Topps Deal Paints Bullish Picture of NFTs

Topps’ plan to go public via a special-purpose acquisition company (SPAC) is the most recent in a series of developments shining a light on the exploding business of digital collectibles in the form of non-fungible tokens (NFTs).

NFTs — one-of-a-kind digital collectibles that can’t be copied and are stored in the Ethereum blockchain — have been skyrocketing. Topps’ agreement with Mudrick Capital values the combined entity at $1.1 billion.

Downstream Royalties

Investor and IP owners’ interest has been piqued by the digital technology and the prospects for collecting royalties not just on the original transaction, but also on subsequent sales downstream, as tracked via the blockchain. Topps, which first entered digital trading cards in 2012 before shifting recently to NFTs, generated a quarter of its $587 million in revenue last year from digital. That percentage seems destined to grow exponentially.

“With blockchain, we’re going to be able to participate in the secondary market. Before, we only participated when we put the analog cards out,” former Disney executive and Topps Chairman Michael Eisner told CNBC. “This is the icing on the cake — going digital completely, with the analog still in place.”

(Licensing International is working with the investment firm Jefferies on a half-day event April 27 — a series of panels and speakers that will help to define the market and discuss the host of definitional, rights, logistical, infrastructure and other issues surrounding NFTs, particularly in the entertainment, fan culture, and sports industries. Registration details will be announced soon.)

Seemingly Unlimited Applications

That NFT icing is being applied to as many different kinds of virtual “items” as you can imagine. A 50-second video by Canadian musician Grimes drew $389,000, while a one-of-a-kind version of internet meme Nyan Cat sold as an NFT for $660,000 in February. Forbes is auctioning a 15-sec. digital rendering of this week’s cover as an NFT to raise funds for a pair of non-profits.

The potential for creating NFT income streams is an element in the ongoing legal fight over collegiate athletes’ ability to benefit from their Name, Image and Likeness (NIL) rights. University of Iowa basketball star Luka Garza (whose NCAA eligibility effectively ended when Iowa was eliminated from March Madness) launched a “National Player of the Year” NFT image, which went up for auction on the crypto market OpenSea on Tuesday night, featuring Garza in his Iowa uniform. (One potential rights issue: Garza is pictured in his Iowa uniform, with team marks.)

“The future of this [NFTs] is paving the way for college athletes to do this to make money off their name, image and likeness,” Garza said. “This is something that could provide an example if name, image and likeness is passed, which I feel a lot of people have confidence” will become a new standard.

Among other recent NFT developments:

- Future Hall of Fame quarterback Tom Brady on Wednesday (April 7) launched an NFT platform called Autograph. The company will work with developers to create NFT digital collectibles featuring celebrities from sports, entertainment, fashion and pop culture. Not to be outdone, Brady’s former New England Patriots teammates Julian Edelman and Ron Gronkowski have introduced comics-inspired and Super Bowl moments NFTs, respectively. And former NFL quarterbacks Peyton Manning and Eli Manning said they’re launching Manning Legacy Collection digital artwork in April 16, with a portion of the sales on MakersPlace going to Tackle Kids Cancer and the Peyton Manning Children’s Hospital in Indianapolis.

