Subscription Boxes Are Being Repackaged

Subscription boxes were a major trend several years ago, promising a new path for brands and licensing. Yet as time has worn on, that trail has proved difficult to navigate.

In many cases, subscribers remain customers for less than 90 days. And as it typically costs as much as $30-$40 to acquire a new subscriber, turning a profit has proven elusive.

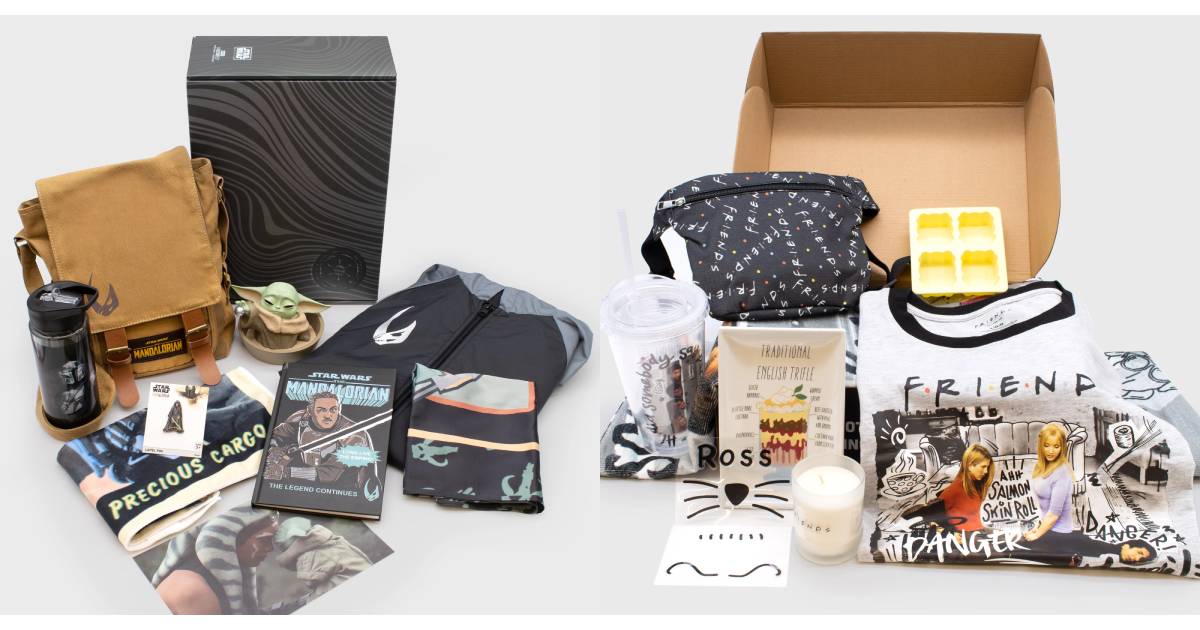

And because subscription box packing products range in focus from pop culture (Loot Crate, CultureFly), to pets (Bark Box), to food (Blue Apron), to apparel (Rent the Runway, RealReal, Stitch Fix), a range of different strategies must be employed to retain subscribers with such varying interests. Some of those strategies will open up new opportunities for licensing.

For example, the crowded meal-kit business in a post-pandemic world forced Blue Apron to restructure, including cutting jobs and selling production assets to fellow meal company FreshRealm, which became the exclusive supplier of the service’s meal kits. Blue Apron also struck a licensing agreement with Food Network star and cookbook author Molly Yeh for a limited-edition meal kit for Mother’s Day. These changes lowered Blue Apron’s subscriber acquisition costs by 50% in Q1 to its lowest levels since 2019, CEO Linda Findley said. The average order size rose to $70.27, up 12% from the previous year.

“Limited-time boxes [such as those with Molly Yeh] are a great way to engage current and prospective customers,” Findley said. “The seasonal boxes have proven to deliver on higher order rates and average order value during the weeks we offer them, along with helping reactivate accounts.”

For Bark Inc., a shifting landscape has meant expanding distribution over several years to Target and other retailers, encompassing more than 40,000 stores and 11.8% of the company’s annual revenue, CEO Matthew Meeker said. It had 2.1 million subscribers as of March 31 and generated $307 million in sales of pet toys, many of them licensed. And toys have since been supplemented by consumables including food, treats, dental products, and toppers, which produced $165 million in annual sales and will launch retail distribution later this year, Meeker said. The average order size was $31.70 in the third quarter ended April 29, up from $29 a year ago.

In the case of pop culture subscription box services, many of them are moving to supplement their business with direct-to-consumer sales of limited-edition items, licensing industry executives said. Loot Crate, an early purveyor of pop culture-based boxes, filed for bankruptcy in 2019 and was acquired by NECA, which merged the company with its collectibles business and renamed it The Loot Co.

“Subscription boxes are still an interesting model, especially if they service that passionate fan,” said Anna Songco Adamian, VP of Global Consumer Products at Crunchyroll. “We are not walking away from them entirely, and see they bring the most impact when the offering is unique and feels truly exclusive to the consumer.”

In seeking out exclusive products, apparel-focused subscription box service Stitch Fix is cutting back on name brands that are available through its Freestyle business, including Free People, Universal Standard, Vince, Madewell, Mother, and Rag & Bone, said Founder Katrina Lake. At the same time, Stitch Fix is repositioning Freestyle as a means for clearing excess inventory rather than offloading it to third-party liquidators and will no longer use it to acquire customers, company executives said.

“Candidly, those brands haven’t performed as well in the Freestyle experience,” Stitch Fix CFO Dan Jedda said. “I would position that as a positive, as being a testament to our personalization. At the end of the day, even if it’s not a brand that somebody recognizes, if you’re delivering jeans that fit someone, someone’s going to buy them.”