Mattel Reports Second Quarter 2025 Financial Results

- Net Sales of $1,019 million, down 6% as reported and in constant currency

- Gross Margin of 50.9%, an increase of 170 basis points; Adjusted Gross Margin of 51.2%, an increase of 200 basis points

- Operating Income of $78 million, a decrease of $5 million; Adjusted Operating Income of $88 million, a decrease of $8 million

- Net Income of $53 million, a decrease of $4 million

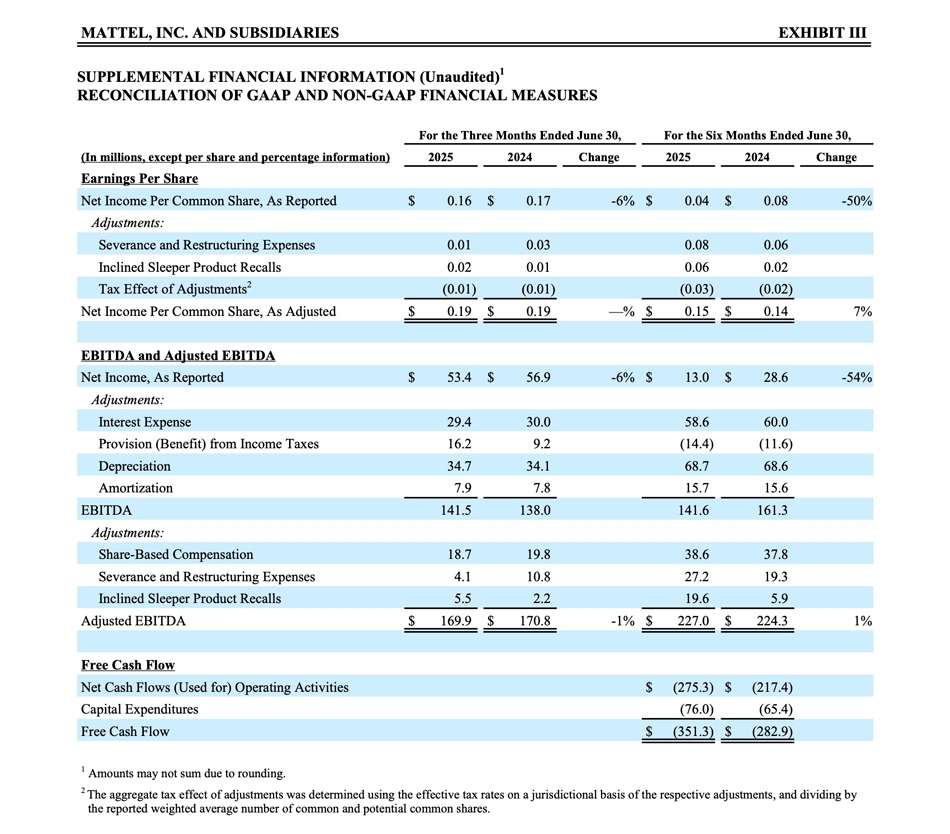

- Earnings per Share of $0.16 compared to $0.17 per share; Adjusted Earnings per Share of $0.19, no change versus the prior year

- Repurchased $50 million of shares, bringing first half total to $210 million

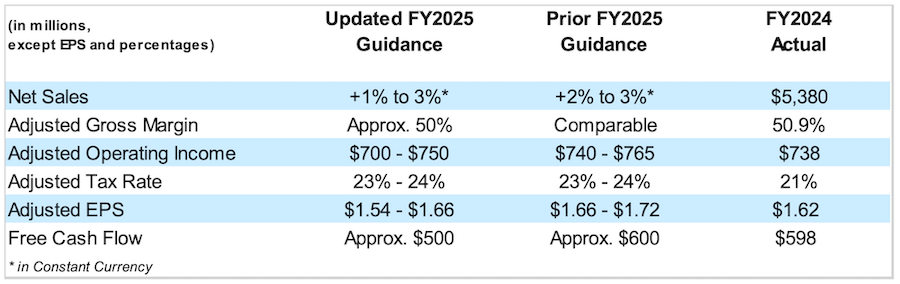

- Company resumes guidance with updated 2025 outlook, and reaffirms 2025 share repurchase target of $600 million

El Segundo, CA — Mattel, Inc. reported second quarter 2025 financial results.

