The Top Trends in Beauty and Personal Care

An Executive Voices Blog by Kayla Villena, Head of Beauty and Personal Care Research at Euromonitor International

With products like fragrance and sun care expected to drive growth in the beauty and personal care category this year, there are a number of opportunities for brands seeking to enter the space.

Euromonitor International regularly surveys its extensive network of industry professionals around the world to uncover trends and innovations within categories, regions, and beyond. Fielded in November 2023, Euromonitor International’s Voice of the Industry—which surveys more than 1,200 industry professionals in 97 countries—revealed the top areas of current and future investment, leading company strategies, and key challenges facing the beauty and personal care industry.

Artificial Intelligence Gets a Makeover

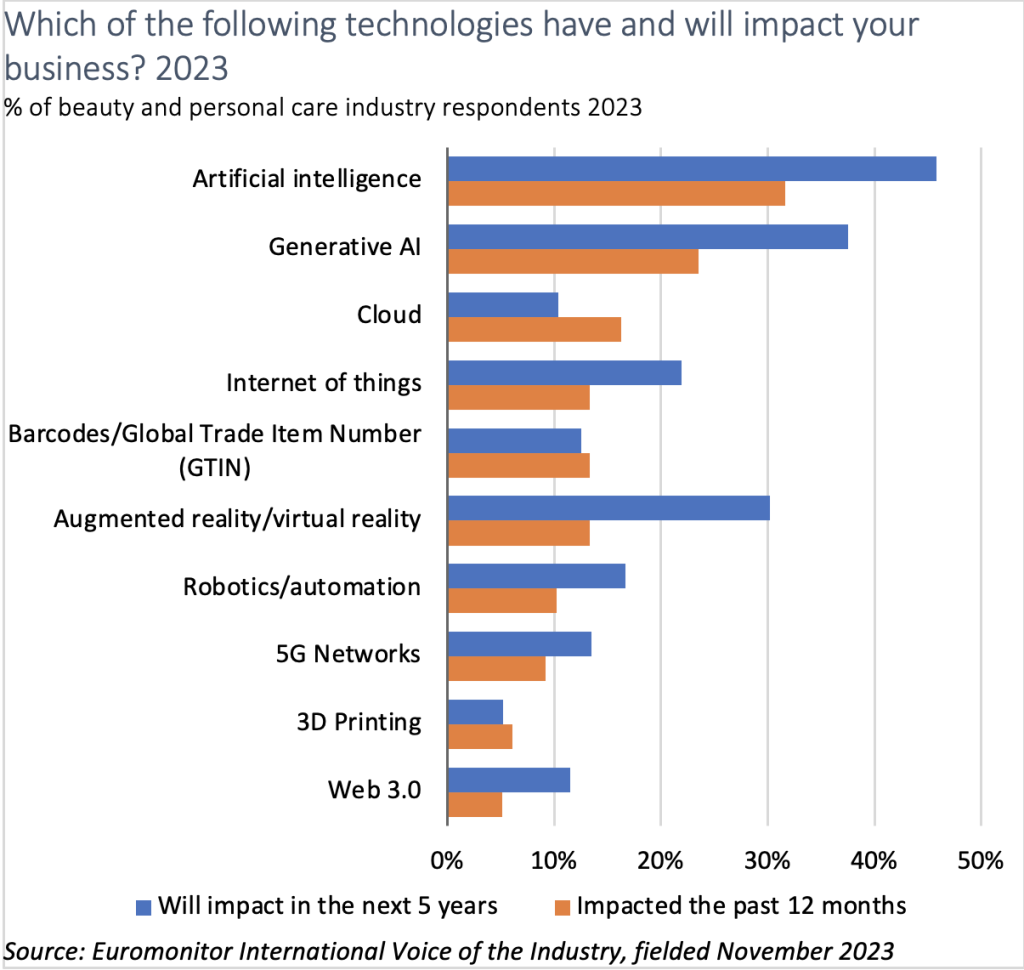

Artificial intelligence stands out as having the greatest impact on beauty and personal care technologies in 2023 and beyond, with almost a third of beauty and personal care industry respondents (32%) reporting it affected their business in the past year, and almost half planning to invest in AI in the next five years.

The industry expects different advantages from traditional AI and generative AI. Over a third of respondents plan to utilise traditional AI in the next 12 months to handle customer service requests (36%) as well as fulfilment and logistics (34%), while 42% plan to use generative AI to analyse customer data for more intelligent shopping suggestions. The beauty industry is already seeing the impact of AI on diagnostics and recommendations in skin care, hair care, and colour cosmetics.

A Key Ingredient

With consumers being increasingly educated about skin health and searching for newness or innovation, the search for additional benefits beyond basic functionality is growing. This, along with consumers’ quest to control health outcomes, is contributing to a rise in ingredient-led beauty, which highlights the benefits of specific ingredients and empowers consumers to seek out specific actives to treat or prevent skin concerns, leading to a more personalised skin care routine.

Ingredient-led beauty also demonstrates how bioengineered ingredients can be just as effective as naturally derived ingredients. The result is greater consumer appetite for sustainability, biotech, and international beauty concepts that is contributing to a wellness-positioned view of cosmetic ingredients.

