Mocktails Enter the Licensing Mix

By Mark Seavy

The growing number of “sober curious” and health-conscious consumers mixed with the ongoing Dry January trend are producing a ready-made market for so-called mocktails and licensing.

This surge underscores a shift in how and why people drink. Nearly 65% of consumers surveyed last year indicated they are making more mindful decisions around alcohol, according to analytics and advisory company Gallup. Just over half (54%) of adults in the U.S. stated they consume alcohol, the lowest level in the 87-year history of the Gallup Poll. Previously, that number was reported as 62% in 2023 and as 58% in 2024. The previous low was 55% in 1958, while the highs were 68-71% between 1974 and1981.

Young adults are driving the decline. Once a prime target for alcohol, they now show an appetite for mocktails. About 50% of young adults surveyed by Gallup stated they drink alcohol, down from 59% in 2023. And 53% of U.S. consumers indicated they believe moderate drinking (one or two drinks a day) is bad for one’s health. The result has been a market where mocktail sales at bars and restaurants—as well as for consumption at home—are forecast to rise 8.4% annually to hit $18 billion in 2032, up from $9.64 billion in 2023, according to Bridge Market Research.

The increase in sales for mocktails is being supported by new brands as well as by incumbent beer and spirits companies with options that carry the brand name but not the alcohol content of their better-known brethren.

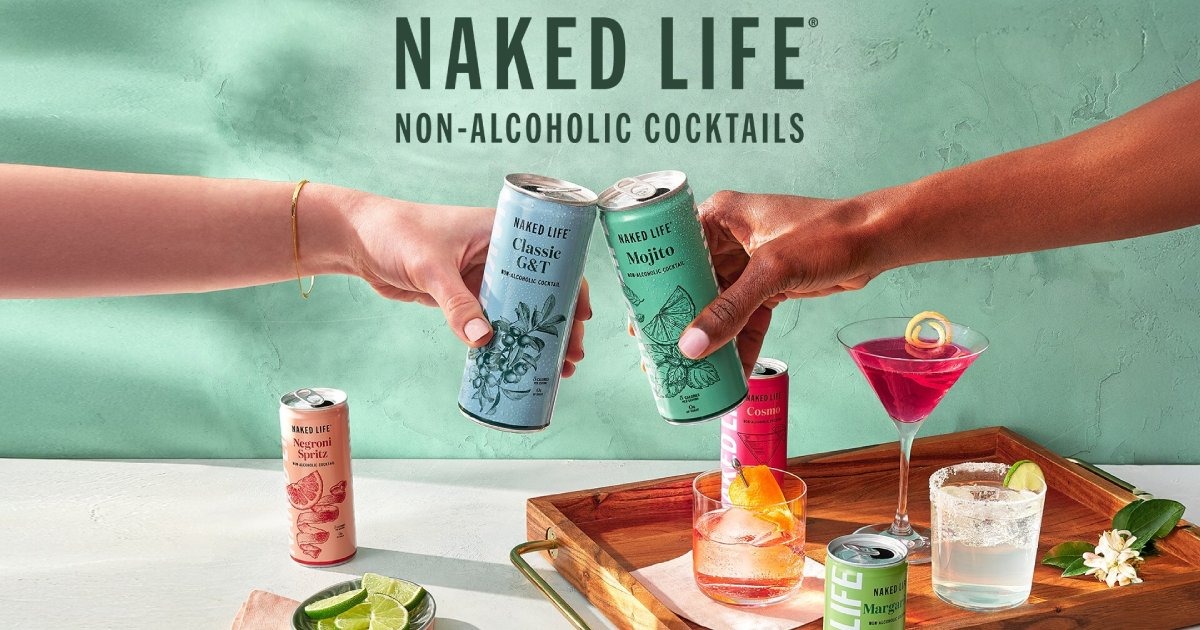

For example, Naked Life paired with brewer Molson Coors for Mojito, Negroni Spritz, Classic Gin & Tonic, and Cosmopolitan ready-to-drink cans featuring a mix of cherry, amaro, orange, lemon, cranberry, and lime flavors. PepsiCo, meanwhile, has given its Bubly sparkling water brand a mocktail spin with Bellini Bliss in peach, pineapple, and mango flavors. And Mingle Mocktails partnered with entrepreneur Bethenny Frankel, who built a business around Skinnygirl cocktails and licensing, for gluten-free and vegan mocktails like Blackberry Hibiscus Bellini and Pineapple Paloma.

“Consumers are regulating their consumption with an eye toward obtaining nutritional enhancements while enjoying the taste of the liquids they drink,” Bridge Market Research reported. “That is why brands and mixologists are producing cocktails that use ingredients like turmeric, ginger, collagen, and CBD to stick to health-conscious targets. There are an increasing number of consumers that are conscious of their health while at the same time wishing to quench their thirst for social drinking.”

And while that thirst for mocktails is being met by the major beverage companies—Celsius Holdings, which is partly owned (11%) by PepsiCo, recently acquired Rockstar Energy and launched mocktails—new suppliers have also emerged.

Nitro Mocktails took inspiration from breweries by including a widget in the bottom of its canned mocktail that releases nitrogen bubbles when it is opened. The activity inside the can replicates a cocktail being shaken, which boosts the aromas and flavor found in non-alcohol drinks like a Cosmopolitan Expresso Martini and a Moscow Mule. And Free AF, which claims a 40% share of the New Zealand market for no-alcohol drinks, is fielding Apero Spritz (orange, tangerine) and Vodka Spritz (lime, passionfruit) with no added sweeteners.

As the market continues to grow it is not without risk, industry executives said. Awareness of mocktails remains low in emerging markets. And the cost of manufacturing remains high, especially for quality natural ingredients and lengthy recipes that frequently require fresh herbs, fruits, and condiments needed for real taste. The result is that mocktails are expensive and on par with prices charged for alcohol-based drinks.

And there is also the risk of trademark infringement by emerging producers of non-alcohol brands. That trend requires alcohol companies adapt to the growing market and protect their marks, according to the Miller Nash law firm.

“The non-alcohol market represents a permanent shift in consumer behavior, not a passing fad,” Miller Nash reported. “Success in this new environment requires a dual approach of market adaption and vigilant trademark protection.”