Agility Will Be Key in Film-Based Licensing

Whatever anyone thought they knew about the shape of film licensing in 2021 has long since been discarded, so the accent for retailers, licensors and licensee will be on agility. More than a dozen films planned for this year were delayed until next year and others slated for 2021 also got shifted.

A huge asterisk

So the normal cycle of signing merchandise agreements, manufacturing products and moving them through physical or online retail continues to carry a giant asterisk. The creativity that the film business displays on the screen is being matched by that shown within the licensing community.

Our latest information on prime licensing movies can be found on our constantly updated Theatrical Film Tracker.

As we’ve discussed, even studios known to be the most rigid in enforcing their agreements are acknowledging the uncertainty of it all, and contracts are being modified – whether renegotiated overtly or via lack of enforcement.

Some potential good news

The latest news about potential vaccines are a cause for hope that cinemas in various parts of the world will be able to open and attract audiences in the first part of the year. But the continuing uncertainty has scrambled the normal flow. Retailers, rather than buying inventory months in advance of a film’s release, are hedging by moving purchases closer to potential on-screen dates, licensing executives say.

They “aren’t committing more than a few weeks in advance” to make orders, says Dean Allen, Chief Merchandising Officer at Mad Engine. “Retailers are going to chase inventory in 2021 because there is a great degree of uncertainty.” He adds that the focus, therefore, “is definitely on franchise films for which product “will sell regardless of the release date.”

The focus on well-known properties is already apparent. In some cases, merchandise is being sold at the time a film was supposed to be in theaters, rather than keeping it in inventory until the planned new release date.

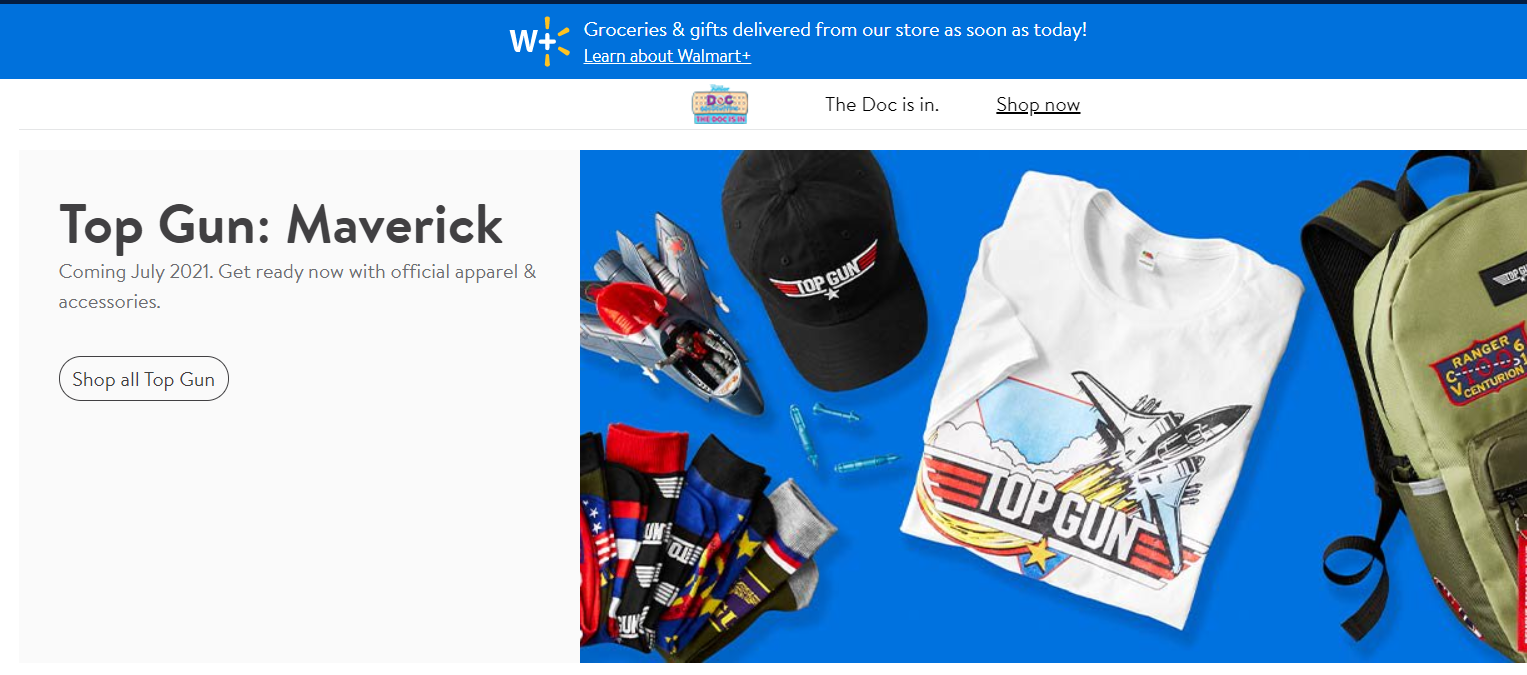

For example, Walmart is already selling Top Gun: Maverick apparel and backpacks online and through an in-store pallet program, despite the film being delayed from this coming Christmas to July 2. And Hot Topic is promoting Black Widow hoodies, t-shirts and jewelry even though the film was delayed until May 7 (after being postponed twice from Oct. 2 and then Dec. 25).

Says one major Disney licensee: “We know retailers and even consumers are to be drawn more to established brands and characters with stronger stories. There always will be newness in the market, but the actual revenue that newness actually brings probably isn’t going to keep the lights on right now. We are definitely going to be diving deep with existing licenses.”

There will certainly be more content – streaming and in theaters – to choose from. In some cases, tentpole films whose releases were once separated are now sharing dates. For example, Universal’s Minions: The Rise of Gru and Paramount’s Top Gun: Maverick will be both be released on July 2. And Clifford the Big Red Dog, Eternals and Spider-Man 3 all are slated to debut on Nov. 5.

For some licensees it will be a question of making choices. Others are trying to cover all their bases. Concept One is readying extra inventory for its retail programs for headwear and accessories to chase additional business in the first and second quarters, says President Sam Hafif, whose company is a Disney, Marvel and Star Wars licensee and also has licenses for Space Jam 2 (July 16 release) and SpongeBob Movie Rehydrated (Nov. 14, 2021). It also has a license for Soul, which switched from theatrical release to Disney Plus streaming (Dec. 25), with the chidlren and adult headwear going on sale on Amazon this week.

“More content is always good for business,” says Hafif. “We are seeing more demand for headwear and accessories in the spring than we’ve seen in a long time. We are very bullish on business right now.”

Yet if the pandemic reinforced anything for licensees, it’s the need to broaden their brand license portfolio beyond film and entertainment properties and to include more consumer product and corporate brands. Those moves are being made to counteract the uncertainties that have always accompanied the film business, but which were underscored by the pandemic.

“The newer generations of consumers don’t want to be spoon fed the product developed for the same old franchises, albeit films that may be taking on a new form,” says a licensee executive. “That means we may have dig deeper into studios’ archives to create newness or develop products around the food and other brands outside the film industry that are becoming increasingly popular” amid the pandemic.