Ynon Kreiz, Chairman and CEO of Mattel, said: “Our second quarter performance reflects operational excellence in the current macroeconomic environment as we continue to execute our strategy to grow Mattel’s IP-driven toy business and expand our entertainment offering. We achieved meaningful gross margin expansion, grew internationally, and further progressed our entertainment slate. We are embracing technology and collaborating with world-class partners to bring our iconic brands to life in new ways to position Mattel for long-term success.”

Paul Ruh, CFO of Mattel, added: “Mattel’s adjusted EPS was the same as last year, despite global trade dynamics and timing shifts in retailer ordering patterns impacting our US business. We grew in Action Figures and Vehicles, increased our POS, and repurchased more shares. We are confident in the power of our brand portfolio and our ability to navigate ongoing uncertainty. Our balance sheet is strong and we are executing in line with our capital allocation priorities to create long-term shareholder value.”

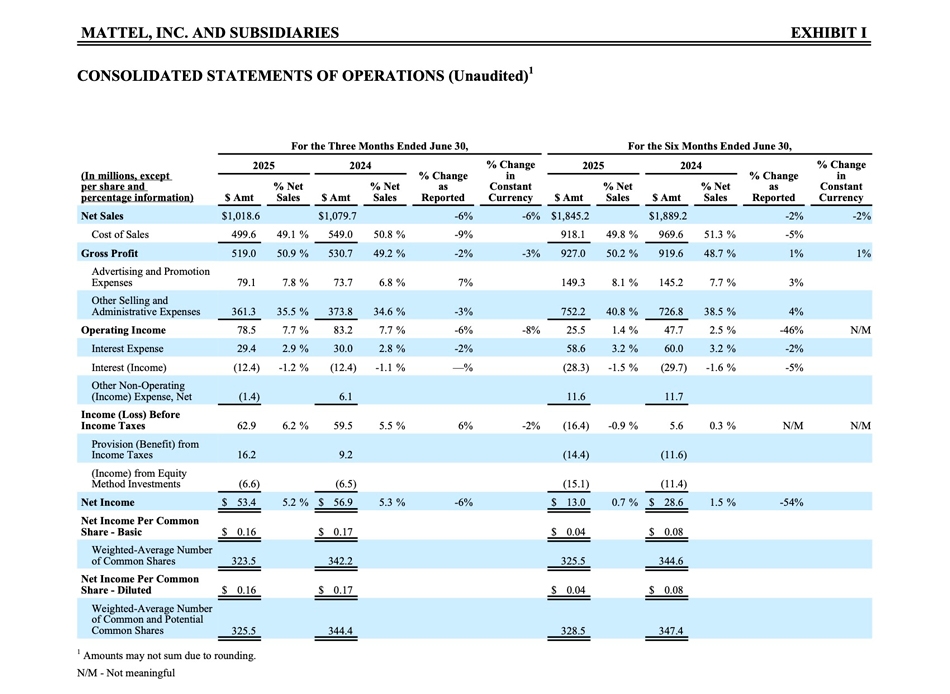

Second Quarter Financial Overview

Net Sales

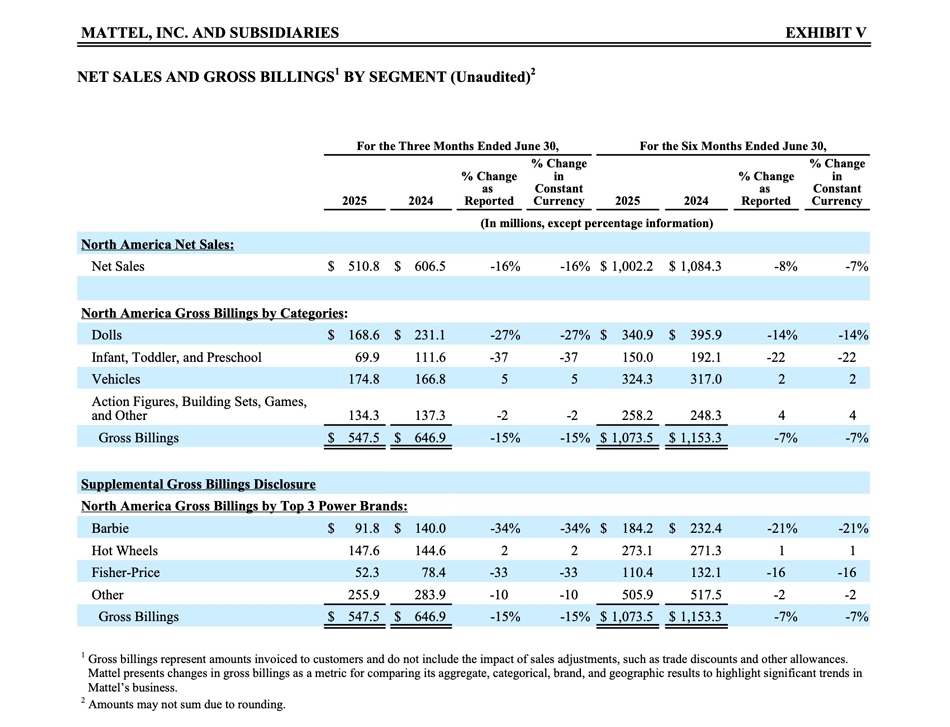

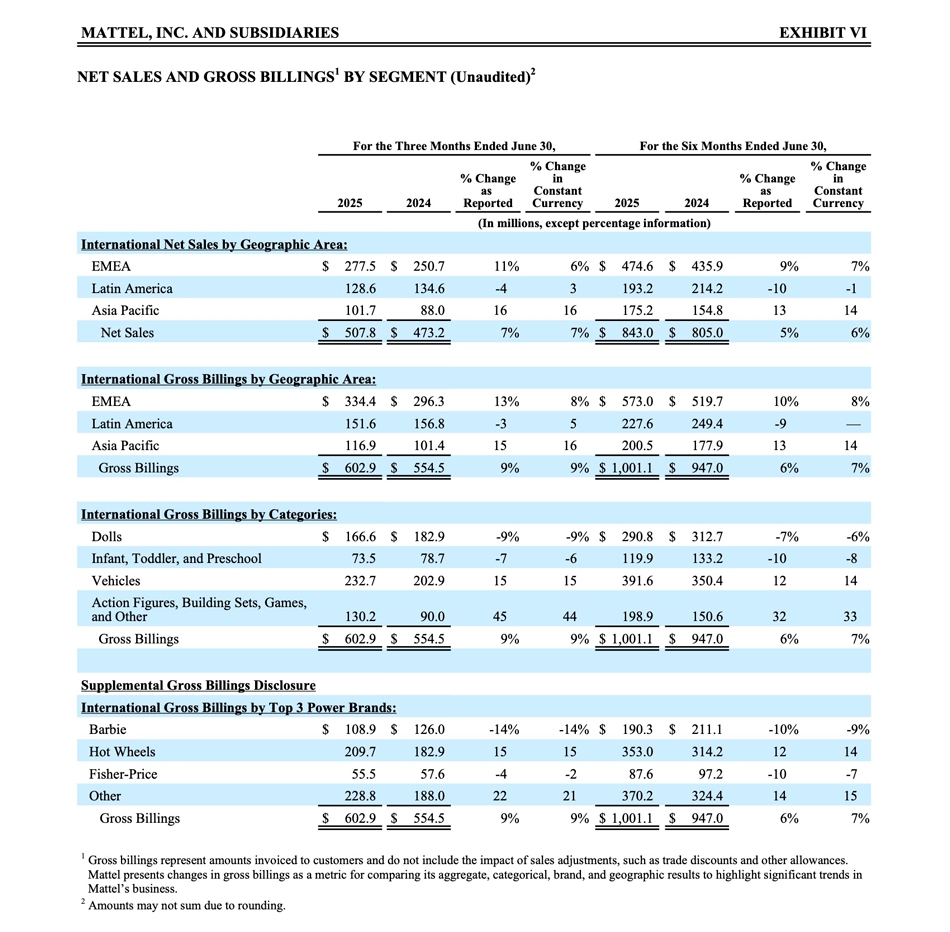

Net Sales were $1,019 million, down 6% as reported and in constant currency, versus the prior year’s second quarter. The decrease in Net Sales was driven by a 16% decrease in North America, partially offset by a 7% increase in International.

