Apparel, NFTs Lead College Athletes’ Products

The first collegiate athlete-licensed product has been making its way to store shelves and websites this fall. Not surprisingly, they consist mostly of apparel and NFTs. Most of the business so far centers around football, though that will change, since the NCAA basketball season has just kicked off this week.

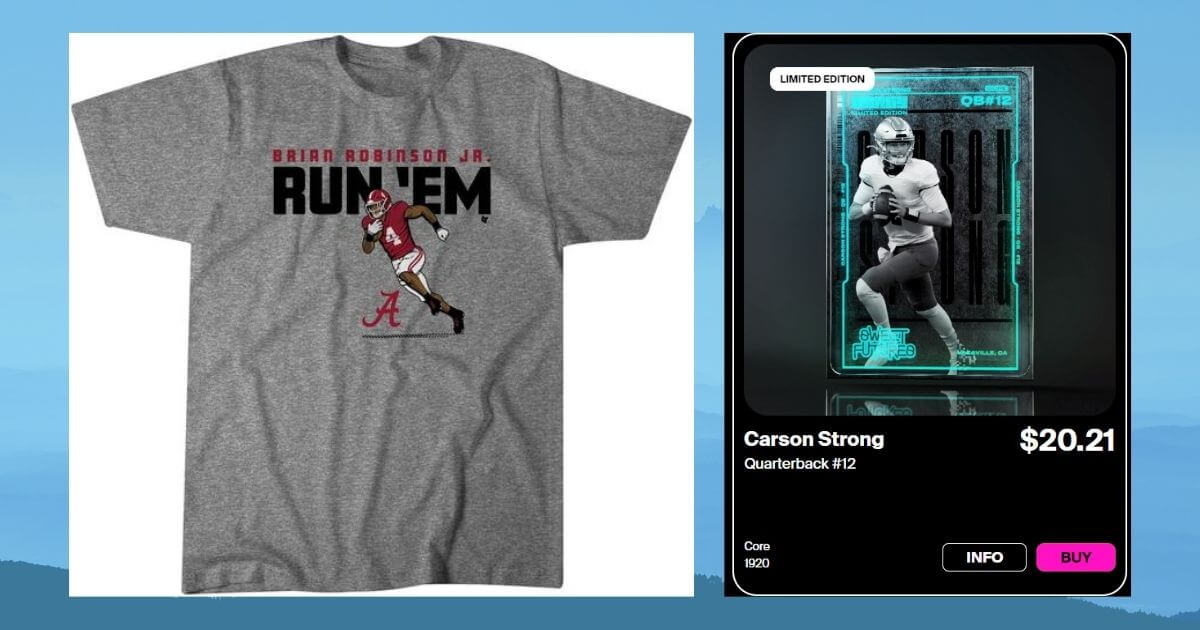

Fanatics’ Candy Digital introduced its first series of “Sweet Futures” – digital collectibles featuring prominent college football players that include their jersey numbers, but no trademarks or identifiable uniform traits (or even descriptive copy) connecting them to their universities. An executive familiar with Fanatics’ business said there hasn’t been enough time since the governing NCAA took the shackles off athletes’ ability to profit from their Name, Image and Likeness (NIL) rights to get approval from the schools to use their marks, but that he expects those kinds of NFTs to start coming to market next year.

Former stars, and current athletes

Campus Legends, meanwhile, signed a license for NFTs (launching this week) with the University of Florida and several of its former football stars, as well as a few current athletes the University’s other sports. Former quarterback Tim Tebow is part of the company’s management team. (The company’s site also features logos for six other universities, though it’s not apparent that any product has been developed, or which if any athletes connected to those schools have been signed up.)

Candy and Campus Legends have started with standard player images, but the latter plans to have video content from the Atlantic Coast Conference by early 2022, says Wesley Haynes, CEO at Brandr Group, which is handling group licensing for athletes at more than 20 schools. And Recur, which has licensing agreements with 32 schools, will launch NFTs that include licensed video content by the time of the NCAA men’s basketball tournament in March, says Co-CEO Trevor George.

Everyone is feeling their way through this initial phase. “Does our fan base buy [NFTs] because it is the individual or because they play for the team they love? We really don’t know that yet,” says Rick Van Brimmer, Assistant VP for Business Advancement, Trademark and Affinity Management at Ohio State. “What will be interesting to see with NFTs and non-NFT [trading] cards is which will be more attractive to the consumer.”

On the apparel side, one limiting factor for a true test of the market is the availability of blank football jerseys that can be turned into player-identified products. Ohio State launched sales in September and sold more than 600 player-licensed jerseys by mid-October through its Legends-operated ecommerce site, says Van Brimmer. He adds that some athletes at the school also are considering posters as a product that can be bought to market quickly this year with little or no impact from supply chain issues.

Print on demand supplier BreakingT has introduced a collection of athlete-specific t-shirts and hoodies, in some cases using the trademarks of their schools, in other cases without them. And apparel company 500 Level introduced apparel with University of Wisconsin quarterback Graham Mertz without any connection to the school.

For the most part, schools and licensees are looking at the fall 2022 sports season as the true test for creating and selling licensed goods based on collegiate athletes. Outerstuff, which is working with Brandr, is developing designs and expects have a deep selection of t-shirts, hoodies and other products by the 2022 back-to-school season, says Josh Feinstein, EVP New Business and Strategic Partnerships.

“We are taking a very strategic approach strategic approach and we want to get it right,” says Feinstein. “This takes time. The bigger opportunity will be fall [2022] delivery, as we have a more robust list of schools and student athletes and all contract work is done.”

The University of Southern California also is being cautious, says Matt Curran, Director of Trademarks and Contracts Compliance. “We are taking a measured approach to co-branding opportunities related to merchandise; we want to make sure we do it right with the right partners,” says Curran.

Overall, as predicted, the business has mostly revolved around the low-hanging fruit — the best-known players in the most visible sports. “The easiest ones to pick off have been the marquee stars, all-conference and all-American selections and then you look at the breakout star,” Haynes. “The trends are looking good but we need to get scale and get more schools signed up [for group licensing] and get the school, athlete and their parents educated about NIL. Companies are still struggling with the relatively short shelf life of college athlete.”

For athletes in less-visible sports (or who aren’t as visible within a major sport), the opportunities revolve more around local or even national endorsements. That’s particularly true for those who have built their own following on social media.

Louisiana State University gymnast Olivia “Livvi” Dunne, who has five million followers on social media, signed a two-year deal with activewear brand Vuori. And University of Nebraska volleyball star Lexi Sun signed an agreement with Omaha-based jewelry chain Borsheims that includes a “Lexi Sun Edit” curated collection from the retailer’s offerings including rings.