Fashion Sales Require Collaboration Between eCommerce and Brick-and-Mortar Retail

An Executive Voices Blog by Marguerite Le Rolland, Research Manager for Euromonitor International

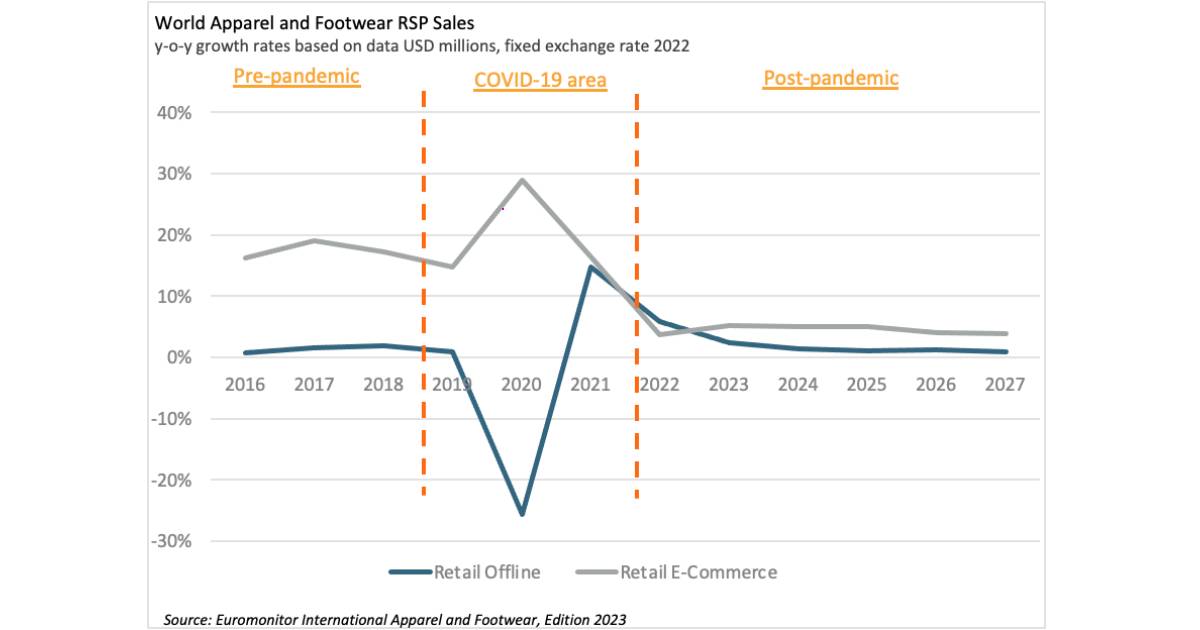

Following significant increases in recent years, eCommerce now accounts for 38% value sales of apparel and footwear in the U.S., compared to 27% in 2019. However, the growth of eCommerce sales in fashion has been slowing following the gradual easing of restrictions in most regions. In fact, brick-and-mortar stores (up 3%) performed better than eCommerce (up 1%) in the U.S. in 2022 in terms of value sales over the same period.

A similar trend has been observed worldwide as global eCommerce sales of apparel and footwear grew by 3% in 2022 compared with 6% growth in-store, according to the Euromonitor International Apparel and Footwear, Edition 2023 (data in USD million, current prices, and fixed 2022 exchange rates).

Moving forward, eCommerce is expected to record further growth—thanks in large part to the ongoing digitalisation of consumers’ lifestyles—albeit at a pace more on par with that of retail offline.

Euromonitor International’s Voice of the Consumer Lifestyle Survey shows that online shopping is motivated by convenience in terms of being able to shop anywhere at any time, the choice of various delivery options, and the ability to easily and quickly compare options, prices, and reviews.

In fact, according to the Euromonitor International Voice of the Consumer Digital Survey 2022, for over 60% of global consumers, the shopping journey now starts online. Consumers look to eCommerce to initially conduct research, no matter whether they are making the actual purchase online or offline. Hence, having a strong online presence and a clear SEO strategy is essential to increasing visibility among consumers.

However, if consumers largely expect online searches and eCommerce to offer greater convenience, the same survey also shows that they also strive for personal service and distinctive experiences that only physical stores seem able to provide.

Many consumers want to interact physically with the brand and products, have immediate access, and avoid inconvenient or negative delivery experiences. Most of them also perceive actual stores as more trustworthy than online purchases, as illustrated by the Euromonitor International Voice of the Consumer Digital Survey 2022, which shows that only 26% of global respondents are comfortable buying from companies that solely offer online customer service, while 58% prefer to talk to a person when it comes to customer service questions.

Hence, digitally native players are expanding offline, such as the British athleisure unicorn Gymshark, which opened a state-of-the art flagship in Central London in 2022. Even Shein—the Chinese ultra-fast-fashion online player that managed to take the fashion world by storm via social media platforms such as Tik Tok to become the world’s eighth largest apparel and footwear player in less than 10 years—is now banking on pop-ups and is likely to open more permanent physical stores around the world following the success of its first permanent location in Tokyo in 2022.

In a time of unprecedented inflation levels, building an omnichannel presence and creating distinctive experiences is becoming imperative as consumers’ budgets tighten. In such a context, consumers are more selective in their fashion spending and will increasingly favour retailers and brands that offer them a positive and seamless shopping journey, both online and offline.

Inflation also exacerbates the costs that retailers must bear for free returns. In Spring 2022, Inditex started charging online consumers in the U.K. for returning unwanted items unless they deposited them in-store. Since then, the Spanish giant has rolled out similar policies in many other countries, including its home market of Spain. Other high street retailers have followed suit in select markets, including Boohoo, Uniqlo, and Next.

More retailers are expected to end free returns for online orders in the short term, as companies are likely to increasingly leverage their physical touchpoints—not only to reduce their costs and maximise customer engagement, but also to reduce their waste and carbon footprint in anticipation of possible new environmental regulations, starting with the EU Strategy for Sustainable Textile, and the NY Fashion Sustainability & Social Accountability Act, in the U.S.

For more information about this topic is available in the “Competitor Strategies in Apparel and Footwear” report published in January 2023, and the Transforming Fashion Supply Chains in A High Inflation Environment report, published in April 2023.

Euromonitor International helps organizations understand where and how consumers shop through both traditional and emerging retail channels. Comprehensive international coverage and insights as part of syndicated offerings provide retailers, brands, and others in the industry with data and analysis to help guide decisions on investment, expansion, and product positioning by category, channel, or country. Bridging methodologies based on data science and on-the-ground research, we provide context to strategic and tactical data, helping you answer your biggest challenges and identify opportunities.