Alcohol Brands Broaden Their Licensing Programs

In many cases, licensing for brand owners is all about royalties and guaranteed minimums. But sometimes, the primary benefit is to bring a brand to new audiences, cement the relationship with current customers, or help support new strategies when business is forced into unanticipated changes.

Part of the marketing spend

That’s been the case with alcohol brands during the past year. With bars and restaurants closed or operating with reduced capacities, some companies have shifted marketing spending to reach those that might otherwise have been out for a night on the town with their favorite drink – or looking for a new one.

To be sure, many alcohol brand licensing programs were in place pre-pandemic. But what the brands are trying to gain in broadening those efforts is deeper ties with loyal consumers and broader exposure to new ones.

Reaching consumers in new places

“The revenue is there [from licensing], but it is more secondary,” says Andy Topkins, partner at Brandgenuity, which recently signed agreements to represent Sazerac (Fireball, Buffalo Trace and other brands) and Kahlua. “Now is a moment where marketing spending has shifted a little bit because companies moved from promoting at bars to at-home consumption. That opened their eyes to licensing, which enables them to reach consumers in different aisles and provided another means for getting in front of consumers, especially since they aren’t walking into bars and restaurants as much.”

Per capita spending and overall sales of alcohol declined last year as the bar and restaurant business was torpedoed by pandemic restrictions, according to Statista. At-home accounted for 60% of alcohol consumption in 2020, against 40% for bars and restaurants, notably different from the 53%-47% split a year earlier.

That shift was accompanied a further broadening of unique brand pairings. Those were driven partly, in the case of beer brands, by the need to attract younger consumers who have increasingly been drawn to mixed drinks and more recently anything hard, be it seltzer, ice tea or lemonade. Sales of the latter category increased 160% in 2020, jumping to 10% of the size of the beer market, and forecast to hit 15% this year and 40% within a few years, says Citigroup analyst Laurent Grandet.

“It’s all about brands poking fun at themselves because that really is the culture of young consumers,” says Ricky Yoselevitz, VP Brand Partnerships and Business Development at IMG. “There are younger consumers that care a lot about companies’ stances on topical and social issues, and there are those consumers — sometimes the same ones — who want to see brands have fun. It’s doing something fun and irreverent that can create buzz-worthy moments that take on a life of their own.”

Among the developments we’ve seen:

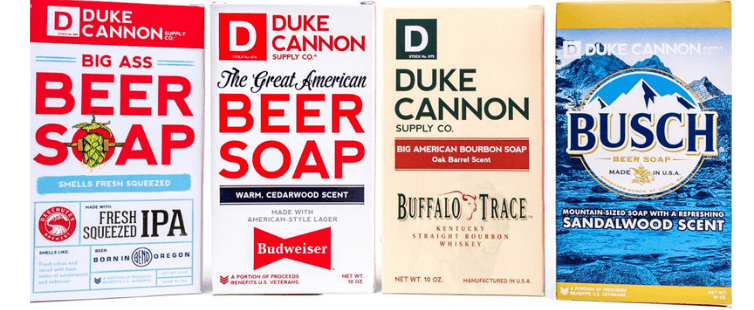

- Duke Cannon Supply Co. has launched a series of beer- and spirts-branded 10-ounce soaps over the past few years, most recently adding Busch to the mix. It even offers a “Beer & Bourbon Box” that features a sandalwood soap made with Busch beer, paired with a fresh woodsy version using ingredients from Deschutes Brewery along with cedarwood scent (Budweiser) and oak barrel (Buffalo Trace bourbon). Lest anyone forget: “You don’t need to be 21 to buy this product as long as you don’t eat it,” Duke Cannon says on its web site.

- Yuengling & Sons Inc. joined with its Pennsylvania neighbor, Hershey Co. for chocolate-flavored porter that launched in sixpacks last fall in 22-states. That built on a draft-only version released in 14 states in 2019.

- Manly Brands launched a 17-piece Jack Daniels wedding band collection late last year ranging from a cobalt chrome version (The Lyndon $800) to solid gold (The Honey $2,350).

- Hard Rock International licensed Stewart Enterprises, known for its non-alcoholic root beer, to make and distribute Hard Rock hard seltzer, the first of which will be available this spring in the U.S., followed by Europe and Asia, says Bill Cross, Senior VP Business Development at Broad Street Licensing Group, which represents Hard Rock. Stewart previously sought to market hard seltzer under its own brand, but took a Hard Rock license both because it represented “good times” and had “hard” in its name, says Cross.

- Brandgenuity will seek to bring the Fireball brand into frozen appetizers and chicken wings. Sazerac marketed Fireball Nognog in 2,500 Walmart stores this past holiday season, and the program will expand in 2021. (Longtime licensee Hood makes and markets Southern Comfort egg nog.) Meanwhile, Cigars International later this year will launch cigars licensed with Sazerac’s Weller (bourbon) brand.