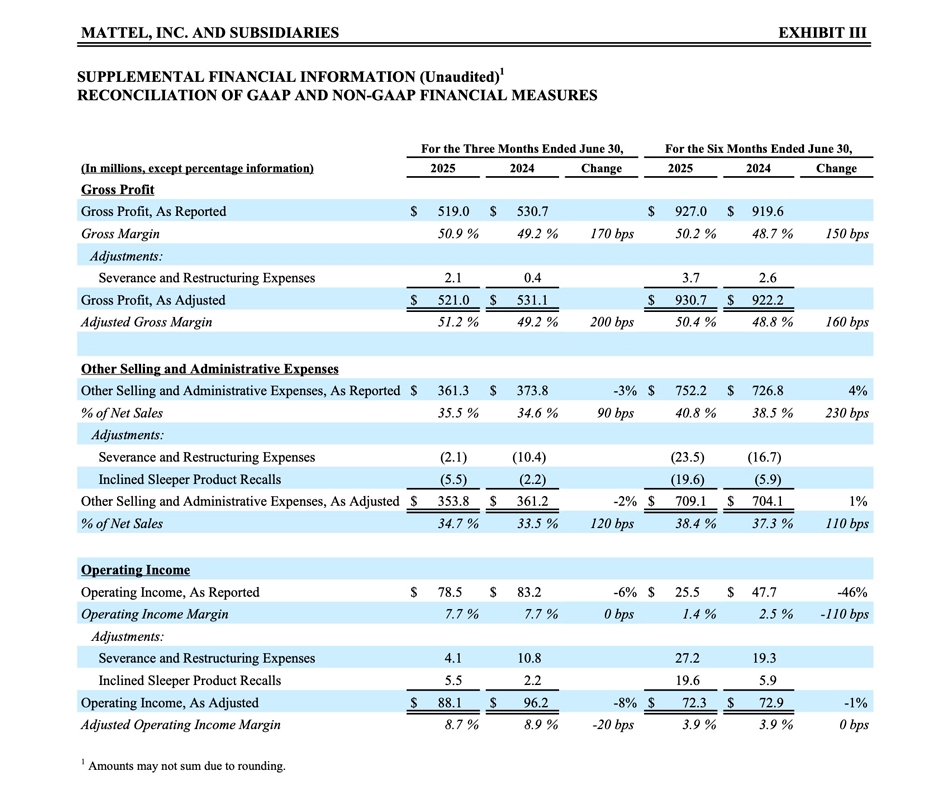

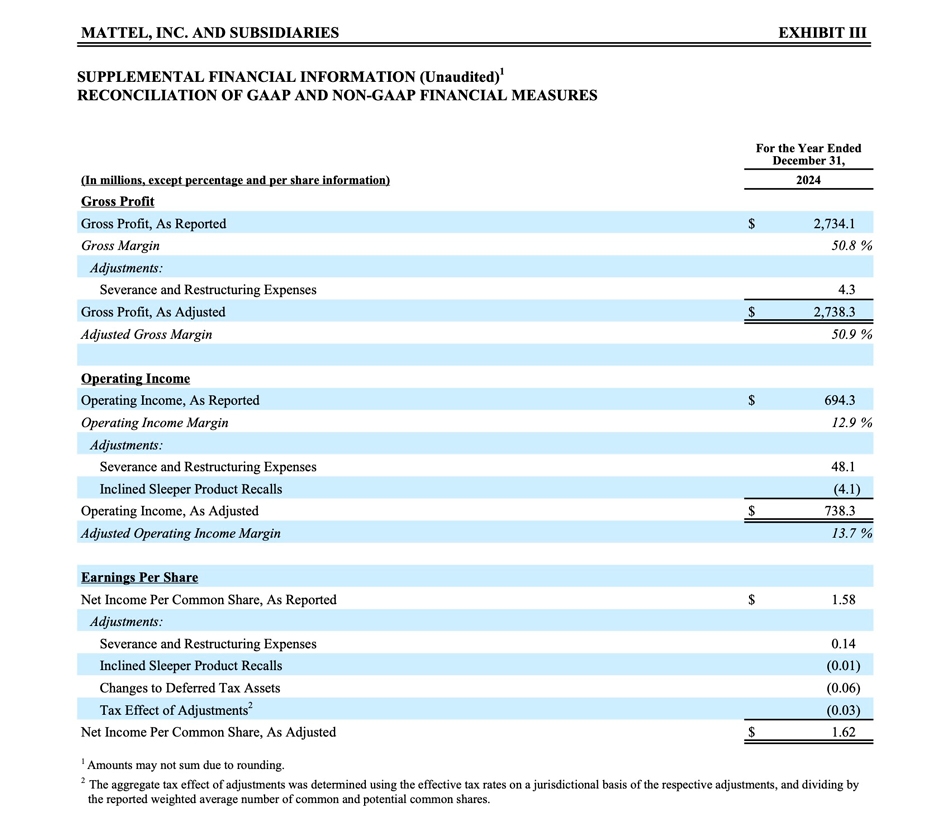

Gross Margin

Reported Gross Margin increased to 50.9%, versus 49.2% in the prior year’s second quarter, and Adjusted Gross Margin increased to 51.2%, versus 49.2%. The increase in Gross Margin was primarily driven by savings from our Optimizing for Profitable Growth program, lower inventory management costs, and favorable mix, partially offset by cost inflation.

Operating Income

Reported Operating Income was $78 million, a decrease of $5 million, and Adjusted Operating Income was $88 million, a decrease of $8 million. The decrease in Operating Income was primarily due to lower Net Sales, partially offset by higher Gross Margin and lower Other Selling and Administrative Expenses.