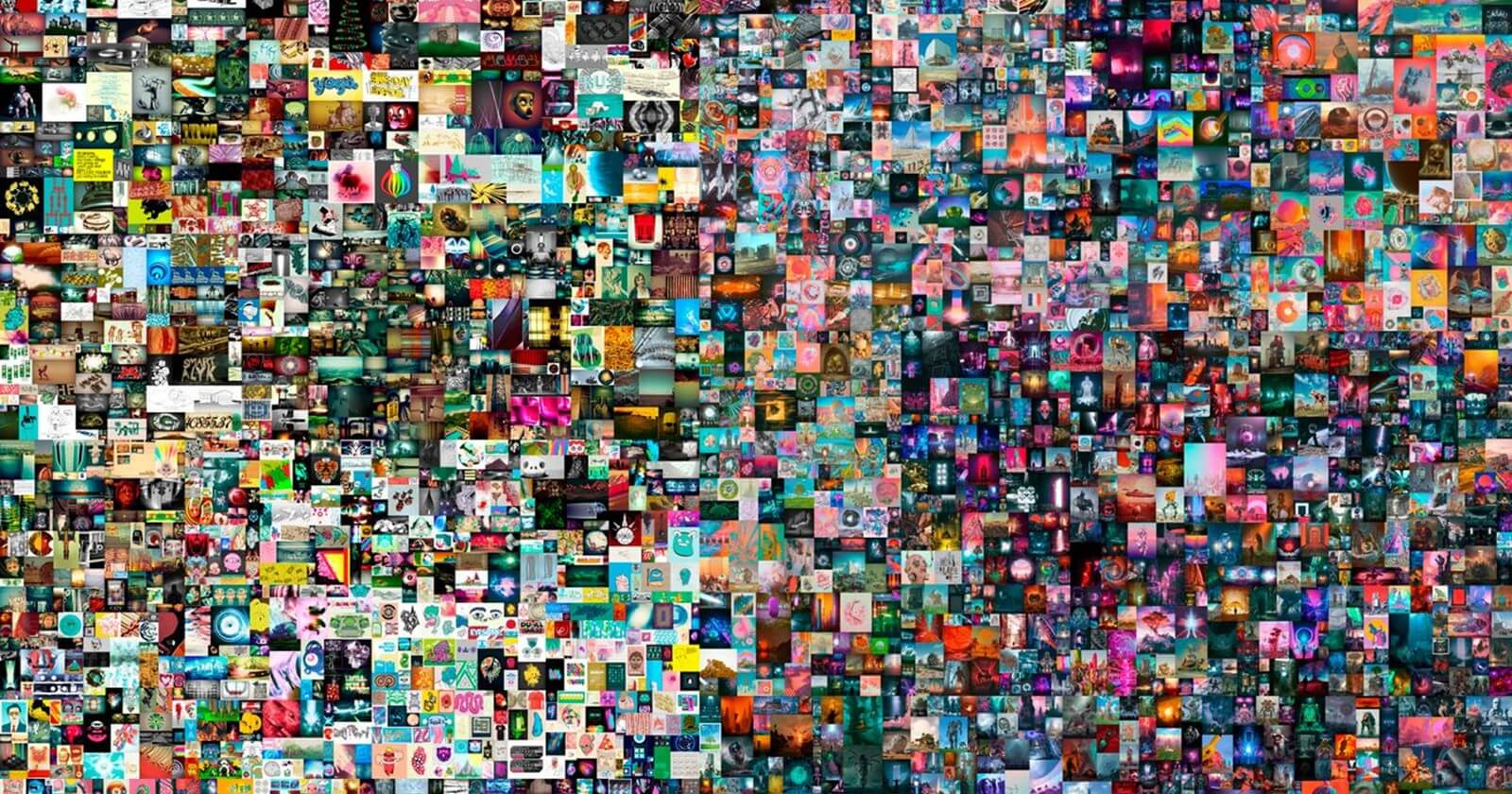

- Digital artist Mike Winkelmann, better known at Beeple, was getting $100 for print versions of his works before switching to NFTs, one of which – “Everydays: The First 5,000 Days” — recently sold at Christie’s Auction House for $69 million. That’s up from Winkelmann’s earlier digital art pieces, a pair of which that sold for $66,666 last November and which are part of larger portfolio that stretches back 13 years.

- Trevco CEO Trevor George raised $5 million in funding last month for RECUR to create “branded NFT Fan Experiences for global brands,” with first due to launch this summer.

“The fan will have no idea who RECUR is and the storefront will be bespoke to the brand, storytelling, stickiness, engagement and collectability,” says George. “The NFTs we offer will be specific to each brand store we create and there will new packs released each week, daily drops and an always-on component. These will be fun fan experiences rather than a singular NFT-branded product.” - NBA Top Shot, a licensed NFT marketplace for digital images of NBA players launched by Dapper Labs last fall, has grown rapidly with people spending more than $230 million as of late February on buying and selling highlights. And there’s room for further expansion, says Sacramento Kings owner and former Facebook executive Chris Kelly. “You’ve seen hundreds of millions of dollars transacted through Top Shot and we are very excited and you definitely are going to see other leagues get into this, Kelly told CNBC.

- Funko recently bought a stake in TokenWave, developers of the TokenHead mobile app for showcasing and tracking NFTs.