evolving U.S. tariff landscape, it is difficult to predict consumer spending and Mattel’s U.S. sales in the remainder of the year and holiday season. The company is therefore pausing full-year 2025 guidance until Mattel has sufficient visibility.

The company is maintaining its $600 million share repurchase target for 2025, in line with the company’s capital allocation priorities.

Share Article