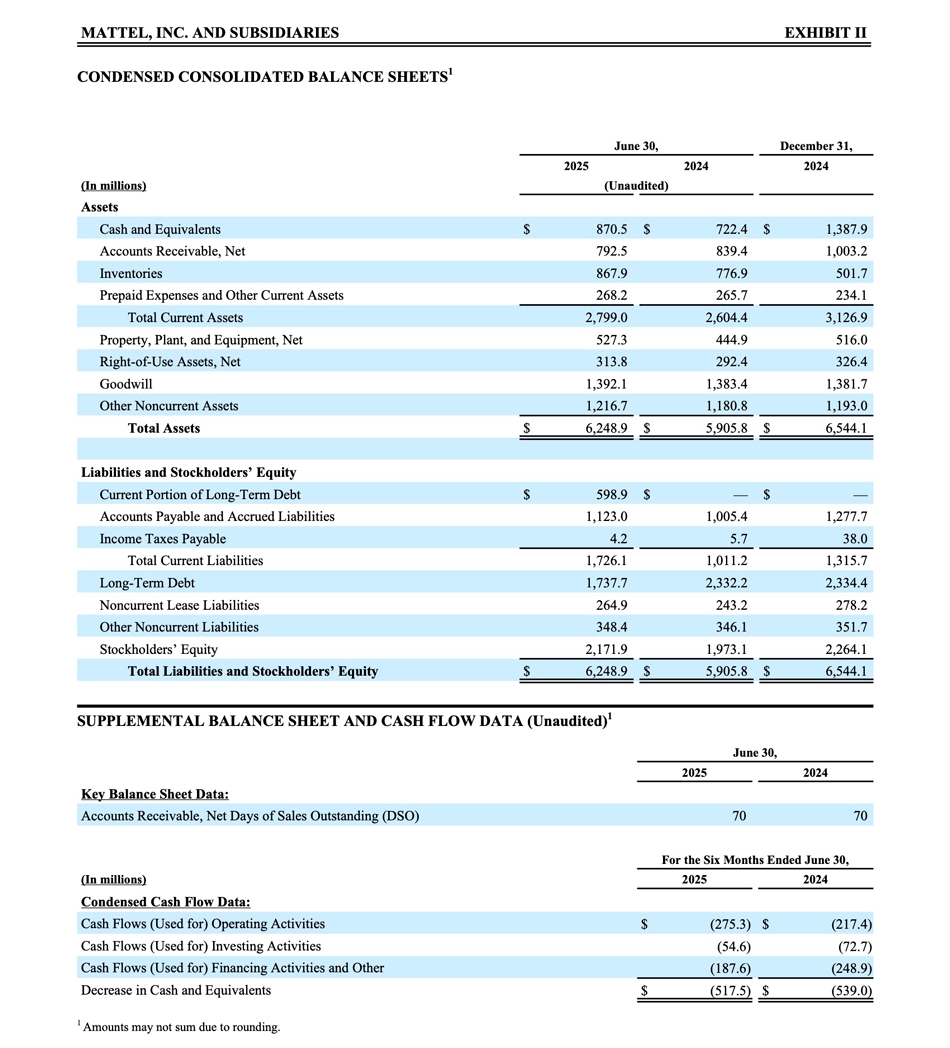

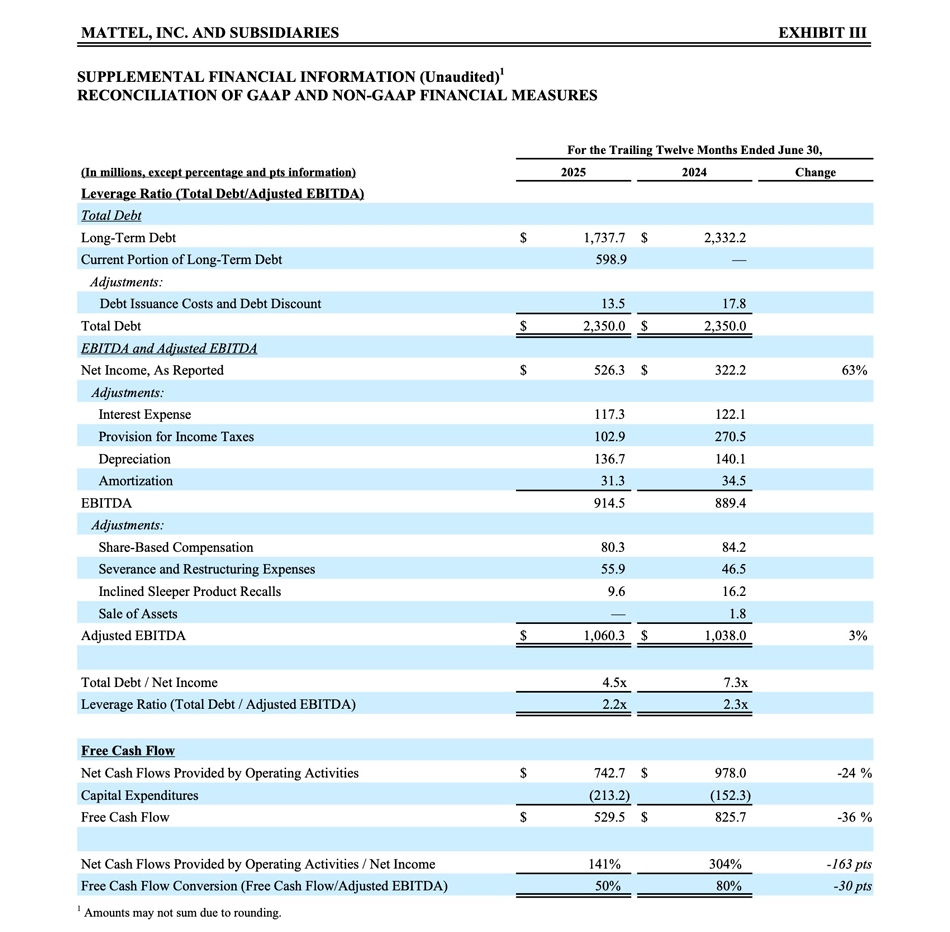

Cash Flow

For the six months ended June 30, 2025, Cash Flows Used for Operating Activities were $275 million, an increase of $58 million, primarily driven by lower net income net of non-cash adjustments and higher working capital usage.