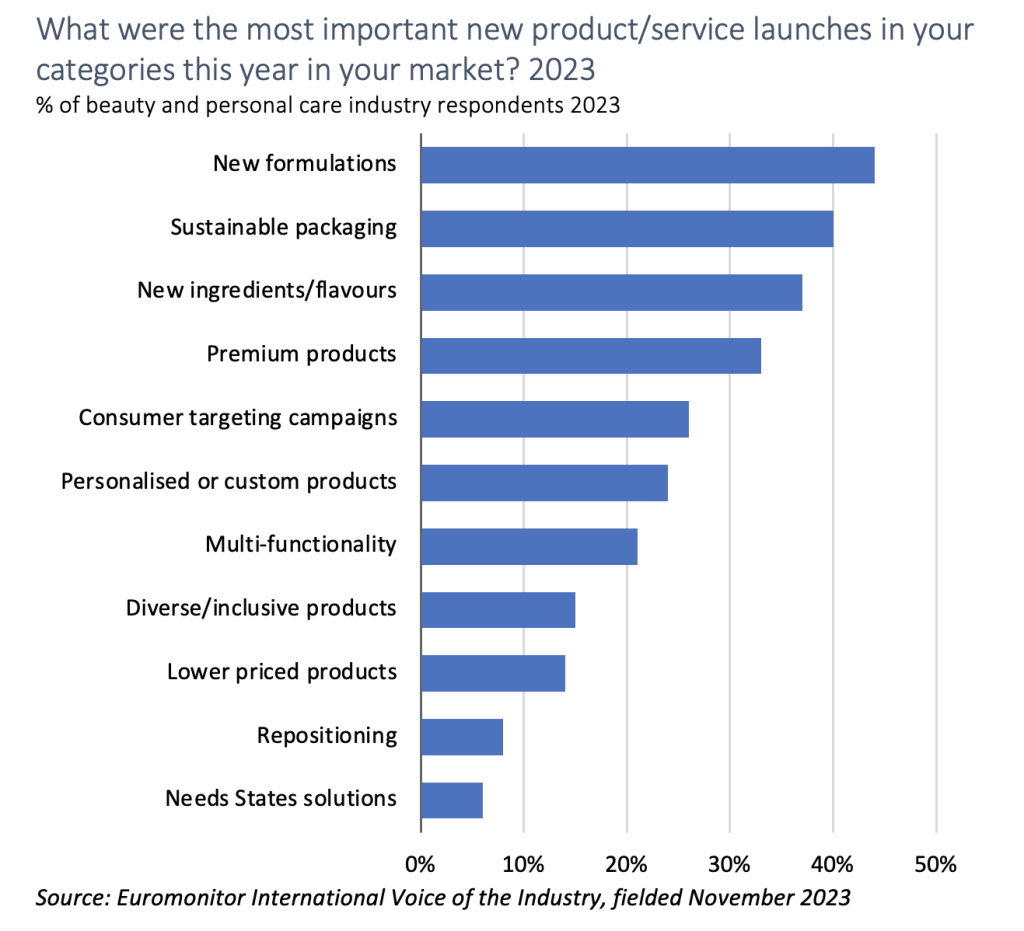

Formulations and ingredients were among the leading new product or service launches in 2023. About 44% of beauty and personal care industry respondents focused on new formulations in 2023. Additionally, 37% stated the most important launches were related to new ingredients and flavours. With increasingly educated and efficacy-driven skin care consumers, players should continue focusing on hero ingredients to meet the growing need for solutions-based benefits, such as spotlighting products that serve specific needs or problems (like targeting dark spots or being safe for eczema-prone skin).

Ingredient-led beauty also focuses on conscious ingredient sourcing (including upcycling and circularity), which appeals to consumers focused of sustainability. Among beauty and personal care industry respondents, 65% believed the rising cost of raw materials extensively impacted business. Lower cost, bioengineered (but still efficacious) ingredient alternatives are becoming more appealing to the industry in 2024, acting as significant motivators to lessen the sourcing and production footprint of ingredients used in beauty. As a result, Euromonitor predicts ingredient-led beauty will become an even more appealing avenue for beauty and personal care players to achieve ingredient-driven efficacy and sustainability goals.

The Appeal of a Good Price

As inflationary pressure reduces spending power, particularly in regions like Western Europe and Latin America, beauty brands should expect consumers to embrace a “less is more” approach to their routines, especially in the short term.

Consumers are making more considered decisions regarding the products they spend their money on, resulting in a polarisation of spending with consumers trading down and limiting the use of some products in order to be able to afford more premium products in other categories. Most consumers are opting to trade down when it comes to practical product categories, like soap and depilatories, that are perceived to provide a similar outcome irrespective of the price.

Despite challenges from inflation, the beauty and personal care industry is still heavily focused on expansion. Euromonitor International’s Forecast Model, last updated on February 5th, 2024, predicts the beauty and personal care industry to grow by 5% in current terms in 2024, with standout performers being colour cosmetics, fragrances, and sun care. What is likely to linger in 2024 is consumer pricing sensitivity and further consumer tradeoffs.

Looking Forward in 2024

The global economy consistently outperformed expectations in 2023 but, in 2024, global economic growth is expected to slow to 2.7% due primarily to the lagging effects of high interest rates and ongoing cost pressures for businesses and consumers globally. As companies pivot to portfolio expansion, channel expansion, entry to new markets, and greater consumer segmentation, Euromonitor expects rosier prospects in 2024. About 56% of beauty and personal care industry professionals expect 2024 performance to improve slightly from 2023, while 46% expect 2028 performance to improve greatly from 2023. Optimism among beauty and personal care professionals in 2024 will be driven by wellness-positioned products, technological developments, and innovations that widen consumer perception of value.

Euromonitor International helps organizations understand where and how consumers shop through both traditional and emerging retail channels. Comprehensive international coverage and insights as part of syndicated offerings that provide retailers, brands, and others in the industry with data and analysis to help guide decisions on investment, expansion, and product positioning by category, channel, or country. Bridging methodologies based on data science and on-the-ground research, Euromonitor International provides context to strategic and tactical data, helping you answer your biggest challenges and identify opportunities.