Toys R Us, Macy’s Try to Build Off Each Other

Last week’s announcement that Toys R Us departments will be inserted into 400 Macy’s stores next year, and that toysrus.com is now operated by Macy’s, paints a picture of two legacy retail brands – one that was one of the original “category killers”, the other the most famous legacy department store brand — seeking to recapture their magic in an uncertain retail environment.

Questions

As this is written, the high-profile announcement doesn’t address some marketing and operational issues:

- Can the Toys R Us brand (owned by WHP Global), whose equity is built on the big box paradigm of “If that toy exists, they’ll have it” translate into the less spacious confines of a department store layout? How large will the departments be during peak and off-peak seasons?

- Who is doing the buying and merchandising, and who owns the merchandise? Is this essentially a leased department?

- How will the Toys R Us/Macy’s combo compete in the toy business with such heavyweights as Amazon, Walmart and Target?

WHP Global took control of the Toys R Us brand in mid-March, buying the parent company TRU Kids, that was formed to buy Toys R us out of bankruptcy in 2017.

A valued incubator

In its glory days, with seemingly miles of shelves, Toys R Us was valued in the licensing and toy businesses as a retailer that gave a new license or product line time to (hopefully) find its footing, and was willing to take a chance on an unproven newcomer.

Macy’s is banking on the Toys R Us brand to be an “entry category” for millennial parents that “will translate into other purchasing,” Macy’s CEO Jeffrey Gennette said as the company reported strong earnings last week. He acknowledged that Macy’s market share in toys is currently “quite small”, but that he expects it to “quintuple” with the addition of the new format.

The companies will do “a lot of marketing together,” he said, including a TRU appearance in the annual Macy’s Thanksgiving Day parade in November. Think we might see a Geoffrey balloon traveling the streets of Manhattan?

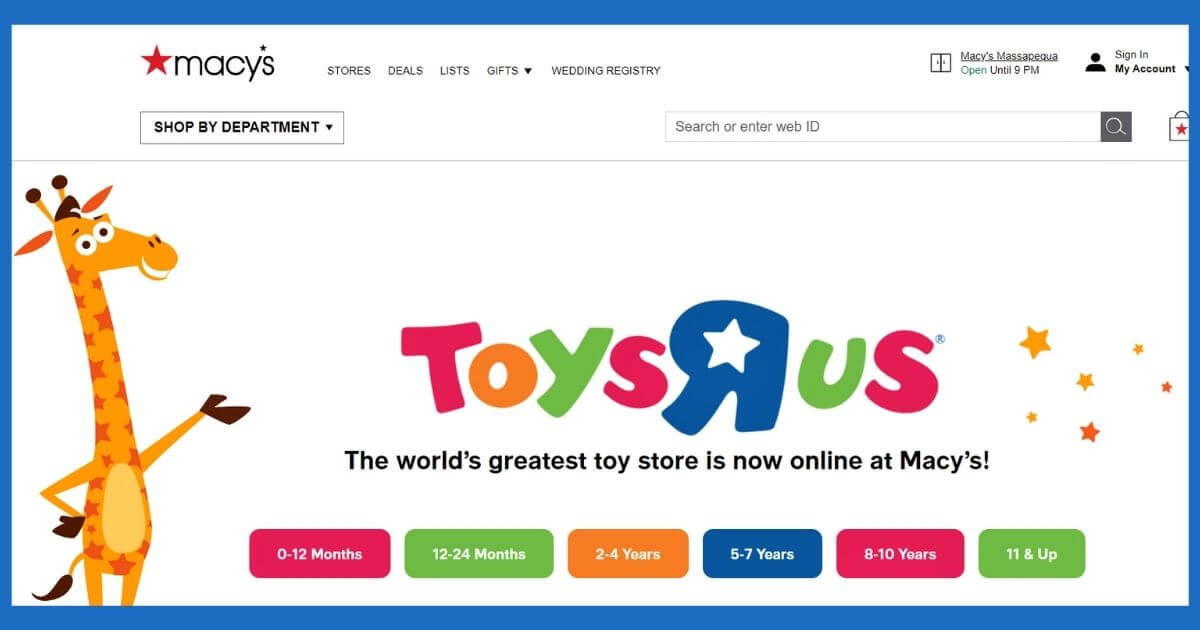

The companies already are meshing online. The Macy’s website visibly promotes the presence of Toys R Us, while visitors to toysrus.com are informed that their purchases are “Sold and shipped by or fulfilled through macys.com.”

The Macy’s agreement gives Toys R Us a highly visible footprint in U.S. retail; its two most recent attempts to rekindle the flame with physical stores closed in January.

The brand maintains a presence outside the U.S. via licensing deals; the company says there are more than 900 Toys R Us and Babies R Us stores in 25 countries.

For example, Fung Retail operates Toys R Us stores throughout the Asia-Pacific region, including 215 locations in China, and the Al-Fultaim Group has 21 licensed TRU stores across the Middle East.

Last week, Fairfax Financial Holdings announced it had sold TRU Canada (including Babies R Us) and its 81 stores to Putnam Investments, three years after acquiring the TRU subsidiary’s stores and IP.

Elsewhere, the brand has disappeared. TRU closed its remaining 100 stores in the UK in 2018, and 53 locations in France were sold the following year, including 44 that were eventually merged into the PicWic Toys chain. It also sold 93 locations in Austria, Germany and Switzerland to Ireland-based Smyths Toys, which rebranded many of them under its own name, and closed the others.

Only time will tell the fate of this latest iteration.