Cash Flows Used for Investing Activities were $55 million, an improvement of $18 million, primarily due to higher proceeds from foreign currency forward exchange contracts.

Cash Flows Used for Financing Activities and Other were $188 million, an improvement of $61 million, primarily driven by the favorable impact of foreign currency exchange rate changes.

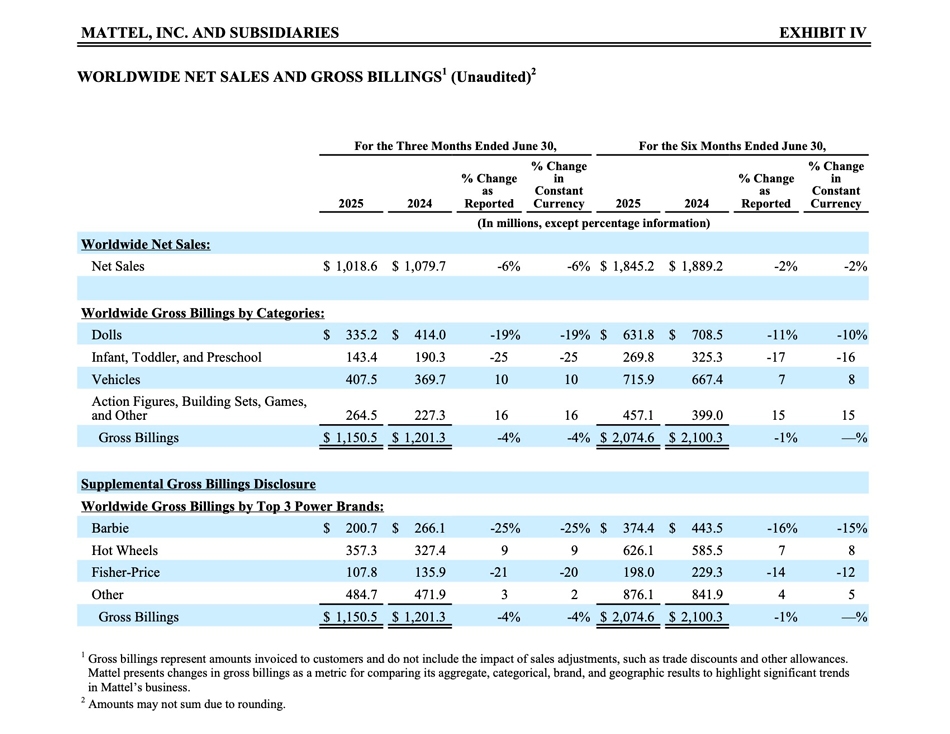

Second Quarter Gross Billings by Category

Worldwide Gross Billings for Dolls were $335 million, down 19% as reported and in constant currency, versus the prior year’s second quarter, primarily due to declines in Barbie.

Worldwide Gross Billings for Infant, Toddler, and Preschool were $143 million, down 25% as reported and in constant currency, primarily due to declines in Fisher-Price and Baby Gear & Power Wheels.

Worldwide Gross Billings for Vehicles were $407 million, up 10% as reported and in constant currency, primarily driven by growth in Hot Wheels.

Worldwide Gross Billings for Action Figures, Building Sets, Games, and Other were $264 million, up 16% as reported and in constant currency, primarily driven by growth in Action Figures, partially offset by a decline in Building Sets.

2025 Guidance

Mattel’s updated full year 2025 guidance is:

Contacts:

Securities Analysts

News Media

MAT-FIN MAT-CORP